Fidicuary Investments paid its employee, Yolanda, wages of $137,000 in 2018. Calculate the FICA tax: Withheld from

Question:

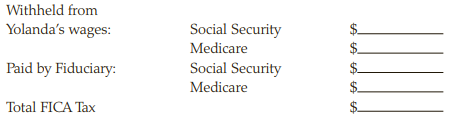

Fidicuary Investments paid its employee, Yolanda, wages of $137,000 in 2018. Calculate the FICA tax:

Transcribed Image Text:

Withheld from Yolanda's wages: Social Security Medicare Paid by Fiduciary: Social Security Medicare Total FICA Tax

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 73% (15 reviews)

Yolanda Social Security 128400 x 62 796080 Medica...View the full answer

Answered By

Charles Okinda

students should give all the instructions concerning the challenge that they face. they will get an immediate response because I am always online.

4.90+

754+ Reviews

1483+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Jenny earns $34,500 in 2014. Calculate the FICA tax that must be paid by: Jenny: Jenny's Employer: Total FICA Tax Soc. Sec. Medicare Soc. Sec. Medicare $S

-

Jenny earns $34,500 in 2015. Calculate the FICA tax that must be paid by: Social Security Medicare Jenny ey's Employer Total FICA Tax Social Security Medicare

-

Jenny earns $44,500 in 2016. Calculate the FICA tax that must be paid by: Jenny: Jenny's Employer Total FICA Tax Social Security Medicare Social Security Medicare

-

Consider a single-output, non-preemptive queueing system. It has three queues connected to the single output, and packets in the queues are handled based on a strict-priority order. The three queues...

-

Using the following categories, indicate the effects of the following transactions. Use + for increase and - for decrease and indicate the accounts affected and the amounts. Assets = Liabilities +...

-

Write down the first five terms of the sequence. {()'} {s} (3,

-

1. How does your family identify itself ethnically?

-

A risky $400,000 investment is expected to generate the following cash flows: a. If the firms cost of capital is 10 percent, should the investment be made? b. An alternative use for the $400,000 is a...

-

Which allowance method approach is considered to be an income statement approach for estimating bad debts? O a. The percentage of accounts written off method O b. The direct write-off method O c. The...

-

1. Identify the U.S. federal law, originally passed in the 1800's, that, among other things, imposes criminal sanctions for agreements in restraint of trade and for misuse of monopoly power...

-

Which of the following is not classified as portfolio income for tax purposes? a. Interest income on savings accounts. b. Dividends paid from a credit union. c. Net rental income from real estate...

-

Which of the following is not true about FICA taxes? a. The FICA tax has two parts, Social Security (Old Age, Survivors, and Disability Insurance) and Medicare. b. In 2018, the maximum wage base for...

-

Golf Academy, Inc., provides private golf lessons. Its unadjusted trial balance at December 31, 2015, follows, along with information about selected accounts. Required: 1. Calculate the (preliminary)...

-

9. [10] Suppose that B and W are BMs and that they are correlated with correlation coefficient P (-1, 1) in the sense that the correlation coefficient between Bt and Wt for all t>0. Then we can...

-

You have just incorporated and started your business. Your corporate pre-tax profit is $40,000. This is your only source of income. This income is eligible for the Small Business Deduction and is...

-

4. Provide the information requested in the statements below: a) Find and draw all C's that do not contain H's (if any). For this, redraw the structure where you show the d ('s). N b) Find and draw...

-

Suppose that f(x) = 8x + 5. (A) Find the slope of the line tangent to f(x) at x = 7. (B) Find the instantaneous rate of change of f(x) at x = -7. C) Find the equation of the line tangent to f(x) at x...

-

Whichof the following regarding the relationship between business risk and financial risk is least accurate based on our discussions in class? A. Business risk represents uncertainty caused by...

-

Sketch the appearance of the 1 H-NMR spectrum of acetaldehyde (ethanal) using J = 2.90 Hz and the data in Exercise 15.9a in a spectrometer operating at (a) 250 MHz, (b) 500 MHz. Data in Exercise...

-

a. Determine the domain and range of the following functions.b. Graph each function using a graphing utility. Be sure to experiment with the window and orientation to give the best perspective of the...

-

If a taxpayers 2022 individual income tax return is due on April 18, 2023 and was filed on March 3, 2023, the statute of limitations would normally run out on: a. April 18, 2025 b. March 3, 2024 c....

-

The taxpayer penalty for writing a check to pay for taxes that has insufficient funds is: a. The same amount the bank charges the IRS for a returned check b. 5 percent of the amount of the total tax...

-

A taxpayer incorrectly reports income and has a substantial understatement of income tax in the amount of $20,000 (but no fraud). The accuracy-related penalty for this error is: a. $20,000 b. $1,000...

-

Answer please, A company uses the perpetual inventory system and recorded the following entry: This entry reflects a

-

As a Financial Analyst in the Finance Department of Zeta Auto Corporation they are seeking to expand production. The CFO asks you to help decide whether the firm should set up a new plant to...

-

Chapter 4 When an Auditor finds misstatements in entities financial statements which may be the result of fraudulent act, what should be the role of an auditor under that situation? (2 Points)

Study smarter with the SolutionInn App