Calculate the total child and other dependent credit for the following taxpayers. Please show your work. a.

Question:

Calculate the total child and other dependent credit for the following taxpayers.

Please show your work.

Transcribed Image Text:

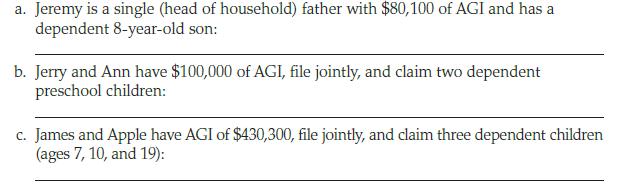

a. Jeremy is a single (head of household) father with $80,100 of AGI and has a dependent 8-year-old son: b. Jerry and Ann have $100,000 of AGI, file jointly, and claim two dependent preschool children: c. James and Apple have AGI of $430,300, file jointly, and claim three dependent children (ages 7, 10, and 19):

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

a 2000 b 4000 The income is less than the phaseout rang...View the full answer

Answered By

Michael Owens

I am a competent Software Engineer with sufficient experience in web applications development using the following programming languages:-

HTML5, CSS3, PHP, JAVASCRIPT, TYPESCRIPT AND SQL.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Russ and Linda are married and file a joint tax return claiming their three children, ages 4, 7, and 18, as dependents. Their adjusted gross income for 2018 is $105,300. What is Russ and Lindas total...

-

Jennifer is divorced and files a head of household tax return claiming her children, ages 4, 7, and 17, as dependents. Her adjusted gross income for 2018 is $211,200. What is Jennifers total child...

-

Write C++ statements to do the following. a. Declare int variables num1 and num2. b. Prompt the user to input two integers. c. Input the first number in num1 and the second number in num2. d. Output...

-

Carol sampled the monthly maintenance costs for automated soldering machines a total of 100 times during 1 year. She clustered the costs into $200 cells, for example, $500 to $700, with cell...

-

In inductive reasoning, conclusions follow not from logically constructed syllogisms, but from evidence. Conclusions are suggested with varying degrees of certainty. The strength of an inductive...

-

The International Monetary Fund (IMF) lists its purposes as follows. Promote international monetary cooperation through consultation and collaboration on international monetary problems. Facilitate...

-

A project manager discovers that his team has neglected to complete the network diagram for the project. The network diagram is shown in Figure P1227. However, the project manager has some...

-

Long Beach, Inc., a lessor, charges Applewood Corp., a lessee, a $1,200 nonrefundable fee to enter into a five-month lease. The lease is effective on 11/1/23. It provides for monthly rental of...

-

Gopher Gulch Corp. is a little two-store retailer operating in a local market. Its problem is that one store in the company is losing money while the other one is making money, based on company...

-

Christine and Doug are married. In 2020, Christine earns a salary of $250,000 and Doug earns a salary of $50,000. They have no other income and work for the same employers for all of 2020. How much...

-

Married taxpayers Otto and Ruth are both self-employed. Otto earns $352,000 of self employment income and Ruth has a self-employment loss of $13,500. How much 0.9 percent Medicare tax for high-income...

-

The proposed design for a blackbody simulator consists of a diffuse gray, circular plate with an emissivity of 0.9 maintained at T p = 600 K and mounted over a well-insulated hemispherical cavity of...

-

15.5 please help will give like if answers r correct Exercise 15-8 (Static) Sales-type lease with selling profit; lessor; calculate lease payments [LO15-3] Manufacturers Southern leased high-tech...

-

When my son was young, he had 8 different plastic dinosaurs to arrange. How many ways could he arrange his 8 dinos? He had favorite dinos, so placing them in proper order was very important. How many...

-

Process P1 init (mutEx); num = 0; loop1 = 0; while (loop1 < 3) wait (mutEx); num num + 1; signal (mutEX); loop1 loop1 + 1; Process P2 loop2 = 0; while (loop2 < 2) wait (mutEx); num num + 10;...

-

PROBLEM 3-5B Following is the chart of accounts of Smith Financial Services: Assets 111 Cash 113 Accounts Receivable 115 Supplies 117 Prepaid Insurance 124 Office Furniture Liabilities 221 Accounts...

-

4. Identify a service you could refer Casey to and write a referral for her (up to 300 words).

-

What is an exchange-traded fund?

-

Fill in each blank so that the resulting statement is true. 83 + 103 = ______ .

-

When calculating ordinary income, partnerships are not allowed which of the following deductions? a. Miscellaneous expenses b. Wages and salaries c. Depreciation d. Cost of goods sold e. Personal...

-

Trevor is a 50 percent partner in the Dalmatian Partnership. His basis in his partnership interest is $30,000 at the end of the tax year but before the partnership gives Trevor a cash distribution of...

-

Which of the following circumstances will not cause a partnership to close its tax year early? a. The partnership terminates by agreement of the partners. b. The business activity of the partnership...

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

-

Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. 2017 Jan. 5 Selk purchased 50,000 shares (25% of total)...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

Study smarter with the SolutionInn App