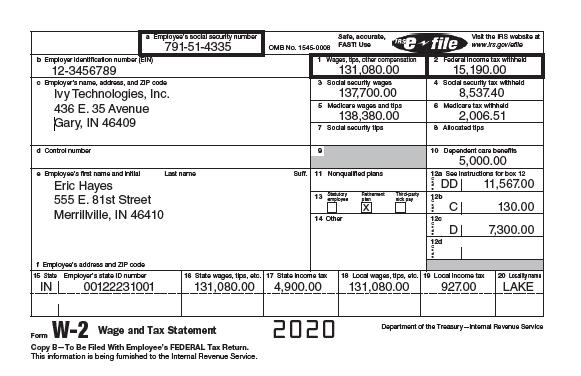

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help.

Question:

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help. Eric’s 2020 salary was $146,000 and he does not understand why the amounts in Boxes 1, 3, and 5 are not $146,000? His final paycheck for the year included the following information:

– Eric contributed 5 percent of his salary to the company 401(k) plan on a pre-tax basis.

– Eric is married with two children. He had $5,000 deducted from his wages for a Dependent

Care Flexible Spending Account.

– Eric is enrolled in the company-sponsored life insurance program. He has a policy that provides a benefit of $146,000.

– Eric contributed the 2020 maximum amount to the Health Care Flexible Spending Account.

Using the information and Eric’s Form W-2, prepare an email to Eric reconciling his salary of $146,000 to the amounts in Boxes 1, 3, and 5.

Step by Step Answer:

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill