Question:

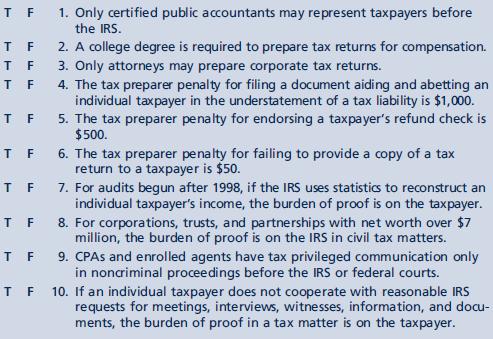

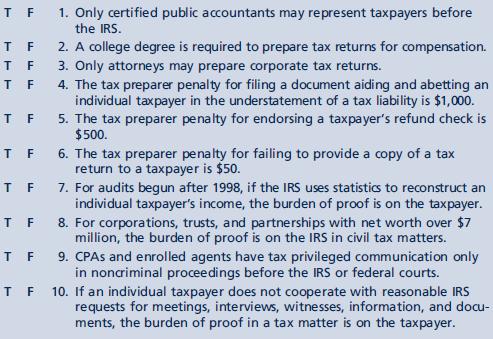

Indicate whether the following statements are true or false by circling the appropriate letter.

Transcribed Image Text:

TF T F TF TF T F 1. Only certified public accountants may represent taxpayers before the IRS. 2. A college degree is required to prepare tax returns for compensation. 3. Only attorneys may prepare corporate tax returns. 4. The tax preparer penalty for filing a document aiding and abetting an individual taxpayer in the understatement of a tax liability is $1,000. 5. The tax preparer penalty for endorsing a taxpayer's refund check is $500. T F 6. The tax preparer penalty for failing to provide a copy of a tax return to a taxpayer is $50. T F 7. For audits begun after 1998, if the IRS uses statistics to reconstruct an individual taxpayer's income, the burden of proof is on the taxpayer. T F T F 8. For corporations, trusts, and partnerships with net worth over $7 million, the burden of proof is on the IRS in civil tax matters. 9. CPAs and enrolled agents have tax privileged communication only in noncriminal proceedings before the IRS or federal courts. T F 10. If an individual taxpayer does not cooperate with reasonable IRS requests for meetings, interviews, witnesses, information, and docu- ments, the burden of proof in a tax matter is on the taxpayer.