A. Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for

Question:

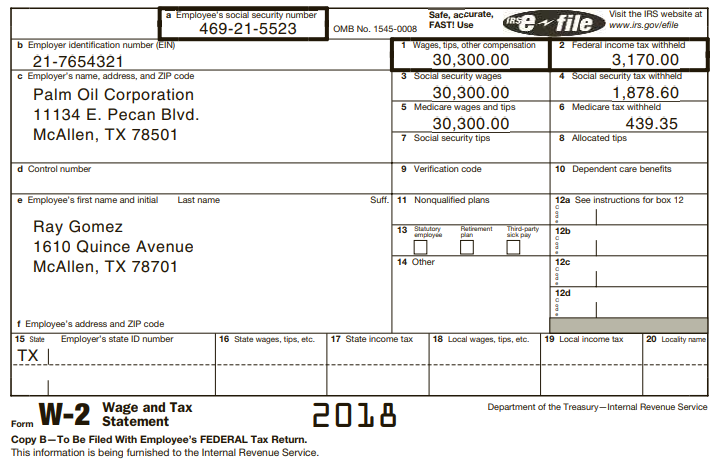

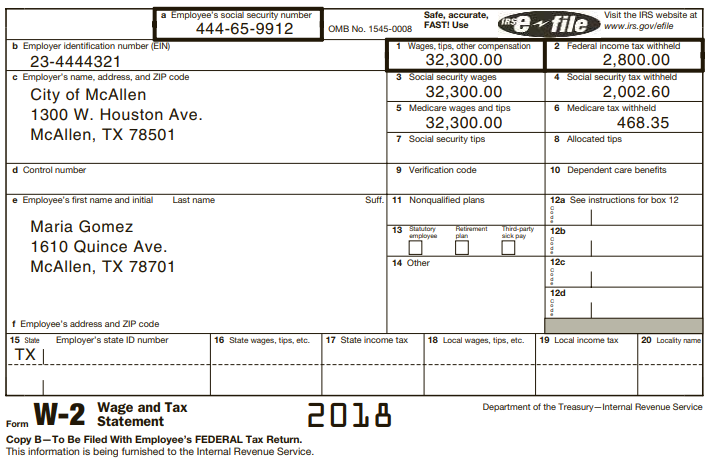

A. Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Ray’s birthdate is February 21, 1990 and Maria’s is December 30, 1992. Ray and Maria’s earnings are reported on the following Form W-2s:

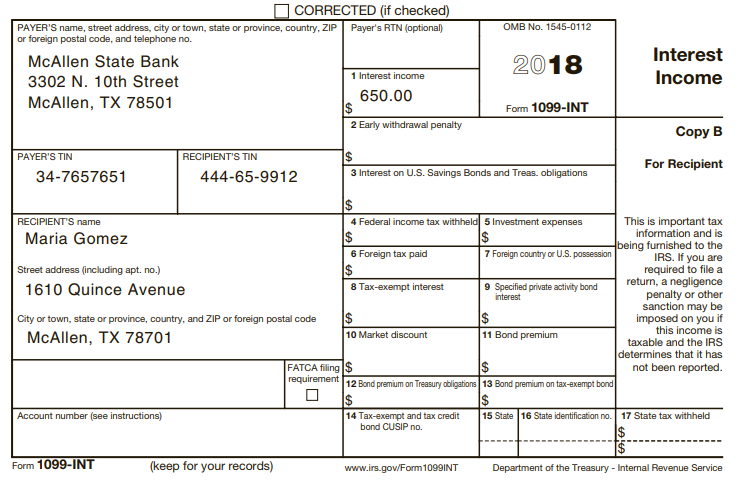

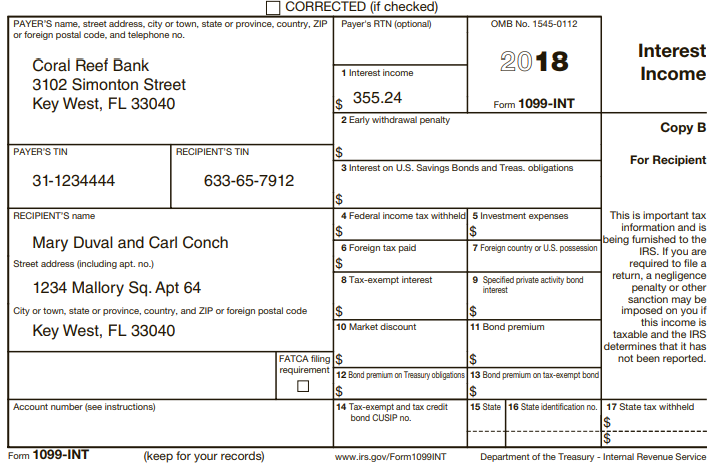

Ray and Maria have interest income as reported on the following 1099-INT:

In addition, they own U.S. Savings bonds (Series EE). The bonds had a value of $10,000 on January 1, 2018, and their value is $10,700 on December 31, 2018. They have not made an election with respect to these bonds. Ray has an ex-wife named Judy Gomez. Pursuant to their divorce decree, Ray pays her $450 per month in alimony. All payments were made on time in 2018. Judy’s Social Security number is 566-74-8765. During 2018, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his hospital and doctor bills. In June of 2018, Maria’s father died. Under a life insurance policy owned and paid for by her father, Maria was paid death benefits of $25,000. Maria bought a Texas lottery ticket on impulse during 2018. Her ticket was lucky and she won $4,000. The winning amount was paid to Maria in November 2018, with no income tax withheld. Palm Oil Corporation provides Ray with a company car to drive while he is working. The Corporation spent $5,000 to maintain this vehicle during 2018. Ray never uses the car for personal purposes.

Required:

Complete the Gomez’s federal tax return for 2018 on Form 1040 and Schedule 1.

B. In addition, they own U.S. Savings bonds (Series EE). The bonds had a value of $10,000 on January 1, 2018, and their value is $10,700 on December 31, 2018. They have not made an election with respect to these bonds. Ray has an ex-wife named Judy Gomez. Pursuant to their divorce decree, Ray pays her $450 per month in alimony. All payments were made on time in 2018. Judy’s Social Security number is 566-74-8765. During 2018, Ray was in the hospital for a successful operation. His health insurance company reimbursed Ray $4,732 for all of his hospital and doctor bills. In June of 2018, Maria’s father died. Under a life insurance policy owned and paid for by her father, Maria was paid death benefits of $25,000. Maria bought a Texas lottery ticket on impulse during 2018. Her ticket was lucky and she won $4,000. The winning amount was paid to Maria in November 2018, with no income tax withheld. Palm Oil Corporation provides Ray with a company car to drive while he is working. The Corporation spent $5,000 to maintain this vehicle during 2018. Ray never uses the car for personal purposes. Required: Complete the Gomez’s federal tax return for 2018 on Form 1040 and Schedule 1.

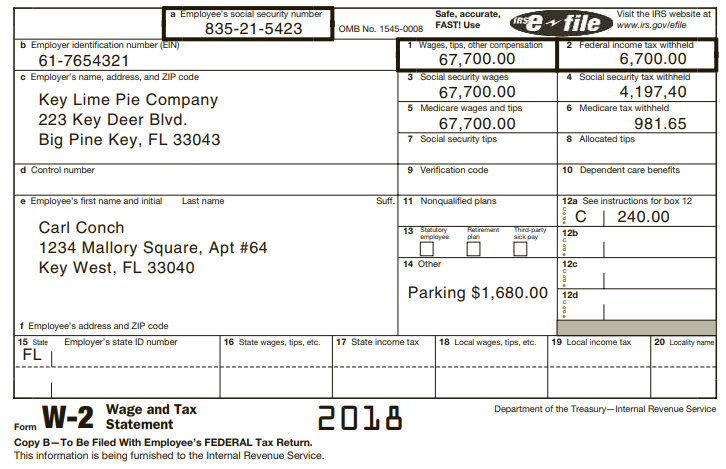

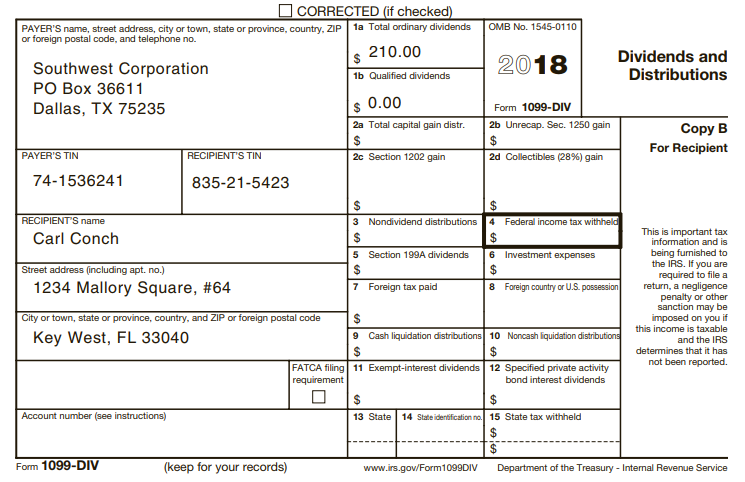

Carl and Mary received the following Forms 1099:

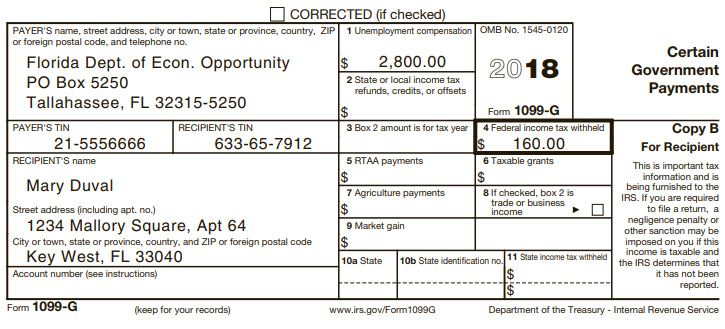

Mary is divorced and she pays her ex-husband (Tom Tortuga) child support. Pursuant to their 2015 divorce decree, Mary pays Tom $500 per month in child support. All payments were made on time in 2018. In June 2018, Mary’s father gave her a cash gift of $75,000. Mary also received unemployment compensation as shown on the following Form 1099-G:

Mary won a $750 prize in a women’s club raffle in 2018. No income tax was withheld from the prize. The Key Lime Pie Company provides Carl with a company car to drive while he is working. The Company spent $6,475 to maintain this vehicle during 2018. Carl never uses the car for personal purposes. The Key Lime Pie Company also provides a cafeteria for all employees on the factory premises. Other restaurants exist in the area and so Carl is not required to eat in the cafeteria, but he typically does. The value of Carl’s meals is $650 in 2018.

Required:

Complete Carl and Mary’s federal tax return for 2018 on Form 1040 and Schedule 1.

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill