DeMaria Corporation, a calendar year corporation, generates the following taxable income (net operating losses) since its inception

Question:

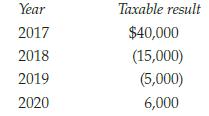

DeMaria Corporation, a calendar year corporation, generates the following taxable income (net operating losses) since its inception in 2017:

Assuming DeMaria makes no special elections with regard to NOLs, what is DeMaria’s net operating loss carryforward into 2021?

Transcribed Image Text:

Year 2017 2018 2019 2020 Taxable result $40,000 (15,000) (5,000) 6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

0 Originally the 2018 and 2019 NOLs coul...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

DeMaria Corporation, a calendar year corporation, generates the following taxable income (net operating losses) since its inception in 2016: Year .................................. Taxable result...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Develop two goals pertaining to your education, future career, or personal life. Each goal includes at least three objectives. Make sure your objectives include performance, conditions, and criteria....

-

Is Stern entitled to a discharge of his student loans on grounds of undue hardship? James Stern took out student loans to attend Bates College and Syracuse College of Law. Afterward, he had...

-

What determines a persons level of job satisfaction

-

Which social factors likely have the most influence on (a) the purchase of a new outfit for a job interview and (b) the choice of a college to attend?

-

What was the average price of a room at two-star, threestar, and four-star hotels around the world during the first half of 2014? The file HotelPrices contains the prices in English pounds (about...

-

Determine the ending balance of each of the following T-accounts. 7.14 points Cash 100 300 20 50 60 Accounts Payable 2,000 8,000 2,700 8 04:17:35 eBook Hint Supplies 10,000 1,100 3,800 Accounts...

-

Selected accounts of Urdu Company are shown below. Instructions From an analysis of the T-accounts, reconstruct (a) The October transaction entries, and (b) The adjusting journal entries that were...

-

For its current tax year, Ilex Corporation has ordinary income of $250,000, a short-term capital loss of $20,000 and a long-term capital gain of $60,000. Calculate Ilex Corporations tax liability for...

-

Ulmus Corporation is an engineering consulting firm and has $1,400,000 in taxable income for 2020. Calculate the corporations income tax liability for 2020. $___________

-

For this problem we will use the data in the file Global100 that was referenced in Section 3.4 as an example for creating a treemap. Here we will use these data to create a GIS chart. A portion of...

-

The copper coil placed inside a stove with the purpose of heating water that flows through the coil. The coil is made from copper tube with an OD of 1 2 . 7 0 mm and ID of 1 1 . 0 8 mm . Water enters...

-

Confidence Levels Given specific sample data, such as the data given in Exercise 1, which confidence interval is wider: the 95% confidence interval or the 80% confidence interval? Why is it wider?

-

Yellow M&Ms Express the confidence interval (0.0847, 0.153) in the form of P - E < p < p + E. 12. Blue M&Ms Express the confidence interval 0.255 (+-) 0.046 in the form of P - E < p < p + E.

-

An ideal, noble gas with a mass of 97.2 g at 25 C and a pressure of 608 torr has a volume of 22.7 L. 1. What is the pressure (in atm)? SHOW ALL WORK. 2. What is R (number and units)? 3. What is the...

-

A drug is used to help prevent blood clots in certain patients. In clinical trials, among 4705 patients treated with the drug, 170 developed the adverse reaction of nausea. Construct a 95% confidence...

-

Compare PengAtlas Maps 1.1 (Developed Economies and Emerging Economies) and Map 1.2 (Political Freedom Around the World). To what extent do developed economies tend to have a high level of political...

-

Whats the difference between an ordinary annuity and an annuity due? What type of annuity is shown below? How would you change the time line to show the other type of annuity?

-

What is the formula for computing taxable income as summarized in the textbook?

-

What is the formula for computing taxable income as summarized in the textbook?

-

Jonathan is a 35-year-old single taxpayer with adjusted gross income of $46,300. He uses the standard deduction and has no dependents. a. Calculate Jonathans taxable income. Please show your work. b....

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App