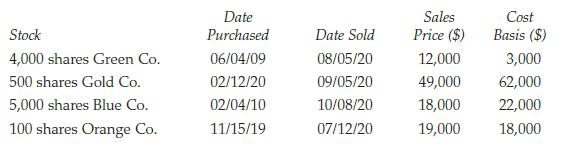

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2020: None of

Question:

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2020:

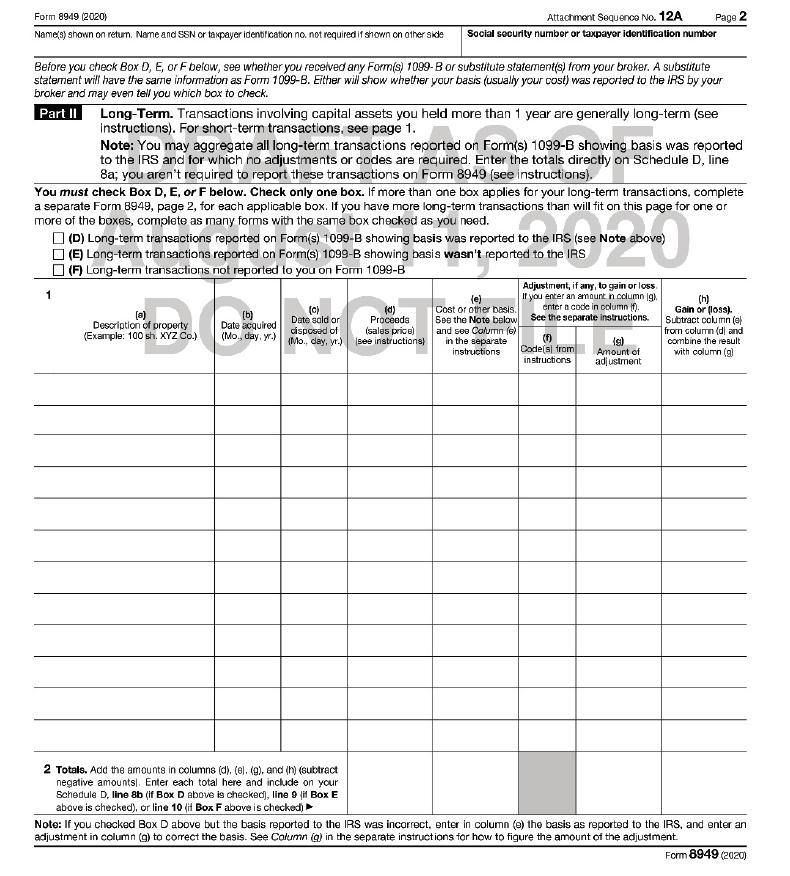

None of the stock is qualified small business stock. The stock basis was reported to the IRS. Calculate Charu’s net capital gain or loss using Schedule D and Form 8949 on Pages 4-53 through 4-56.

Transcribed Image Text:

Stock 4,000 shares Green Co. 500 shares Gold Co. 5,000 shares Blue Co. 100 shares Orange Co. Date Purchased 06/04/09 02/12/20 02/04/10 11/15/19 Date Sold 08/05/20 09/05/20 10/08/20 07/12/20 Sales Price ($) Cost Basis ($) 12,000 3,000 49,000 62,000 18,000 22,000 19,000 18,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

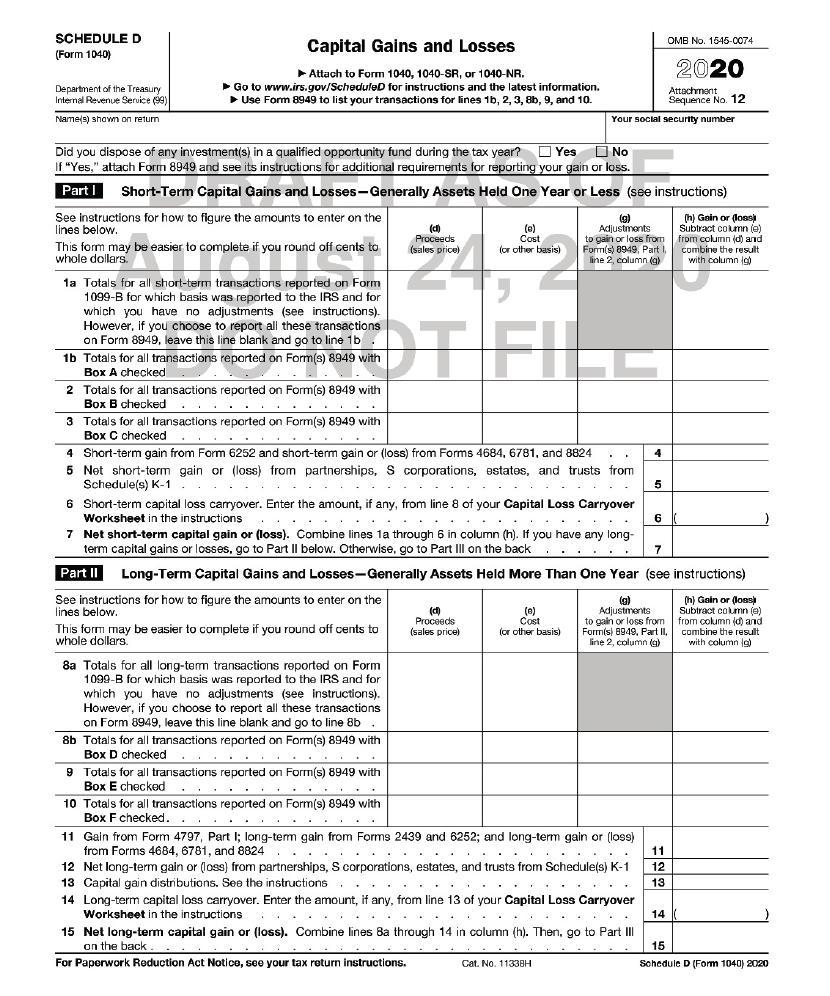

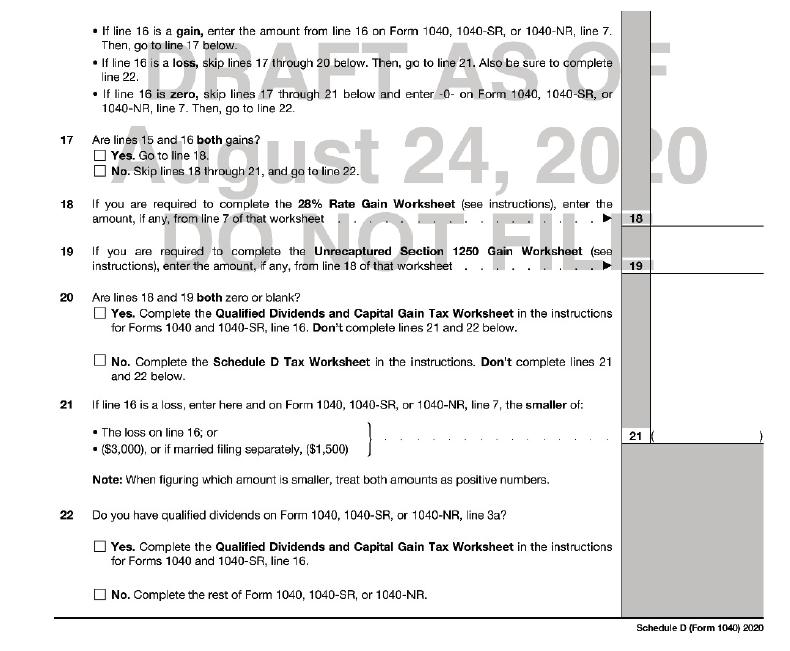

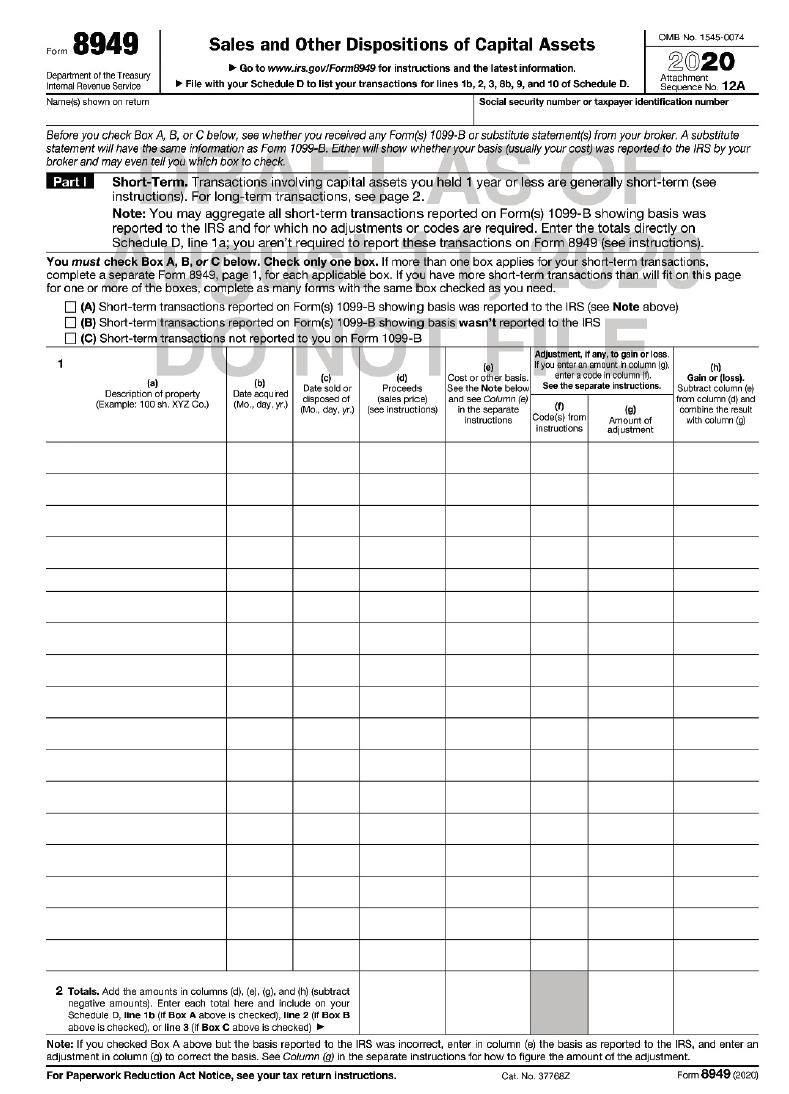

SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service 99 Names shown on retum Capital Gains and Losses Attach to Form 1040 1040SR or 1040NR Go to wwwirsgovScheduled for instructions ...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2016: None of the stock is qualified small business stock. The stock basis was reported to the IRS....

-

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2018: None of the stock is qualified small business stock. The stock basis was reported to the IRS....

-

Karim Depak received a Form 1099-B showing the following stock transactions and basis during 2014: None of the stock is qualified small business stock. Calculate Karim's net capital gain or loss...

-

In Exercises 1318, find the average rate of change of the function from x 1 to x 2 . f(x)=x from x = 4 to x = 9

-

What role does middleware play?

-

Using a graph and illustrative data, identify the premiums for financial risk and business risk at different debt levels. Do these premiums vary depending on the debt level? Explain. AppendixLO1

-

Describe how you can transform a nonstandard normal distribution to a standard normal distribution.

-

Arthur Company is considering investing in an annuity contract that will return $46,000 annually at the end of each year for 15 years. What amount should Arthur Company pay for this investment if it...

-

Ahmad's Corporation had the following transactions during its first month of operations: 1. Purchased raw materials on account, $85,000. 2. Raw Materials of $30,000 were requisitioned to the factory....

-

Ellipses Corp is a small business that operates in Herndon, VA. The company is located at10 Period Lane, Herndon, VA 20170. Its federal Employer Identification Number is 77-7777777, and its...

-

Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at-home parent and Walt is a high school teacher. Skylars...

-

Heather drives her minivan 903 miles for business purposes in 2020. She elects to use the standard mileage rate for her auto expense deduction. Her deduction will be a. $510 b. $515 c. $519 d. $553...

