Charlies Green Lawn Care is a cash-basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some

Question:

Charlie’s Green Lawn Care is a cash-basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2020 customer billings for lawn care into the next year. In addition, he is thinking about paying some of the bills in late December 2020, which he would ordinarily pay in January 2021. This way, Charlie claims, he will have “less income and more expenses, thereby paying less tax!” Is Charlie’s way of thinking acceptable?

Transcribed Image Text:

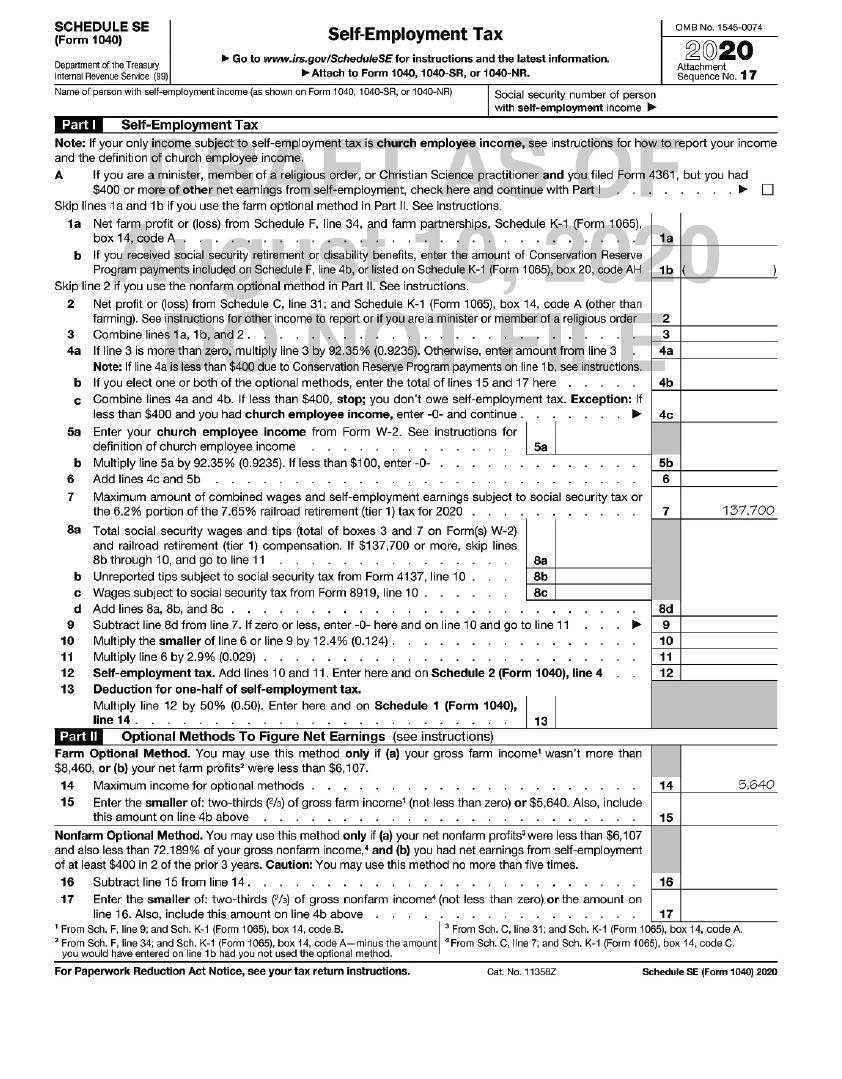

SCHEDULE SE (Form 1040) Department of the Treasury Internal Revenue Service (99) Name of person with self-employment income (as shown on Form 1040, 1040-SR, or 1040-NA) Part I Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions for how to report your income and the definition of church employee income. A 3 4a If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part Skip lines 1a and 1b if you use the farm optional method in Part II. See instructions. 1a b social security retirement or disability benefits, enter the amount of Conservation Reserve If you received Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH no 2 ite Skip line 2 if you use the nonfarm optional method in Part II. See instructions. The 21 you use the 2 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, cade A (other than farming). See instructions for other income to report or if you are a minister or member of a religious order Combine lines 1a, 1b, and 2. 23.3) 92.395 96 (218235). Other of member of a religious or If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. If you elect one or both of the optional methods, enter the total of lines 15 and 17 here Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: If less than $400 and you had church employee income, enter -0- and continue P b c 5a b 6 7 Self-Employment Tax Go to www.irs.gov/ScheduleSE for instructions and the latest information. Attach to Form 1040, 1040-SR, or 1040-NR. SOINS 10 11 Social security number of person with self-employment income 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $137,700 or more, skip lines 8b through 10, and go to line 11 12 Net farm profit or (loss) from Schedule F, line 34, and farm partnerships. Schedule K-1 (Form 1065), box 14, code A COX 14, CODE 13 Enter your church employee income from Form W-2. See instructions for definition of church employee income Multiply line 5a by 92.35% (0.9235). If less than $100, enter -0- Add lines 4c and 5b . . b Unreported tips subject to social security tax from Form 4137, line 10 Wa c Wages subject to social security tax from Form 8919, line 10 www d Add lines 8a, 8b, and 8c ...... ON 9 Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 M Multiply the smaller of line 6 or line 9 by 12.4% (0.124). by C ... Multiply line 6 by 2.9% (0.029)... Papay Saran Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter here and on Schedule 1 (Form 1040), line 14. Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income wasn't more than $8,460, or (b) your net farm profits were less than $6,107. 14 Maximum income for optional methods 15 Enter the smaller of: two-thirds (2/3) of gross farm income (not less than zero) or $5,640. Also, include this amount on line 4b above .. beton Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2020 Po A * From Sch. F, line 34; and Sch. K-1 (Form 1065), box 14, code A-minus the amount you would have entered on line 1b had you not used the optional method. For Paperwork Reduction Act Notice, see your tax return instructions. 5a I F 8a 8b 8c 13 Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $6,107 and also less than 72.189% of your gross nonfarm income, and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14. .. 17 Enter the smaller of: two-thirds (2/3) of gross nonfarm income (not less than zero) or the amount on line 16. Also, include this amount on line 4b above...... 'From Sch. F, line 9; and Sch. K-1 (Form 1065), box 14, code B. 1a 1b 2 3 4a 4b 4c 5b 6 7 8d 9 10 11 12 14 OMB No. 1545-0074 2020 Attachment Sequence No. 17 15 16 137,700 5,640 17 ........ From Sch. C, line 31; and Sch. K-1 (Form 1065), box 14, code A. From Sch. C, line 7; and Sch. K-1 (Form 1065), box 14, code C. Cat No. 11358Z Schedule SE (Form 1040) 2020

