Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guildas

Question:

Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guilda’s basis in her stock is $21,000. On May 26, 2020, Bill sells his stock, with a basis of $40,000, to Loraine for $50,000. For the 2020 tax year, Radiata Corporation has a loss of $104,000.

Transcribed Image Text:

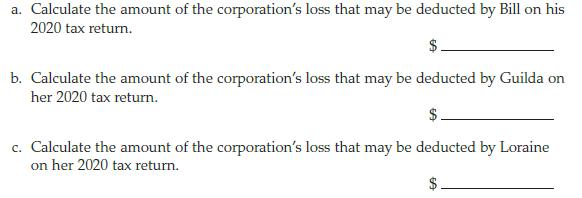

a. Calculate the amount of the corporation's loss that may be deducted by Bill on his 2020 tax return. b. Calculate the amount of the corporation's loss that may be deducted by Guilda on her 2020 tax return. c. Calculate the amount of the corporation's loss that may be deducted by Loraine on her 2020 tax return.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

a 20800 104000 x 50 x 146365 Leap year 208852...View the full answer

Answered By

Shameen Tahir

The following are details of my Areas of Effectiveness. The following are details of my Areas of Effectiveness English Language Proficiency, Organization Behavior , consumer Behavior and Marketing, Communication, Applied Statistics, Research Methods , Cognitive & Affective Processes, Cognitive & Affective Processes, Data Analysis in Research, Human Resources Management ,Research Project,

Social Psychology, Personality Psychology, Introduction to Applied Areas of Psychology,

Behavioral Neurosdence , Historical and Contemporary Issues in Psychology, Measurement in Psychology, experimental Psychology,

Business Ethics Business Ethics An introduction to business studies Organization & Management Legal Environment of Business Information Systems in Organizations Operations Management Global Business Policies Industrial Organization Business Strategy Information Management and Technology Company Structure and Organizational Management Accounting & Auditing Financial Accounting Managerial Accounting Accounting for strategy implementation Financial accounting Introduction to bookkeeping and accounting Marketing Marketing Management Professional Development Strategies Business Communications Business planning Commerce & Technology Human resource management General Management Conflict management Leadership Organizational Leadership Supply Chain Management Law Corporate Strategy Creative Writing Analytical Reading & Writing Other Expertise Risk Management Entrepreneurship Management science Organizational behavior Project management Financial Analysis, Research & Companies Valuation And any kind of Excel Queries.

4.70+

16+ Reviews

34+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guilda's basis in her stock is $25,000. On July 31, 2013, Bill sells his stock, with a basis of $40,000, to...

-

Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guilda's basis in her stock is $25,000. On July 31, 2012, Bill sells his stock, with a basis of $40,000, to...

-

Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guildas basis in her stock is $25,000. On July 31, 2014, Bill sells his stock, with a basis of $40,000, to...

-

The common stock of Fido Corporation was trading at $45 per share on October 15, 2010. A year later, on October 15, 2011, it was trading at $80 per share. On this date, Fidos board of directors...

-

Clarice, a young woman with a mental disability, brought a malpractice suit against a doctor at the Medical Center. As a result, the Medical Center refused to treat her on a nonemergency basis....

-

The effect that perceived organizational support has on employee attitudes and behaviors

-

Discuss postpurchase outcomes.

-

Ellis issues 6.5%, five-year bonds dated January 1, 2015, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is...

-

Rites Ceremonial Ritual Myth Saga Legend Story Folktale Symbol Language Metaphors Values Belief Heroes/Heroines Planned sets of activities that consolidate various forms of cultural expressions into...

-

Sherry Tsang has just started up a small corporation that produces clothing. She has applied for and received a government grant. The grant will automatically be renewed as long as the business shows...

-

Cedar Corporation has an S corporation election in effect. During the 2020 calendar tax year, the corporation had ordinary taxable income of $200,000, and on January 15, 2020, the corporation paid...

-

Which of the following statements is false regarding corporate tax return due dates? a. Corporate tax returns for 2020 calendar-year corporations are due April 15, 2021. b. Corporate tax returns may...

-

Consider an ideal-gas mixture. Explain the differences and similarities among the following measures of composition: mole fraction, volume fraction, and mass fraction.

-

City Feb. Cases March Cases April Cases New York 19 56 189 Los Angeles 6 12 201 Chicago 0 3 14 Houston 19 19 272 Philadelphia 0 1 5 Phoenix 23 78 289 San Antonio 6 9 95 San Diego 3 38 258 Dallas 4 13...

-

Maximize z = 2x+2y x+6y <30 4x + 2y 32 Subject to I 0 W O 0 Maximum is I = y= at

-

2. Determine the unknown force. a) Fret 3 N Right b) Fret 10. N Down F-22 N F?5N c) Feet 12 N Up F-28 N d) Fret 10. N Right F? F-12N e) Fret = 0 F-16N E-? F-12N F-15 N F-? F-30 N F-25 N F-32 N F=24N...

-

If y = ( x ^ 3 + 7 ) ^ x , compute y ' ( 1 ) .

-

To calculate activity expected duration time, the following parameter is essential? Question 7 options: Distribution time of the unit. Time associated with the failure of the unit. Optimistic or...

-

As you review how cultures differ from each other, imagine that you want to develop a flexible and mobile work force that is not controlled by a given culture but could easily relocate to countries...

-

Explain the Hawthorne effect.

-

Ulmus Corporation is an engineering consulting firm and has $1,120,000 in taxable income for 2019. Calculate the corporations income tax liability for 2019.

-

For its current tax year, Ilex Corporation has ordinary income of $260,000, a short-term capital loss of $60,000, and a long-term capital gain of $20,000. Calculate Ilex Corporations tax liability...

-

Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic...

-

Construction of consumer price index number for the given goods and services. Item Weight in % Base period price Current period price Food 35 150 145 Fuel 10 25 23 Cloth 20 75 65 Rent 15 30 30 Misc....

-

Gammaro Corporation has found that 80% of its sales in any given month are credit sales, while the remainder are cash sales of the credit sales, Gammaro Corporation has experienced the following...

-

Swifty Company estimates that 2022 sales will be $43,200 in quarter 1,$51,840 in quarter 2 , and $62,640 in quarter 3 , Cost of goods sold is 50% of sales. Management desires to have ending...

Study smarter with the SolutionInn App