Opportunity cost. (H. Schaefer) Wolverine Corporation is working at full production capacity producing 10,000 units of a

Question:

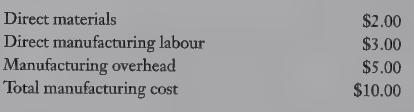

Opportunity cost. (H. Schaefer) Wolverine Corporation is working at full production capacity producing 10,000 units of a unique product, Rosebo. Manufacturing costs per unit 1. Variable costs per unit, $11 for Rosebo are as follows:

‘The unit manufacturing overhead cost is based on a variable cost per unit of $2.00 and fixed costs of $30,000 (at full capacity of 10,000 units). The selling costs, all variable, are $4.00 per unit, and the selling price is $20 per unit.

A customer, the Miami Company, has asked Wolverine to produce 2,000 units of Orangebo, a modification of Rosebo. Orangebo would require the same manufacturing processes as Rosebo. Miami Company has offered to pay Wolverine $15.00 for a unit of Orangebo and half the selling costs per unit.

REQUIRED 1. What is the opportunity cost to Wolverine of producing the 2,000 units of Orangebo?

(Assume that no overtime is worked.)

2. Buckeye Corporation has offered to produce 2,000 units of Rosebo for Wolverine so that Wolverine may accept the Miami offer. That is, if Wolverine accepts the Buckeye offer, Wolverine would manufacture 8,000 units of Rosebo and 2,000 units of Orangebo and purchase 2,000 units of Rosebo from Buckeye. Buckeye would charge Wolverine $14.00 per unit to manufacture Rosebo. Should Wolverine accept the Buckeye offer? (Support your conclusions with specific analysis.)

3. Suppose Wolverine had been working at less than full capacity, producing 8,000 units of Rosebo at the time the Orangebo offer was made. What is the minimum price Wolverine ate accept for Orangebo under these conditions? (Ignore the previous $15.00 selling price.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing