Product life cycle and pricing. (J. Watson) Neptune Ltd. is an established manufacturer of robotic equipment used

Question:

Product life cycle and pricing. (J. Watson) Neptune Ltd. is an established manufacturer of robotic equipment used in industrial applications. Recently it has faced increased competi- tion, primarily from companies in India, and its market share has eroded and profits are declining. To restore its position in the industry, it established a new division to research new applications of the equipment and to design and develop these new products. The inaugural product from the division is the Triton, to be used in the aerospace industry. The costs expended in the preliminary stages of the product were as follows:

In order to manufacture these specialized robots, the company had to adapt existing production equipment at a cost of $900,000. It also invested $400,000 in startup marketing costs, $250,000 in distribution, and $350,000 in establishing a separate customer-service department. Neptune believes that in Year 1 it will have to spend another $125,000 on design-related costs.

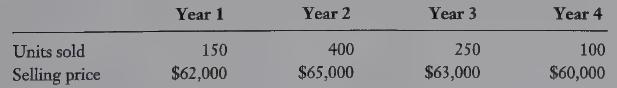

Neptune realizes that technology rapidly becomes obsolete, so it predicts that the Triton will have a four-year life (post-development). It estimates the following sales:

Additional information regarding the production of the Triton follows:

a. Direct materials costs for the Triton are expected to be $16,000 per unit.

b. Direct manufacturing labour costs for the Triton are estimated at $7,000 per unit.

c. Overhead per unit is estimated at $15,000 per unit, of which 60% is fixed. The fixed overhead rate is based on a normal capacity of 250 units per year.

d. The Triton is costly to ship to customers due to its weight and packaging needs. Distribution costs will average $3,200 per unit. Distribution costs are variable.

e. Marketing costs are predicted at $1,800 per unit, all variable.

f. Customer-service costs will be $2,400 per unit plus fixed costs of $250,000 per year.

REQUIRED 1. Prepare a product-life-cycle costing report.

2. Triton is considering dropping its price by 10%. It believes this will increase units sold in each year by 20%. Should Triton drop its price?

3. What are the advantages of using product-life-cycle reporting when setting prices?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing