Derek purchases a small business from Art on June 30, 2020. He paid the following amounts for

Question:

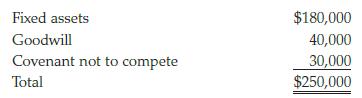

Derek purchases a small business from Art on June 30, 2020. He paid the following amounts for the business:

a. How much of the $250,000 purchase price is for Section 197 intangible assets?

$___________________

b. What amount can Derek deduct on his 2020 tax return as Section 197 intangible amortization?

$___________________

Transcribed Image Text:

Fixed assets Goodwill Covenant not to compete Total $180,000 40,000 30,000 $250,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

a 70000 40000 ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Derek purchases a small business from Art on August 1, 2015. He paid the following amounts for the business: Fixed assets ................................. $220,000 Goodwill...

-

Derek purchases a small business from Art on June 30, 2019. He paid the following amounts for the business: Fixed assets...........................$180,000...

-

Derek purchases a small business from Art on August 30, 2022. He paid the following amounts for the business: a. How much of the $240,000 purchase price is for Section 197 intangible assets? b. What...

-

Dozier Industries Inc. manufactures only one product. For the year ended December 31, 2014, the contribution margin increased by $38,500 from the planned level of $1,386,000. The president of Dozier...

-

Seventy-Three Land, Inc., sued Maxlar Partners for the balance due on a note made by the partnership. Max, a partner, asked the court to dismiss the claim against him personally because the plaintiff...

-

Correlation coefficients can help us understand how two variables are related. What are two variables that might have a strong positive correlation? A strong negative correlation? What might be two...

-

Understand how to manage the diversity of international accounting and tax practices. LO.1

-

1. What is the delivery cost per unit of woofers and tweeters for each option? 2. Why do the delivery costs of woofers and tweeters vary among the four options? 3. Which option do you recommend for...

-

Wilson Co. purchased land as a factory site for $1,350,000. Wilson paid $120,000 to tear down two buildings on the land. Salvage was sold for $8,000. Legal fees of $5,000 were paid for title...

-

Here are simplified financial statements for Phone Corporation in a recent year: Calculate the following financial ratios for Phone Corporation: a. Return on equity b. Return on assets c. Return on...

-

In 2020, Mary sells for $24,000 a machine used in her business. The machine was purchased on May 1, 2018, at a cost of $22,000. Mary has deducted depreciation on the machine of $6,000. What is the...

-

Tom has a successful business with $100,000 of taxable income before the election to expense in 2020. He purchases one new asset in 2020, a new machine which is 7-year MACRS property and costs...

-

A 1.0-cm-tall object is 7.5 cm in front of a diverging lens that has a 10 cm focal length. Use ray tracing to find the position and height of the image. To do this accurately, use a ruler or paper...

-

The table 1 below is shown the production theory of labour for company D'LIMAU Sdn Bhd. Input X Input Y Total Product (TP/Q) 1 0 0 1 1 20 1 2 80 1 3 180 1 4 230 1 5 270 1 6 270 1 7 210 Average...

-

Describe the most important three rights in the Bill of Rights of the United States Constitution. The Bill of Rights is the first ten amendments to the Constitution, but they contain far more than...

-

A red/white wine-tasting party will be held in the school in April, and the theme of the event will be formulated based on the season (April), place (Ontario/Canada), and target participants. Please...

-

We explored many of the revenue streams available to fund fire prevention practices. Describe one revenue stream and explain why you feel it is the most important in supporting fire prevention...

-

Multi-national management in a global economy requires a variety of hard and soft skills. This assignment is meant to enhance the understanding of multi-national situations locally or globally, and...

-

A couple wants to accumulate a retirement fund of $300,000 in current dollars in 18 years. They expect inflation to be 4 percent per year during that period. If they set aside $20,000 at the end of...

-

Find an equation of the given line. Slope is -2; x-intercept is -2

-

John Fuji (birthdate June 6, 1979) moved from California to Washington in December 2015. He lives at 468 Cameo Street, Yakima, WA 98901. Johns Social Security number is 571-78-5974 and he is single....

-

The following information is available for the Albert and Allison Gaytor family in addition to that provided in Chapters 1 4. Albert and Allison received the following form: Albert and Allison paid...

-

The cost of which of the following expenses is not deductible as a medical expense on Schedule A, before the 10 percent of adjusted gross income limitation? a. A psychiatrist b. Botox treatment to...

-

In 2019, Sunland Company had a break-even point of $388,000 based on a selling price of $5 per unit and fixed costs of $155,200. In 2020, the selling price and the variable costs per unit did not...

-

11. String Conversion Given a binary string consisting of characters '0's and '1', the following operation can be performed it: Choose two adjacent characters, and replace both the characters with...

-

Consider the table shown below to answer the question posed in part a. Parts b and c are independent of the given table. Callaway Golf (ELY) Alaska Air Group (ALK) Yum! Brands (YUM) Caterpillar...

Study smarter with the SolutionInn App