During 2018, Palo Fiero purchases the following property for use in his calendar yearend manufacturing business: Palo

Question:

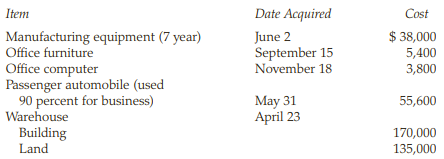

During 2018, Palo Fiero purchases the following property for use in his calendar yearend manufacturing business:

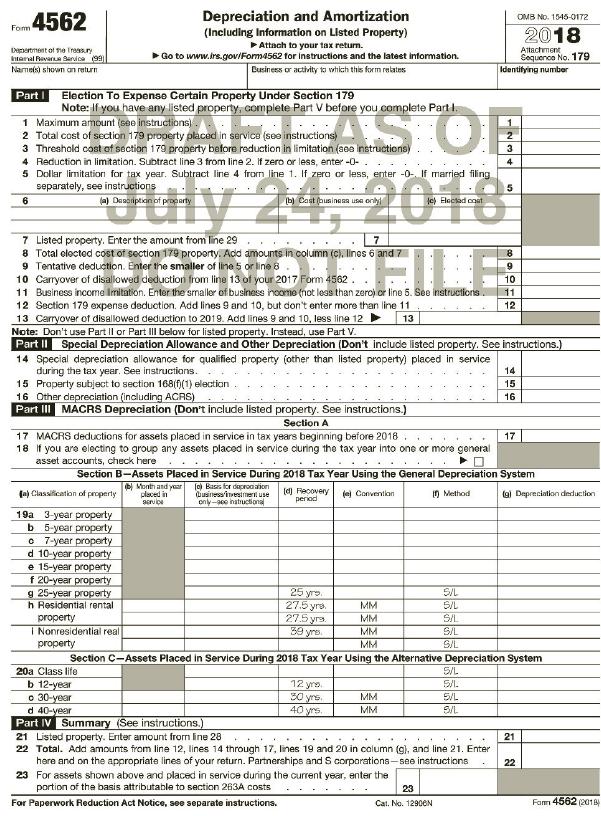

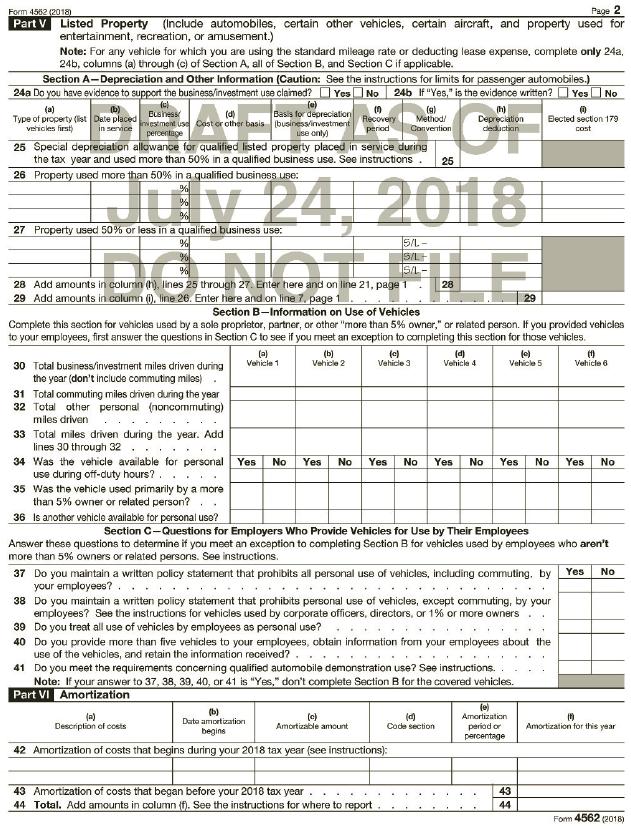

Palo uses the accelerated depreciation method under MACRS, if available, and does not make the election to expense or take bonus depreciation. Use Form 4562 on Pages 843 and 844 to report Palo’s depreciation expense for 2018.

Transcribed Image Text:

Date Acquired June 2 September 15 November 18 Item Cost Manufacturing equipment (7 year) Office furniture Office computer Passenger automobile (used 90 percent for business) Warehouse Building $ 38,000 5,400 3,800 May 31 April 23 55,600 170,000 135,000 Land

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

Form 4562 Department of the Treasury Internal Revenue Service 99 Names shown on return Depreciation and Amortization Including Information on Listed Property Attach to your tax return Go to wwwirsgovF...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

During 2014, Palo Fiero purchases the following property for use in his calendar year-end manufacturing business: Palo uses the accelerated depreciation method under MACRS, if available, and does not...

-

During 2015, Palo Fiero purchases the following property for use in his calendar year-end manufacturing business: Item Date Acquired Cost Manufacturing equipment ............ June 2...

-

During 2016, Palo Fiero purchases the following property for use in his calendar year-end manufacturing business: Palo uses the accelerated depreciation method under MACRS, if available, and does not...

-

Identify in which ledger (general or subsidiary) each of the following accounts is shown: 1. Rent Expense 2. Accounts Receivable-Chen 3. Bank Loan Payable 4. Service Revenue 5. Salaries Payable 6....

-

Refer to E9-4. In information Chapter 9 Exercise 4 Manufacturing equipment ................................. $160,000 Accumulated depreciation through 2012 ................. 100,000 During the first...

-

A circle and a line intersect at most twice. A circle and a parabola intersect at most four times. Deduce that a circle and the graph of a polynomial of degree 3 intersect at most six times. What do...

-

2. The supervisor in each group sets performance standards for making the yachts in 10 minutes. These should include quality as well as quantity standards. In setting the standards, the supervisor...

-

The following financial statements were prepared on December 31, Year 6. Additional Information: Pearl purchased 80% of the outstanding voting shares of Silver for $3,300,000 on July 1, Year 2, at...

-

Howard is thinking of investing in a fund run by Babinda Investment Co. Ltd. He will be required to invest 12 equal annual payments of $1,500 , starting one year from today. If the required rate of...

-

The straight-line y = 2x 2 intersects the curve x 2 y = 5 at the points A and B. Given that A lies below the x-axis and the point P lies on AB such that AP: PB = 3: 1, find the coordinates of P.

-

Serena is a 40-year-old single taxpayer. She operates a small business on the side as a sole proprietorship. Her 2018 Schedule C reports net profits of $5,624. Her employer does not offer health...

-

Go to the IRS website (www.irs.gov) and assuming bonus depreciation is used, redo Problem 11, using the most recent interactive Form 4562, Depreciation and Amortization. Print out the completed Form...

-

Consider a (v, b, r, k, )-design on the set V of varieties, where |V| = v > 2. If x, y V, how many blocks in the design contain either x or y?

-

Problem 8-19 (Algo) Cash Budget; Income Statement; Balance Sheet [LO8-2, LO8-4, LO8-8, LO8-9, LO8- 10] Minden Company is a wholesale distributor of premium European chocolates. The company's balance...

-

Consider the unsteady flow of a fluid in the x direction through a control volume. The linear momentum of the fluid within the control volume is a function of time given by 200ti slug*ft/s, where t...

-

For a continuous uniform distribution with u = 0 and o = 1, the minimum is - V3 and the maximum is V3. For this continuous uniform distribution, find the probability of randomly selecting a value...

-

Marc Goudreau, administrator of Clearwater Hospital, was puzzled by the prior month's reports. "Every month, it's anyone's guess whether the lab will show a profit or a loss. Perhaps the only answer...

-

A system consisting of a gas consisting of O2 (32 Da), H2 (2 Da), and Ar (40 Da) molecules and a billiard ball is at some temperature . Relative to O2, the billiard ball is 1.0 E+26 times as massive...

-

Silvan picks berries at Seymours Berry Farm. He receives 58 cents for each small basket picked. Last weekend, he was able to pick 731 baskets. How much did he earn?

-

Using thermodynamic data from Appendix 4, calculate G at 258C for the process: 2SO 2 (g) + O 2 (g) 88n 2SO 3 (g) where all gases are at 1.00 atm pressure. Also calculate DG8 at 258C for this same...

-

Proudfoot, Inc. would like to deduct expenditures for tangible personal property under $4,000 as maintenance and repairs costs. To implement this policy, which of the following is not required? a. A...

-

An asset (not an automobile) put in service in June 2022 has a depreciable basis of $24,000 and a recovery period of 5 years. Assuming bonus depreciation is used, half-year convention and no election...

-

Micahs business has four different building projects underway. Select the project that is likely to be immediately deductible. a. Micah is installing a new roof on a warehouse. The roof has started...

-

Suppose the S&P 500 currently has a level of 960. One contract of S&P 500 index futures has a size of $250 S&P 500 index. You wish to hedge an $800,000-portfolio that has a beta of 1.2. (A)In order...

-

Exhibit 4.1 The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during...

-

Haley is 57 years of age. She is planning for future long-term care needs. She knows that yearly nursing home costs in her area are currently $69,000, with prices increased by 5 percent annually....

Study smarter with the SolutionInn App