David and Darlene Jasper have one child, Sam, who is 6 years old (birthdate July 1, 2010).

Question:

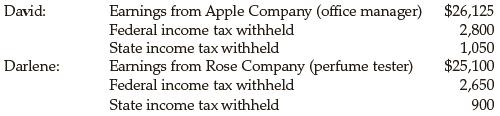

David and Darlene Jasper have one child, Sam, who is 6 years old (birthdate July 1, 2010). The Jaspers reside at 4639 Honeysuckle Lane, Los Angeles, CA 90248. David’s Social Security number is 577-11-3311, Darlene’s is 477-98-4731, and Sam’s is 589- 22-1142. David’s birthdate is May 29, 1984 and Darlene’s birthday is January 31, 1986. David and Darlene’s earnings and withholdings for 2016 are:

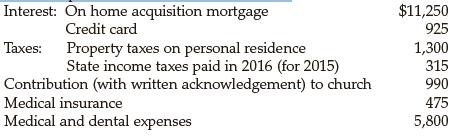

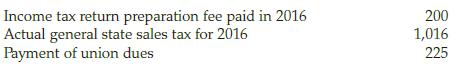

Their other income includes interest from Pine Tree Savings and Loan of $1,825. Other information and expenditures for 2016 are as follows:

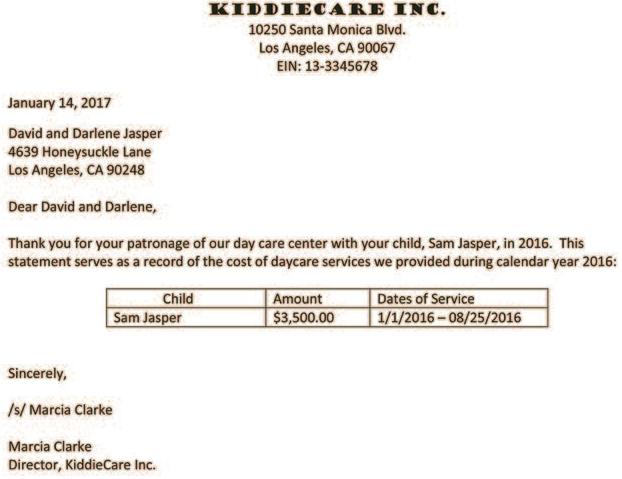

David and Darlene received the following letter from Sam’s daycare provider:

In 2016, David lost his job. David paid for one month of insurance out-of-pocket and then the family went without insurance for September through December 2016. They are not eligible for any exemptions from health care coverage.

Required: Complete the Jaspers’ federal tax return for 2016. Use Form 1040, Schedule A, Schedule B, Form 2441 on Pages 6-73 through 6-77, and the Shared Responsibility Payment Worksheet on Page 6-82 and the Flat Dollar Amount Worksheet on Page 6-83. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller