Go to the IRS website (www.irs.gov) and redo Problem 10 above using the most recent interactive Form

Question:

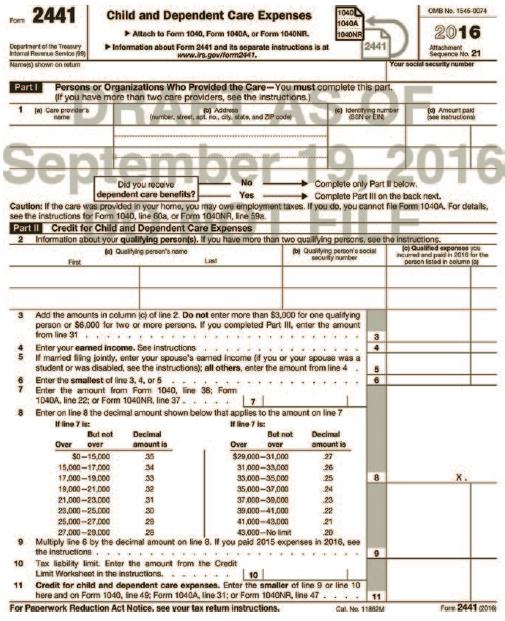

Go to the IRS website (www.irs.gov) and redo Problem 10 above using the most recent interactive Form 2441, Child and Dependent Care Expenses. Print out the completed Form 2441.

Data From Problem 10:

Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in qualified child care expenses during the year. If her adjusted gross income (all from wages) for the year is $18,500, calculate Clarita’s child and dependent care credit for 2016.

Form 2441:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller

Question Posted: