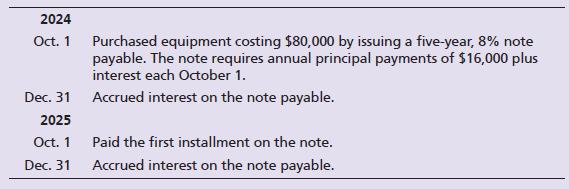

Consider the following note payable transactions of Caleb Video Productions. Requirements 1. Journalize the transactions for the

Question:

Consider the following note payable transactions of Caleb Video Productions.

Requirements

1. Journalize the transactions for the company.

2. Considering the given transactions only, what are Caleb Video Productions’ total liabilities on December 31, 2025?

Transcribed Image Text:

2024 Oct. 1 Dec. 31 2025 Oct. 1 Dec. 31 Purchased equipment costing $80,000 by issuing a five-year, 8% note payable. The note requires annual principal payments of $16,000 plus interest each October 1. Accrued interest on the note payable. Paid the first installment on the note. Accrued interest on the note payable.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

To answer your request lets break down the transactions and journalize them Then we can calculate the total liabilities as of December 31 2025 Journal ...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Managerial Chapters

ISBN: 9781292412337

7th Global Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura

Question Posted:

Students also viewed these Business questions

-

Consider the following note payable transactions of Caleb Video Productions. 2018 Oct. 1 Purchased equipment costing $80,000 by issuing a five-year, 8% note payable. The note requires annual...

-

Consider the following note payable transactions of Caldwell Video Productions. 2016 Apr. 1 Purchased equipment costing $56,000 by issuing a seven-year, 13% note payable. The note requires annual...

-

On August 10, 2017, Sophia purchased and placed into service a commercial building (39 years SL) for $3.000,000 (building $2,250,000 and land $750,000). On January 1, 2022, the commercial building...

-

The rigid bar AB is supported by a pin at B and by two the cables AC (perpendicular to the beam) and AD (inclined with respect to the beam) attached at A as shown in Fig. 3. A C 30 in D B 80 in...

-

The earth, which is not a uniform sphere, has a moment of inertia of 0.3308MR2 about an axis through its north and south poles. It takes the earth 86,164 s to spin once about this axis. Use Appendix...

-

The opportunity for independent thought and action in that job 1 2 3 4 5 6 7 LO.1

-

Choosing at random. Abby, Deborah, Mei-Ling, Sam, and Roberto work in a firms public relations office. Their employer must choose two of them to attend a conference in Paris. To avoid unfairness, the...

-

Rework Problem 15-10 using a spreadsheet model. After completing Parts a through d, respond to the following: If Bowers customers began to pay late, collections would slow down, thus increasing the...

-

On January 1, 2022, King Cones signed a long-term finance lease for a manufacturing facility. The terms of the lease required King to pay $29,000 annually, beginning December 31, 2022, and continuing...

-

SB Electronics is considering two plans for raising $4,000,000 to expand operations. Plan A is to issue 9% bonds payable, and plan B is to issue 500,000 shares of common stock. Before any new...

-

Computing the debt to equity ratio Jackson Corporation has the following amounts as of December 31, 2024. Compute the debt to equity ratio at December 31, 2024. Total assets Total liabilities Total...

-

You have performed a simple regression analysis using the natural log (Ln) of cumulative production as the X-variable and the natural log of cumulative average cost as the Y variable with the...

-

FA II: Assignment 1 - COGS & Bank Reconciliation 1. The following data pertains to Home Office Company for the year ended December 31, 2020: Sales (25% were cash sales) during the year Cost of goods...

-

Bramble Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Jan. 15 20 Feb. 10 15 Made Bramble credit card sales totaling...

-

11. Korina Company manufactures products S and T from a joint process. The sales value at split-off was P50000 for 6,000 units of Product S and P25,000 for 2,000 units of Product T. Assuming that the...

-

Karak Company produces Product (A) for only domestic distribution since year 2017. In 2019, a similar product to Karak Company has come onto the market by another competitor. Karak Company is keen to...

-

1. Purchase equipment in exchange for cash of $20,400. 2. Provide services to customers and receive cash of $4,900. 3. Pay the current month's rent of $1,000. 4. Purchase office supplies on account...

-

A heat pump that operates on the ideal vapor-compression cycle with refrigerant-134a is used to heat a house and maintain it at 26oC by using underground water at 14oC as the heat source. Select...

-

1-Stern observed all of the following results EXCEPT _______ in his experiment. A-one of the recombinant phenotypes was associated with an X chromosome of normal length B-the number of car, B+ male...

-

What are the components of an organizational framework for security and control? a) Define general controls and describe each type of general control. b) Define application controls and describe each...

-

What are the most important tools and technologies for safeguarding information resources? a) Name and describe three authentication methods. b) Describe the roles of firewalls, intrusion detection...

-

How do enterprise systems help businesses achieve operational excellence? a. Define an enterprise system and explain how enterprise software works. b. Describe how enterprise systems provide value...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App