Juanita contributes property with a fair market value of $30,000 and an adjusted basis of $16,000 to

Question:

Juanita contributes property with a fair market value of $30,000 and an adjusted basis of $16,000 to a partnership in exchange for an 10 percent partnership interest.

Transcribed Image Text:

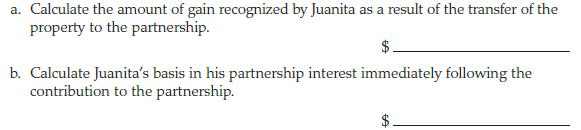

a. Calculate the amount of gain recognized by Juanita as a result of the transfer of the property to the partnership. $ b. Calculate Juanita's basis in his partnership interest immediately following the contribution to the partnership. 69

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

a 0 b 16000 The ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

1. Jay contributes a property with a fair market value of $16,000 and an adjusted basis of $5,000 to a partnership in exchange for an 8 percent partnership interest. a . Calculate the amount of gain...

-

1. Betty contributed property with a $40,000 basis and fair market value of $85,000 to the Rust Partnership in exchange for a 50% interest in partnership capital and profits. During the first year of...

-

Multiple choice Questions: 1. Which of the following is not a partnership for tax purposes? a. Willis and James purchase and operate a shoe store. b. Sharon and Gary operate an accounting practice...

-

StudentGrades.java import java.io.File; import java.io.FileReader; import java.io.IOException; import java.io.PrintWriter; import java.util.Map; import java.util.Scanner; import java.util.Set; import...

-

Did a majority of the board of directors have a conflict of interest? Was demand on the board futile? Pierre M. Omidyar and Jeffrey Skoll founded eBay, Inc., a company that hosts an online auction...

-

The similarities and differences among the various needmotivevalue theories of motivation

-

Trek has designed a new off-road bicycle designed to stand up to the rugged conditions of trail riding. Develop a theme for an advertising strategy that covers all three components of attitude.

-

Aerostar, Inc., operates as a retailer of casual apparel. A recent, condensed income statement for Aerostar follows: Requirements 1. Assume that the following transactions were inadvertently omitted...

-

The 2024 income statement and comparative balance sheot of Digtal Subscriptions, Ino, follow: (Cick the icon bo vew the income statement) (Click the icon to view the additional information.) , Ciex...

-

Calculate the volumetric thermal source strength, Btu/hr ft' at a point 49.9 percent of the radial distance and halfway above the center plane of a cylindrical, homogeneous bare reactor core...

-

Abigail contributes land with an adjusted basis of $50,000 and a fair market value of $60,000 to Blair and Partners, a partnership. Abigail receives a 50 percent interest in Blair. What is Abigails...

-

Abigail contributes land with an adjusted basis of $50,000 and a fair market value of $60,000 to Blair and Partners, a partnership. Abigail receives a 50 percent interest in Blair. What is Blairs...

-

1. Management originally predicted that the profits from the sales of a new product could be approximated by the graph of the function f shown. The actual profits are represented by the graph of the...

-

Determine dy/dr when 3x+4y = 3.

-

Problem 3. Doping a Semiconductor The following chemical scheme is used to introduce P-atoms as a dopant into a semiconductor - a silicon chip. POCI3 Cl POCI 3 vapor P P SiO2 + P(s) CVD coating Si...

-

The system shown in the following figure is in static equilibrium and the angle is equal to 34 degrees. Given that the mass1 is 8 kg and the coefficient of static friction between mass1 and the...

-

Pre-Writing step for a report for your boss on Richard Hackman's statement that using a team to complete a complex project may not be the best approach. Review your classmates' contributions to the...

-

For the graph of the equation x = y - 9, answer the following questions: the x- intercepts are x = Note: If there is more than one answer enter them separated by commas. the y-intercepts are y= Note:...

-

After comparing the three views of globalization, which seems the most sensible to you and why?

-

Match the following. Answers may be used more than once: Measurement Method A. Amortized cost B. Equity method C. Acquisition method and consolidation D. Fair value method Reporting Method 1. Less...

-

Margaret started her own business in the current year and will report a profit for her first year. Her results of operations are as follows: What is the net income Margaret should show on her...

-

Kevin owns a retail store, and during the current year he purchased $610,000 worth of inventory. Kevins beginning inventory was $67,000, and his ending inventory is $77,200. During the year, Kevin...

-

Go to the IRS website (www.irs.gov) and find the most recent IRS Publication 538, Accounting Periods and Methods. Print out the first two pages of the part on inventories.

-

Problem 12.6A (Algo) Liquidation of a partnership LO P5 Kendra, Cogley, and Mel share income and loss in a 3.21 ratio (in ratio form: Kendra, 3/6: Cogley, 2/6; and Mel, 1/6), The partners have...

-

Melody Property Limited owns a right to use land together with a building from 2000 to 2046, and the carrying amount of the property was $5 million with a revaluation surplus of $2 million at the end...

-

Famas Llamas has a weighted average cost of capital of 9.1 percent. The companys cost of equity is 12.6 percent, and its cost of debt is 7.2 percent. The tax rate is 25 percent. What is the companys...

Study smarter with the SolutionInn App