-

Using the Date type, calculate the date 12 months from now and write this into a web page.

-

How do you demonstrate resilience as a leader during times of crisis or uncertainty, and what steps do you take to bolster your team's resilience ?

-

What would you do if it becomes clear to you that the potential successor you were grooming is not going to make the grade as a supervisor? What are your next steps? Do you think this grooming is...

-

How do services and products differ? What kind of decisions do companies make regarding products and services? Why are brands important to marketers? How do marketing strategies change during the...

-

What leadership principles do you feel you possess that are important for APRNs to exhibit? What principles do you need to explore to be more confident in performing? Which leadership style do you...

-

Question 1- Where do you go in the Courier to find out your amount of leftover inventory for a specific product last round? Based on the production tab of the worksheet I gave you; how do you use...

-

Bugatti Company has a September 30 fiscal year end and prepares adjusting entries on an annual basis. The trial balance included the following selected accounts: Accumulated depreciation...

-

In Exercises 15 through 30, find the derivative dy/dx. In some of these problems, you may need to use implicit differentiation or logarithmic differentiation. y ex + et -2x 1 + e

-

Teresa is a civil engineer who uses her automobile for business. Teresa drove her automobile a total of 11,965 miles during 2018, of which 80 percent was business mileage. The actual cost of...

-

Heather drives her minivan 953 miles for business purposes in 2018. She elects to use the standard mileage rate for her auto expense deduction. Her deduction will be a. $510 b. $515 c. $519 d. $181...

-

Joan is a self-employed attorney in New York City. Joan took a trip to San Diego, CA, primarily for business, to consult with a client and take a short vacation. On the trip, Joan incurred the...

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App