The job-costing system at Sheris Custom Framing has five indirect-cost pools (purchasing, material handling, machine maintenance, product

Question:

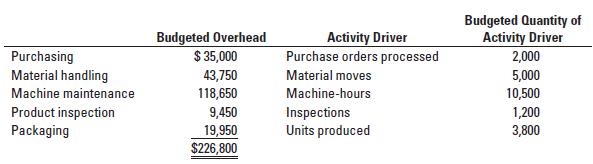

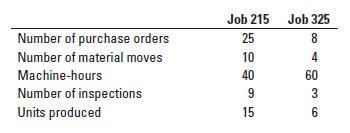

The job-costing system at Sheri’s Custom Framing has five indirect-cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging). The company is in the process of bidding on two jobs: Job 215, an order of 15 intricate personalized frames, and Job 325, an order of 6 standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect-cost pool and the budgeted quantity of activity driver are as follows:

Information related to Job 215 and Job 325 follows. Job 215 incurs more batch-level costs because it uses more types of materials that need to be purchased, moved, and inspected relative to Job 325.

Required

1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on machine-hours.

2. Compute the total overhead allocated to each job under an activity-based costing system using the appropriate activity drivers.

3. Explain why Sheri’s Custom Framing might favor the ABC job-costing system over the simple job-costing system, especially in its bidding process.

![]()

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan