Question:

28. During the 2010 tax year, Brian, a single taxpayer, received $6,000 in Social Security benefits. His adjusted gross income for the year was $18,000 (not including the Social Security benefits) and he received $30,000 in tax-exempt interest income. Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2010.

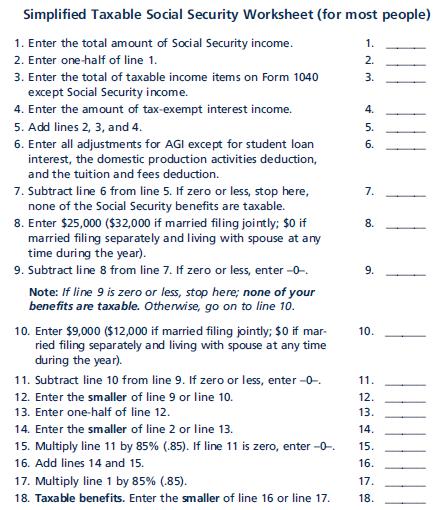

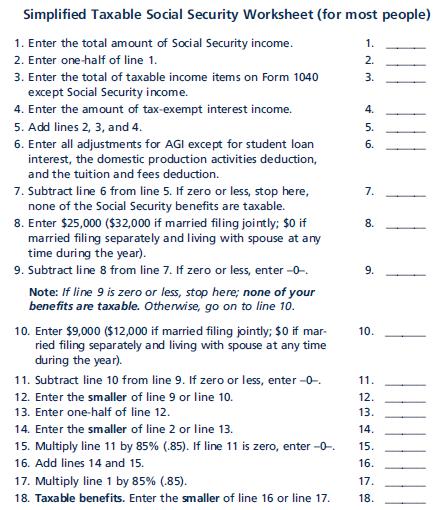

Transcribed Image Text:

Simplified Taxable Social Security Worksheet (for most people) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1. 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2, 3, and 4. 6. Enter all adjustments for AGI except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5. If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $25,000 ($32,000 if married filing jointly; $0 if married filing separately and living with spouse at any time during the year). 9. Subtract line 8 from line 7. If zero or less, enter -0-. Note: If line 9 is zero or less, stop here; none of your benefits are taxable. Otherwise, go on to line 10. 10. Enter $9,000 ($12,000 if married filing jointly; $0 if mar- ried filing separately and living with spouse at any time during the year). 1. 2. 3. 4. 456 5. 6. 7. 8. 9. 10. 11 11. Subtract line 10 from line 9. If zero or less, enter -0- 11. 12. Enter the smaller of line 9 or line 10. 12. 13. Enter one-half of line 12. 13. 14. Enter the smaller of line 2 or line 13. 14. 15. Multiply line 11 by 85% (.85). If line 11 is zero, enter -0- 16. Add lines 14 and 15. 15. 16. 17. Multiply line 1 by 85% (.85). 17. 18. Taxable benefits. Enter the smaller of line 16 or line 17. 18.