Wellington Vents Ltd operates and services snack vending machines located in restaurants, metro stations, canteens, etc. The

Question:

Wellington Vents Ltd operates and services snack vending machines located in restaurants, metro stations, canteens, etc. The machines are rented from the manufacturer. In addition, the company must rent the space occupied by its machines. The following expense and revenue relationships pertain to a contemplated expansion program of 20 machines.

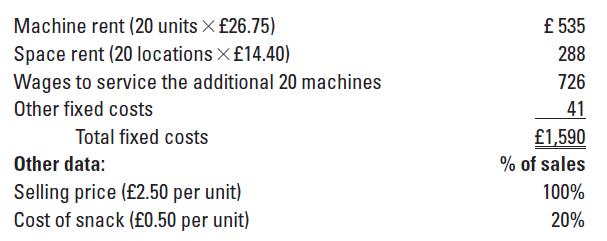

Monthly fixed costs consist of the following:

Consider each of the following questions separately.

Required

1. Calculate the contribution margin per unit and contribution margin percentage.

2. What is the monthly breakeven point in unit sales and pounds?

3. If 20,000 units were sold, what would be the company’s net income?

4. If the space rent was doubled, what would be the monthly breakeven point in unit sales and pounds?

5. In addition to the fixed rent, if the machine manufacturer was paid £0.10 for each unit sold, what would be the new

a. Breakeven units and breakeven revenues?

b. Operating income if 20,000 units were sold?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan