Ranking of capital budgeting projects, alternative selection methods, capital rationing. (CMA, adapted) Conglomerates has not yet told

Question:

Ranking of capital budgeting projects, alternative selection methods, capital rationing. (CMA, adapted) Conglomerates has not yet told Sam Pilon what the total amount of funds available for capital projects at Firthing Manufacturing will be, except for the after-tax required rate of return being 12%.

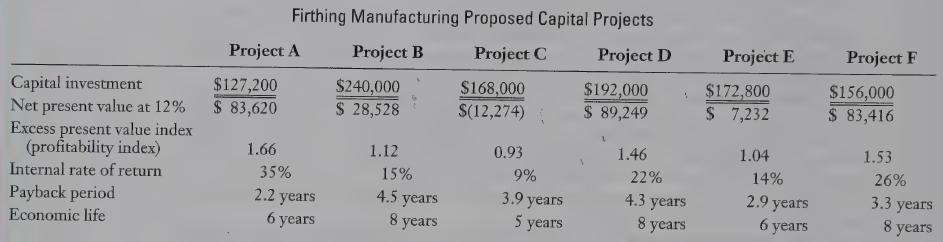

Pilon, division president of Firthing, is preparing the 2011 capital budget for submission to corporate headquarters at Conglomerates Inc. Each project is considered to have the same degree of risk. Projects A and D are mutually exclusive: either one can be chosen, not both.

When analyzing projects, Firthing assumes that any budgeted amount not spent on the identified projects will be invested at the after-tax required rate of return, and funds released at the end of a project can be reinvested at the hurdle rate. Further information about each of these projects is presented in the following schedule:

REQUIRED 1. Assume that Firthing Manufacturing has no budget restrictions for capital expenditures and wants to maximize its value to Conglomerates. Identify the capital investment projects that Firthing should include in the capital budget it submits to Conglomerates Inc. Explain the basis for your selection.

2. Ignore your response to requirement 1. Assume that Conglomerates Inc. has specified that Firthing Manufacturing will have a restricted budget for capital expenditures, and that Firthing should select the projects that maximize the company’s value. Identify the capital investment projects Firthing should include in its capital expenditures budget, and explain the basis for your selections, if the budget is

(a) $540,000 and

(b) $600,000.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing