Brian and Kim have a 12-year-old child, Stan. For 2020, Brian and Kim have taxable income of

Question:

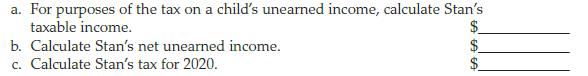

Brian and Kim have a 12-year-old child, Stan. For 2020, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. No election is made to include Stan’s income on Brian and Kim’s return.

Transcribed Image Text:

a. For purposes of the tax on a child's unearned income, calculate Stan's taxable income. b. Calculate Stan's net unearned income. c. Calculate Stan's tax for 2020. $ $ EA GA

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

a 3400 4500 1...View the full answer

Answered By

Shehar bano

I have collective experience of more than 7 years in education. my area of specialization includes economics, business, marketing and accounting. During my study period I remained engaged with a business school as a visiting faculty member and did a lot of business research. I am also tutoring and mentoring number of international students and professionals online for the last 7 years.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Brian and Kim have a 12-year-old child, Stan. For 2014, Brian and Kim have taxable income of $52,000, and Stan has non-qualifying dividend income of $4,500 and investment expenses of $250. No...

-

Brian and Kim have a 12-year-old child, Stan. For 2013, Brian and Kim have taxable income of $52,000, and Stan has non-qualifying dividend income of $4,500 and investment expenses of $250. No...

-

Brian and Kim have a 12-year-old child, Stan. For 2012, Brian and Kim have taxable income of $52,000, and Stan has nonqualifying dividend income of $4,500 and investment expenses of $250. No election...

-

Since the introduction of enhanced security measures by the U.S. Department of Homeland Security in 2017, flights bound for the U.S. from Canada are subject to additional screening by airline...

-

Daily revenue from vending machines placed in various buildings of a major university is as follows: 20, 75, 43, 62, 51, 52, 78, 33, 28, 39, 61, 56, 43, 49, 48, 49, 71, 53, 57, 46, 42, 41, 63, 36,...

-

Distinguish between expected emotions, integral immediate emotions, and incidental immediate emotions. L01

-

Suppose you had to raise capital to fund international value-adding activities and investment projects. From what types of sources (e.g., stock markets) would you most likely obtain each type of...

-

Howe and Duleys company is organized as a partnership. At the prior year- end, partnership equity totaled $150,000 ($100,000 from Howe and $50,000 from Duley). For the current year, partnership net...

-

7. Which of the following Environmental Cost Accounting Method uses environmental cost drivers (7 Point) Live cycle costing Environmental activity-based accounting Input/Output analysis Flow cost...

-

Prop and Flap have produced the following statements of financial position as at 31 October 2008: The following information is relevant to the preparation of the financial statements of the Prop...

-

B Corporation, a calendar year-end, accrual basis taxpayer, is owned 75 percent by Bonnie, a cash basis taxpayer. On December 31, 2020, the corporation accrues interest of $4,000 on a loan from...

-

Pekoe sold stock to his sister Rose for $12,000, its fair market value. Pekoe bought the stock 5 years ago for $16,000. Also, Pekoe sold Earl (an unrelated party) stock for $6,500 that he bought 3...

-

SnowCastles operates a Rocky Mountain ski resort. The company is planning its lift ticket pricing for the coming ski season. Investors would like to earn a 14% return on the company's $100 million of...

-

Suppose youre applying a simulated annealing algorithm to a certain problem, where T is the parameter that measures the tendency to accept the current candidate to be the next trial solution. You...

-

Following is a partially completed balance sheet for Epsico Incorporated at December 31, 2022, together with comparative data for the year ended December 31, 2021. From the statement of cash flows...

-

Assume, further, that the acquisition was consummated on October 1, 2024, as described above. However, by the end of 2025, Ayayai was concerned that the fair values of one or both of the acquired...

-

You have been asked to prepare a brief presentation on a criminological topic or issue of interest to you. Go to the Bureau of Justice Statistics (BJS) Publications & Products Overview page (See link...

-

Sparta Fashions owns four clothing stores, where it sells a wide range of women's fashions, from casual attire to formal wear. In addition, it rents formal wear and gowns for special occasions. At...

-

Shelly had just inherited money from her parents that she was considering placing in a joint account with her husband. She also was contemplating a legal separation from her husband. What advice...

-

Tell whether the angles or sides are corresponding angles, corresponding sides, or neither. AC and JK

-

If a taxpayers 2016 individual income tax return was filed on March 3, 2017, the statute of limitations would normally run out on: a. April 15, 2019 b. March 3, 2016 c. April 15, 2020 d. March 3,...

-

Which of the following deductions has a 6-year statute of limitations? a. Depreciation b. Salaries c. Travel and entertainment d. A return in which the taxpayer omitted gross income in excess of 25...

-

Which of the following tax preparers may not represent their clients in all IRS proceedings? a. An enrolled agent b. A certified public accountant c. An attorney d. All of the above may represent...

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App