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Unless otherwise restricted by law taxpayers can elect to use either the ...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Charlies Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2018 customer billings for lawn care into the next year. In...

-

Charlies Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2014 customer billings for lawn care into the next year. In...

-

Charlie's Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2012 customer billings for lawn care into the next year. In...

-

Identify each of the following items relating to sections of a balance sheet as Current Assets (CA), Property and Equipment (PE), Current Liabilities (CL), Long-Term Liabilities (LTL), or Owners...

-

Dow Chemical is considering licensing a low liquid discharge (LLD) water treatment system from a small company that developed the process. Dow can purchase a 1-year option for $150,000 that will give...

-

Obtain the Health and Safety Policy from any organisation and assess the policy in the light of these four points. LO4

-

Explain how to decide whether a sample correlation coefficient indicates that the population correlation coefficient is significant.

-

Multiple Choice Questions 1. A company should recognize revenue when: a. The revenue is earned b. The contract is signed c. The seller satisfies the performance obligation d. The consideration is...

-

Presented below are the income statement and balance sheet of Windsor, Inc: Income Statement 2020 Sales $100 Cost of goods sold 40 Gross profit 60 Operating expense 9 Interest expense 4 Taxes 6 Loss...

-

Harriet's Hats is a retailer who buys hats from a manufacturer and then sells them in its stores. The following information includes the company's December 31, 20Y8 Balance Sheet and the details of...

-

Antonio is a small business owner and files jointly with his spouse. In 2020, he generates $100,000 of net profits from his business. His spouse, Maria, has $4,000 of state income tax withheld from...

-

In April 2020, Fred paid $40 of state income tax that was due when he filed his 2019 income tax return. During 2020, Freds employer withheld $1,200 of state income tax from his pay. In April 2021,...

-

Wislow Corp. is currently selling for $24, currently paying $2 in dividends, and investon expect dividends to grow at a constant rate of 6% a year. If an investor has a 15 percent required rate of...

-

The problem I have identified is that healthcare leaders could benefit from addressing the issue of stress and burnout, which impact revenue (Scott, 2022). I have found a peer-reviewed article...

-

Facebook, Inc is the company Complete a 3-5 year forecast for your target company assuming a 10% average growth rate for the duration of the forecast period Assuming a long-term growth rate of 5%...

-

BSC-It is important for healthcare leaders to link their departmental balanced scorecard (BSC) to a corporate BSC because it facilitates alignment with the overall strategic objectives of the...

-

Hebert Company adds material at the beginning of production. The following production information is available for March: Beginning Work in Process Inventory (40% complete as to conversion) Started...

-

What modifications would you suggest the leaders of the steel organization when dealing with the use of more efficient technology, carbon emissions, and negative economic impacts in order tomake in...

-

Compare a pretax $10,000 sum placed in bonds yielding 6 percent in a qualified pension with an investment in a municipal bond yielding 5 percent. The municipal bond sum deposited was made with...

-

Could the owner of a business prepare a statement of financial position on 9 December or 23 June or today?

-

Sarah has begun to analyse the data that she is getting through her blog. How should she continue this process? Some sample data is shown in the blog screenshot opposite as well as the sample...

-

What methods could Sarah employ to take her initial blog research further, disaggregate comments more and delve into the topic in even greater depth? Sarah had always had a keen interest in movies...

-

Draft an outline structure of headings that would be broadly suitable for the main body of a consultancy report for James client (including James report) and explain the purpose of such a report....

-

You are evaluating a new project for the firm you work for, a publicly listed firm. The firm typically finances new projects using the same mix of financing as in its capital structure, but this...

-

state, "The subscription price during a rights offering is normally r; lower ; lower r; higher er; higher than the rights-on price and

-

Arnold inc. is considering a proposal to manufacture high end protein bars used as food supplements by body builders. The project requires an upfront investment into equipment of $1.4 million. This...

Study smarter with the SolutionInn App