2. Kathy Kennedy (age 44) is a single taxpayer and she lives at 212 North Pine Way,...

Question:

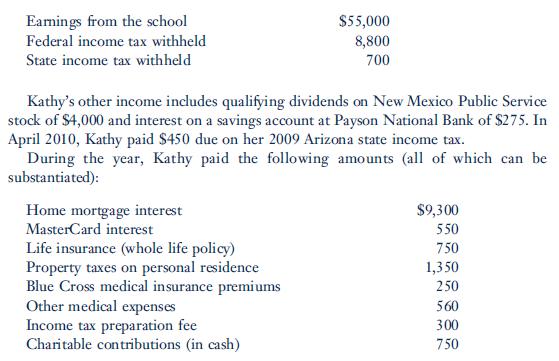

2. Kathy Kennedy (age 44) is a single taxpayer and she lives at 212 North Pine Way, Payson, AZ 85541. Her Social Security number is 467-98-9784. Kathy’s earnings and income tax withholding as the principal of the local high school for 2010 are:

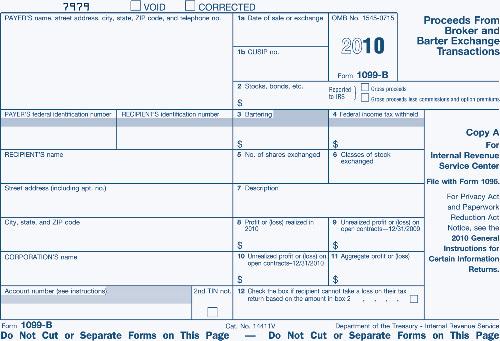

Kathy had one stock transaction in 2010. Kathy received the following 1099-B from her sale of Gold Company stock. All stock sales must be reported both to taxpayers and to the IRS on Form 1099-B so the proceeds can be matched by the IRS to each tax return. Kathy purchased the stock on August 31, 2009, for $42,800 before the stock plummeted in the last months of 2009.

On January 28, 2010, Kathy sold raw land for $150,000 (basis to Kathy of $90,000).

The land was purchased 6 years ago. She received $30,000 as a down payment and the buyer’s 10-year note for $120,000. The note is payable at the rate of $12,000 per year plus 8 percent interest. On January 28, 2011, the first of the ten principal and interest payments is due.

Required: Complete Kathy’s federal tax return for 2010. Use Form 1040, Schedule A, Schedule B, Schedule D, Schedule M, the worksheet, and Form 6252 on Pages 8-61 to 8-69 to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2011

ISBN: 9780538469197

29th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller