A. Dr. George E. Beeper is a single taxpayer born on September 22, 1970. He lives at

Question:

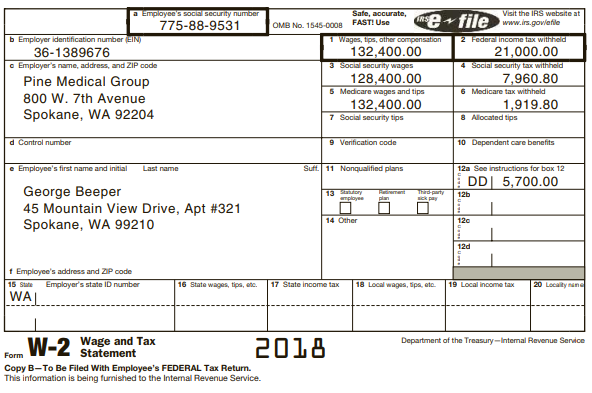

A. Dr. George E. Beeper is a single taxpayer born on September 22, 1970. He lives at 45 Mountain View Dr., Apt. 321, Spokane, WA 99210. Dr. Beeper’s Social Security number is 775-88-9531. Dr. Beeper works for the Pine Medical Group, and his earnings and income tax withholding for 2018 are:

Dr. Beeper owns a rental house located at 672 Lake Street, Spokane, WA 99212. The house rents for $1,000 per month and was rented for the entire year. The following are the related expenses for the rental house:

Real estate taxes................... $ 5,800

Mortgage interest ...................14,500

Insurance................... 2,225

Depreciation (assume fully depreciated)................... 0

Repairs................... 550

Maintenance ...................1,980

The house was purchased on July 5, 1983. Dr. Beeper handles all rental activities (e.g., rent collection, finding tenants, etc.) himself. In 2018, Dr. Beeper sold his primary residence as he wished to move to an apartment to avoid the maintenance and upkeep of a single-family home. Dr. Beeper’s home sold on February 12, 2018 for $345,000 net after commissions. He acquired the home on June 3, 2000 for $260,000 and had made improvements of $10,000. Dr. Beeper was divorced in 2012. The divorce decree requires Dr. Beeper to pay his ex-wife, Meredith Gray (Social Security number 333-45-1234), $800 per month. Dr. Beeper made all his monthly alimony payments in 2018.

Required:

Complete Dr. Beeper’s federal tax return for 2018. Determine if Form 8949 and Schedule D are required. If so, use those forms and Form 1040, Schedule E, and Form 8582 (page one only) to complete this tax return. Do not complete Form 4562 for reporting depreciation.

B. In 2018, Professor Patricia (Patty) Pâté retired from the Palm Springs Culinary Arts Academy (PSCAA). She is a single taxpayer and is 62 years old. Patty lives at 98 Colander Street, Apt. 206D, Henderson, NV 89052. Professor Pâté’s Social Security number is 565-66-9378. In 2018, Patty had just a few months of salary from her previous job:

Wages.................... $9,800

Federal tax withheld....................450

State tax withheld....................0

Patty owns a rental condo located at 392 Spatula Way, Mount Charleston, NV 89124. The condo rented for two months of 2018 for $850 a month but a mold problem was discovered in the condo, her renters moved out, and she was unable to rent the apartment after the repairs (although she vigorously pursued new tenants). Patty actively manages the property herself. The following are the related expenses for the rental house:

Real estate taxes......................$3,900

Mortgage interest......................9,100

Insurance......................561

Depreciation (assume fully depreciated)......................0

Homeowners’ Association dues ......................1,260

Repairs ......................1,195

Gardening ......................560

Advertising ......................1,200

The condo was purchased on August 31, 1979. Professor Pâté handles all rental activities (e.g., rent collection, finding tenants, etc.) herself. In 2018, Patty sold her beloved home for almost 30 years for $380,000 on February 27, 2018. Her basis in the home was $120,000 and she acquired the home sometime in July of 1988 (she could not remember the day).

Required:

Complete Professor Pâté’s federal tax return for 2018. Use Form 1040, Schedule D, Form 8949, Schedule E, and Form 8582 (page one only) to complete this tax return. Also, complete only Schedule A of Form 1045.

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill