Transferred-in costs, weighted-average and FIFO. Frito-Lay Inc. manufactures convenience foods, including potato chips and corn chips. Production

Question:

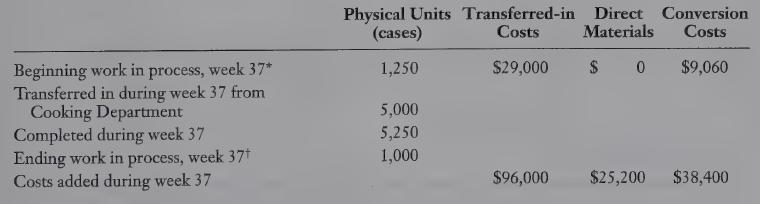

Transferred-in costs, weighted-average and FIFO. Frito-Lay Inc. manufactures convenience foods, including potato chips and corn chips. Production of corn chips occurs in four | joi) cost of work in process, departments: Cleaning, Mixing, Cooking, and Drying and Packaging. Consider the Drying 473,360 and Packaging Department, where direct materials (packaging) is added at the end of the process. Conversion costs are added evenly during the process. Suppose the accounting records of a Frito-Lay plant provided the following information for corn chips in its Drying and Packaging Department during a weekly period (week 37):

REQUIRED 1. Using the weighted-average method, summarize the total Drying and Packaging Department costs for week 37, and assign total costs to units completed (and transferred out) and to units in ending work in process.

2. Assume that the FIFO method is used for the Drying and Packaging Department. Under FIFO, the transferred-in costs for work-in-process beginning inventory in week 37 are $28,920 (instead of $29,000 under the weighted-average method), and the transferred-in costs during the week from the Cooking Department are $94,000 (instead of $96,000 under the weighted-average method). All other data are unchanged. Summarize the total Drying and Packaging Department costs for week 37 and assign total costs to units completed and transferred out and to units in ending work in process using the FIFO method.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing