1. Dick owns a house that he rents to college students. Dick receives $750 per month rent...

Question:

1. Dick owns a house that he rents to college students. Dick receives $750 per month rent and incurs the following expenses during the year:

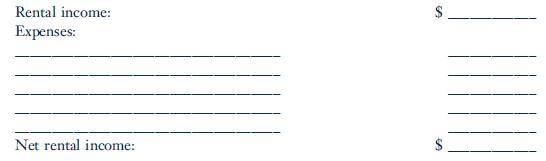

Real estate taxes $ 1,250 Mortgage interest 1,500 Insurance 375 Repairs 562 Association Dues 1,600 Dick purchased the house in 1975 for $48,000. The house is fully depreciated. Calculate Dick’s net rental income for the year, assuming the house was rented for a full 12 months.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2011

ISBN: 9780538469197

29th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller

Question Posted: