1. Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham,...

Question:

1. Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local college. Carol’s earnings and withholding from the college for 2010 are:

Earnings from the college $54,000 Federal income tax withheld 8,800 State income tax withheld 2,500 FICA tax of $3,348 and Medicare tax of $783 were also withheld from Carol’s earnings.

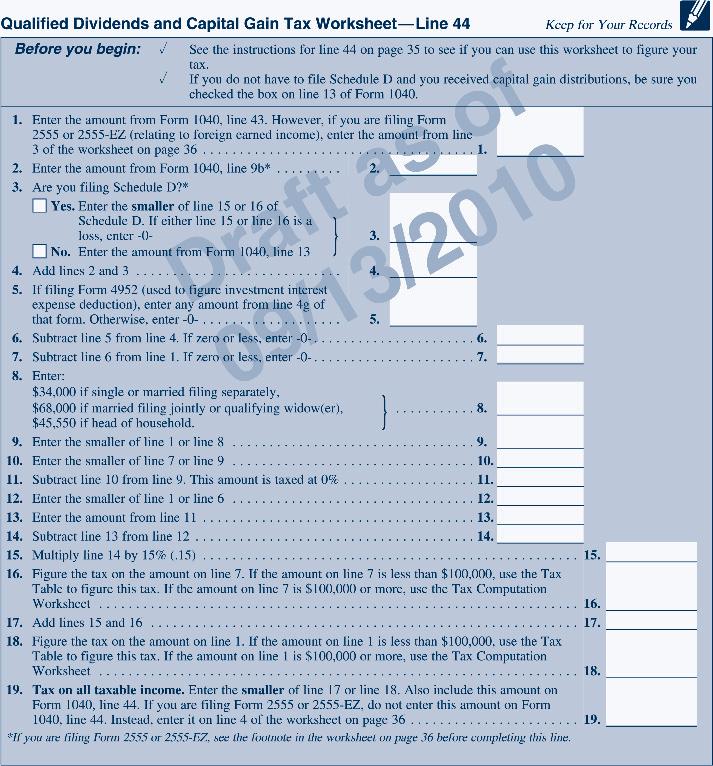

Carol’s other income includes interest of $145 from a savings account at New England Bank and $450 of qualified dividends from Microsoft.

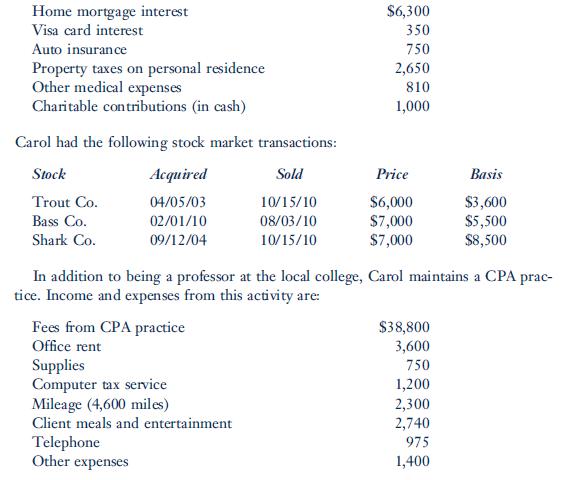

During the year, Carol paid the following amounts (all of which can be substantiated):

Carol drove her car 20,000 miles in total, of which 5,000 miles were for commuting.

Carol made 2010 estimated tax payments to the U.S. Treasury of $3,000 for each quarter.

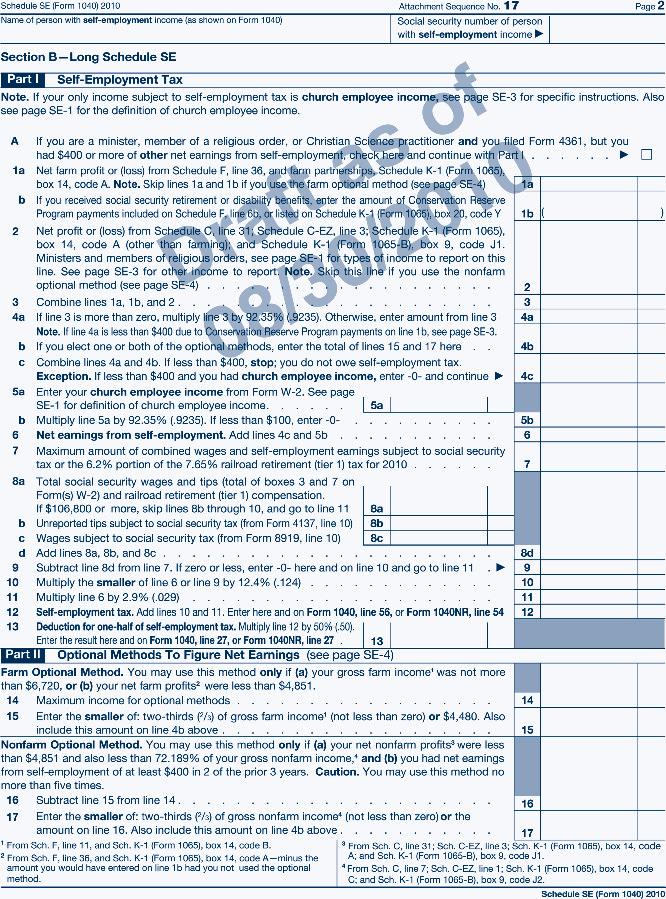

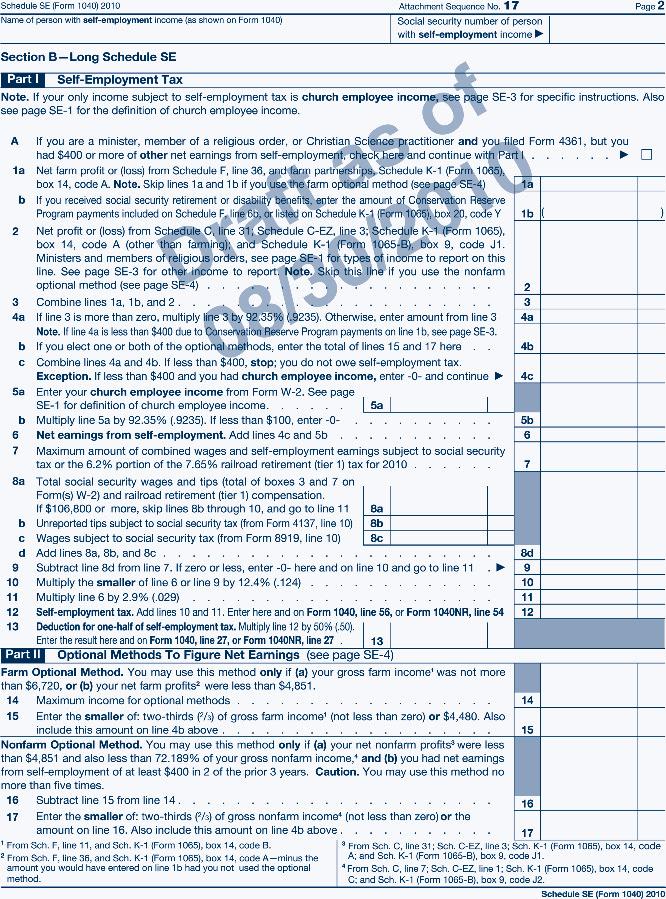

Required: Complete Carol’s federal tax return for 2010. Use Form 1040, Schedule A, Schedule C, Schedule D, Schedule SE, Schedule M, and the worksheet on pages 9-49 through 9-60 to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2011

ISBN: 9780538469197

29th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller