Target rate of return on investment, activity-based costing. Electronic Arts (EA) distrib- utes video games to retail

Question:

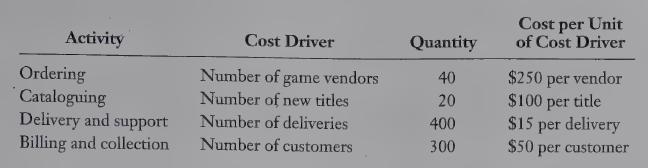

Target rate of return on investment, activity-based costing. Electronic Arts (EA) distrib- utes video games to retail stores and video-game arcades. It has a simple business model: order the video games, catalogue the games on the company's website, deliver and provide on-site support, and bill and collect from the customers. EA reported the following costs in 1. Gross margin, $84,000

‘April 2009:

In April 2009, EA purchased 12,000 video-game discs at an average cost of $15 per disc,and sold them at an average price of $22 per disc. The catalogue on the website and the customer interactions that occur during delivery are EA’s main marketing inputs. EA incurs no other costs.

REQUIRED 1. Calculate EA’s operating income for April 2009. If the monthly investment in EA is $300,000, what rate of return on investment does the business earn?

2. The current crop of game systems is maturing, and prices for games are beginning to decline. EA anticipates that from May onward, it will be able to sell 12,000 game discs each month for an average of $18 per disc and can purchase the discs at a cost of $12 each.

Assuming other costs are the same as in April, will EA be able to earn its 15% target rate of return on investment?

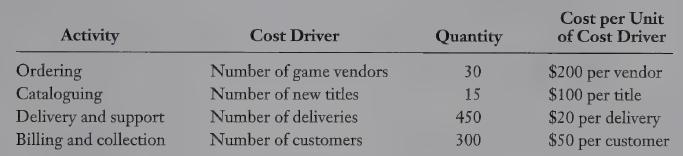

3. EAs small workforce gathers as a team and considers process improvements. They recommend “firing” the marginal vendors—those who need a lot of hand-holding but whose titles are not very popular. They agree that they should shift some of their resources from vendor relationships and cataloguing to delivery and customer relationships. In May 2009, EA reports the following support costs:

Ata selling price of $18 and a cost of $12 per disc, how many game discs must EA sell in May to earn its 15% target rate of return on investment?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing