Answered step by step

Verified Expert Solution

Question

1 Approved Answer

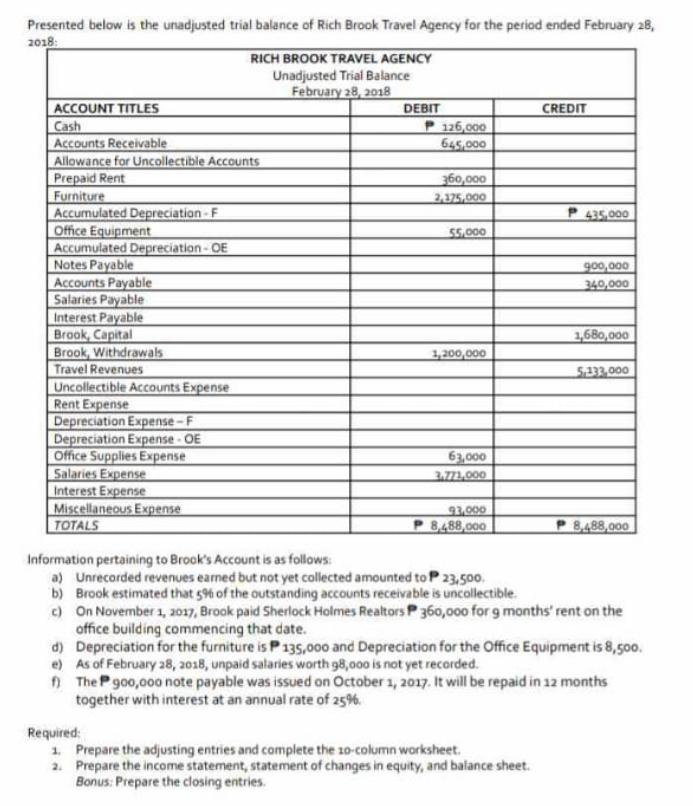

Presented below is the unadjusted trial balance of Rich Brook Travel Agency for the period ended February 28, 2018: ACCOUNT TITLES Cash Accounts Receivable

Presented below is the unadjusted trial balance of Rich Brook Travel Agency for the period ended February 28, 2018: ACCOUNT TITLES Cash Accounts Receivable Allowance for Uncollectible Accounts Prepaid Rent Furniture Accumulated Depreciation-F Office Equipment Accumulated Depreciation-OE Notes Payable Accounts Payable Salaries Payable Interest Payable Brook, Capital Brook, Withdrawals Travel Revenues Uncollectible Accounts Expense Rent Expense Depreciation Expense-F Depreciation Expense-OE RICH BROOK TRAVEL AGENCY Unadjusted Trial Balance February 28, 2018 Office Supplies Expense Salaries Expense Interest Expense Miscellaneous Expense TOTALS DEBIT P126,000 645,000 360,000 2,375,000 55,000 1,200,000 63,000 3.771,000 93,000 8,488,000 CREDIT Required: 1. Prepare the adjusting entries and complete the 10-column worksheet. 2. Prepare the income statement, statement of changes in equity, and balance sheet. Bonus: Prepare the closing entries. 435,000 900,000 340,000 1,680,000 5,133,000 8,488,000 Information pertaining to Brook's Account is as follows: a) Unrecorded revenues earned but not yet collected amounted to P 23,500. b) Brook estimated that 5% of the outstanding accounts receivable is uncollectible. c) On November 1, 2017, Brook paid Sherlock Holmes Realtors P 360,000 for 9 months' rent on the office building commencing that date. d) Depreciation for the furniture is P135,000 and Depreciation for the Office Equipment is 8,500. e) As of February 28, 2018, unpaid salaries worth 98,000 is not yet recorded. f) The P 900,000 note payable was issued on October 1, 2017. It will be repaid in 12 months together with interest at an annual rate of 25%.

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Here are the adjusting entries 1 Record accrued revenues Debit Accounts Receivable Credit Travel Revenues 23500 2 Record allowance for doubtful accounts Debit Allowance for Uncollectible Accounts Cred...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started