In 2018, Jeff spends $6,000 on solar panels to heat water for his main home. What is

Question:

In 2018, Jeff spends $6,000 on solar panels to heat water for his main home. What is Jeff’s credit for his 2018 purchases?

Transcribed Image Text:

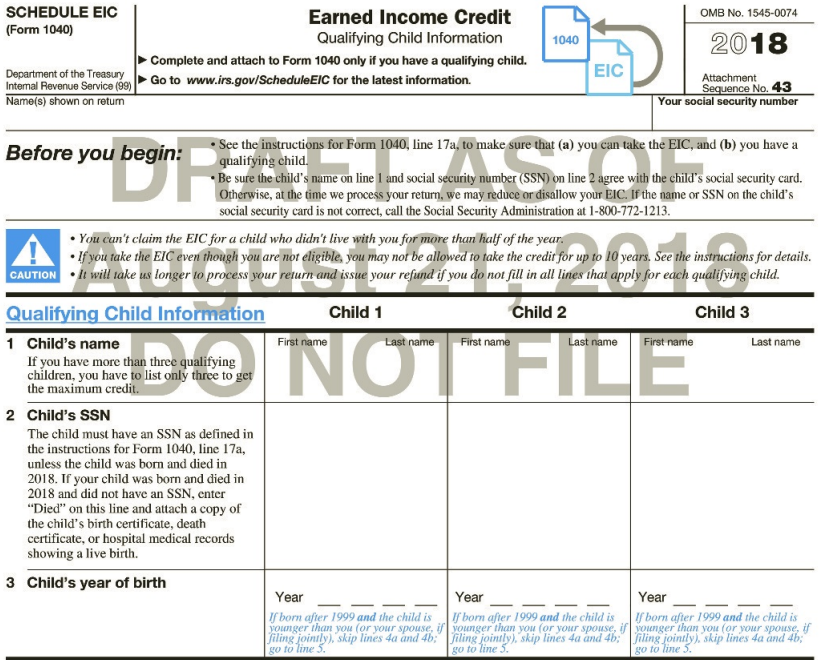

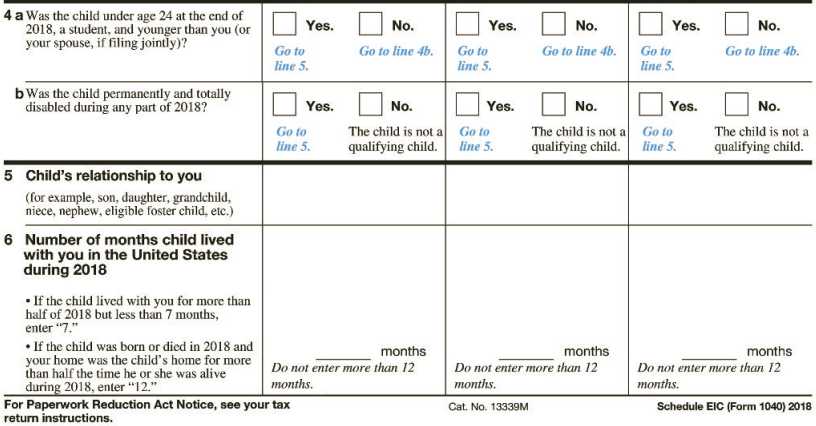

SCHEDULE EIC OMB No. 1545-0074 Earned Income Credit (Form 1040) Qualifying Child Information 2018 1040 Complete and attach to Form 1040 only if you have a qualifying child. EIC Department of the Treasury Intermal Revenue Service (9) Name(s) shown on retun Attachment Sequence No. 43 Your social security number Go to www.irs.gov/ScheduleEIC for the latest information. • See the instructions for Form 1040, line 17a, to make sure that (a) you can take the EIC, and (b) you have a qualifying child. • Be sure the child's name on line 1 and social security number (SSN) on line 2 agree with the child's social security card. Otherwise, at the time we process your return, we may reduce or disallow your EIC. If the name or SSN on the child's social security card is not correct, call the Social Security Administration at 1-800-772-1213. DR Before you begin: • You can't claim the EIC for a child who didn't live with you for more than half of the year. • If you take the EIC even though you are not eligible, you may not be allowed to take the credit for up to 10 years. See the instructions for details. •it will take us longer to process your return and issue your refund if you do not fill in all lines that apply for each qualifying child. 2018 CAUTION Qualifying Child Information Child 1 Child 2 Child 3 ONOT FILE 1 Child's name If you have more than three qualifying children, you have to list only three to get the maximum credit. First name First name Last name First name Last name Last name 2 Child's SSN The child must have an SSN as defined in the instructions for Form 1040, line 17a, unless the child was born and died in 2018. If your child was born and died in 2018 and did not have an SSN, enter "Died" on this line and attach a copy of the child's birth certificate, death certificate, or hospital medical records showing a live birth. 3 Child's year of birth Year Year Year If born after 1999 and the child is younger than you (or your spouse, if younger than you (or your spouse, if younger than you (or your spouse, if filing jointly), skip lines 4a and 4b:iling jointly), skip lines 4a and 4b; iling jointly), skip lines 4a and 46; go to line 5. If born after 1999 and the child is If born after 1999 and the child is go to line 5. go to line 5. 4 a Was the child under age 24 at the end of 2018, a student, and younger than you (or your spouse, if filing jointly)? Yes. No. Yes. No. Yes. No. Go to line 5. Go to line 4b. Go to line 5. Go to line 4b. Go to Go to line 4b. line 5. bWas the child permanently and totally disabled during any part of 2018? Yes. No. Yes. No. Yes. No. Go to line 5. The child is not a Go to qualifying child. line 5. The child is not a qualifying child. line 5. Go to The child is not a qualifying child. 5 Child's relationship to you (for example, son, daughter, grandchild, niece, nephew, eligible foster child, etc.) 6 Number of months child lived with you in the United States during 2018 • If the child lived with you for more than half of 2018 but less than 7 months, enter "7." • If the child was born or died in 2018 and your home was the child's home for more Do not enter more than 12 than half the time he or she was alive during 2018, enter "12." For Paperwork Reduction Act Notice, see your tax return instructions. months months months Do not enter more than 12 months. Do not enter more than 12 тonths. months. Cat. No. 13339M Schedule EIC (Form 1040) 2018

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 81% (11 reviews)

Jeff s ...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

In 2016, Jeff spends $6,000 on solar panels to heat water for his main home. What is Jeff's credit for his 2016 purchases?

-

Solar Panels, Inc., has the following items and amounts as part of its master budget at the 10,000-unit level of sales and production: Sales revenue . . . . . . . . . . . . . . . . . . . . . . . . ....

-

The March 31, 2011, edition of the Wall Street Journal includes an article by Russell Gold entitled Solar Gains TractionThanks to Subsidies. Instructions Read the article and answer the following...

-

Dr. Bold has a personal automobile policy with liability limits as follows: $100,000/$300,000 BI and $50,000 PD. Dr. Bold is held liable in an accident in which he must pay for bodily injuries as...

-

Grocery Corporation received $300,328 for $250,000, 11 percent bonds issued on January 1, 2012, at a market interest rate of 8 percent. The bonds stated that interest would be paid each December 31...

-

Determine the appropriate rotation formulas to use so that the new equation contains no xy-term. 34x 2 24xy + 41y 2 25 = 0

-

Engage group members in an evaluation of their own success during the meeting (what went well and what needs improvement in their own process); use these suggestions for improvement in the next...

-

According to the 2010 Census, 11.4% of all housing units in the United States were vacant. A county supervisor wonders if her county is different from this. She randomly selects 850 housing units in...

-

Chapter 7 problem 3 Moss Piano Company purchased a Delivery Truck on May 1 , 2 0 2 4 the cost of the asset, the salvage value and the useful life information is provided in the table below. The miles...

-

Klyn Manufacturing Company experienced the following accounting events during its first year of operation. Except for the depreciation adjusting entries, all transactions are cash transactions. 1....

-

Matthew borrows $250,000 to invest in bonds. During the current year, his interest on the loan is $30,000. Matthews taxable interest income from the bonds is $10,000. This is Matthews only investment...

-

Marys mother defaults on a home loan and Mary pays $600 in loan payments, including $175 in interest. Mary is not legally obligated on the loan and has no ownership interest in her mothers home. a....

-

On July 1, 2013, McEnroe Company used receivables totaling $150,000 as collateral on a $100,000, 15% note from Standard One Bank. The transaction is not structured such that receivables are being...

-

In countries with high unemployment and poverty rates, the nation's people are often more concerned with the economic environment than the intricacies of its political systems. In 2010, Mohamed...

-

Analyze this approach: Consider that you could increase the productivity of your department, you have thought about certain ways to do it, but you are not sure. Your team has a lot of experience, but...

-

What is the research question or objective? What research methods did the authors use? Examples include survey, case study, interviews, opinions, qualitative, quantitative, etc. What are the...

-

Provide a critical reflection on each department outlining which services, aspects and operational factors you should further investigate to help improve customer satisfaction. Express the negative...

-

1. Many courses use group projects. What are some of the things that make positive group project experiences? 2. How can a manager motivate employees? Give some specific ideas. Include when you've...

-

General purpose financial reports are only one source of information for users when making a variety of decisions. What other sources of information are available to users and why is it important...

-

What is the order p of a B + -tree? Describe the structure of both internal and leaf nodes of a B + -tree.

-

If an individual taxpayer generates a net capital loss in excess of $3,000 in 2022: a. The loss can be carried back for 3 years and forward for 5 years b. The loss can be carried back for 2 years and...

-

Serena, a married filing jointly taxpayer, has the following capital gains and losses in 2022: ? $4,000 short-term capital gain ? $2,000 short-term capital loss ? $2,000 long-term capital gains ?...

-

Tyler, a single taxpayer, generates business income of $3,000 in 2019. In 2020, he generates an NOL of $5,000. In 2021, he generates business income of $1,000. In 2022, his business generates income...

-

please explain thoroughly how to do in excel 1. Find the number of units to ship from each factory to each customer that minimizes total cost

-

For esch of the following Independent tranactiona, determine the minimum amount of net income or loas for tox purposes snd the tsxpsyer to which it applies. 1 An individual purchases a $ 1 0 , 0 0 0...

-

Suppose a bond has a modified duration of 4. By approximately how much will the bonds value change if interest rates: a. Increase by 50 basis points b. Decrease by 150 basis points c. Increase by 10...

Study smarter with the SolutionInn App