During the 2010 tax year, Frank and Betty paid the following medical expenses: Hospitalization insurance $ 425

Question:

During the 2010 tax year, Frank and Betty paid the following medical expenses:

Hospitalization insurance $ 425 Prescription medicines and drugs 364 Hospital bills 2,424 Doctor bills 725 Eyeglasses for Frank’s dependent mother 75 Doctor bills for Betty’s sister, who is claimed as a dependent by Frank and Betty 220 In addition, in 2010, they drove 848 miles for medical transportation in their personal automobile. Their insurance company reimbursed Frank and Betty $1,420 during the year for the medical expenses. If their adjusted gross income for the year is $25,400, calculate their medical expense deduction.

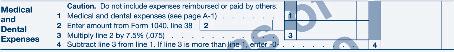

Use the segment of Schedule A of Form 1040 reproduced below.

Step by Step Answer:

Income Tax Fundamentals 2011

ISBN: 9780538469197

29th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller