Lamden Company paid its employee, Trudy, wages of $61,500 in 2020. Calculate the FICA tax: Withheld from

Question:

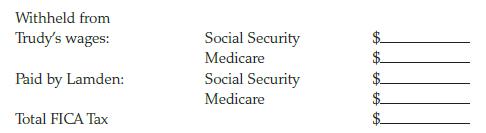

Lamden Company paid its employee, Trudy, wages of $61,500 in 2020. Calculate the FICA tax:

Transcribed Image Text:

Withheld from Trudy's wages: Paid by Lamden: Total FICA Tax Social Security Medicare Social Security Medicare GA GA GA GA FA

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 16% (6 reviews)

Trudy Lamden Company Total FICA Ta...View the full answer

Answered By

Elias Gichuru

am devoted to my work and dedicated in helping my clients accomplish their goals and objectives,providing the best for all tasks assigned to me as a freelancer,providing high quality work that yields high scores.promise to serve them earnestly and help them achieve their goals.i have the needed expertise,knowledge and experience to handle their tasks.

4.80+

325+ Reviews

859+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Lamden Company paid its employee Trudy, wages of $61,500 in 2020. Of this amount, $2,400 was allocated to sick pay for two weeks due to Trudys spouse contracting COVID and Trudy being quarantined....

-

0Lamden Company paid its employee Trudy, wages of $61,500 in 2020. Of this amount, $2,400 was allocated to sick pay for two weeks due to Trudys spouse contracting COVID and Trudy being quarantined....

-

Start of Payroll Project 7-3a October 9, 20-- No. 1 The first payroll in October covered the two workweeks that ended on September 26 and October 3. This payroll transaction has been entered for you...

-

Why does the magnetization current impose an upper limit on the voltage applied to a transformer core?

-

Multiply Choice 1. Suppose that you are the manager of a General Motors plant that is about to start producing Hummers. The Hummer requires special protective paint that, as it turns out, reacts with...

-

Know what classes of people are protected by federal law

-

NCAA rules for athletes. The National Collegiate Athletic Association (NCAA) requires Division II athletes to get a combined score of at least 820 on the Mathematics and Critical Reading sections of...

-

Ticotin Inc. is a retailer operating in British Columbia. Ticotin uses the perpetual inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory...

-

Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Whitman Company Income Statement Sales (41,000 units X $44.60...

-

The data set from Dalia Research (youll learn more about Dalia in Chapter 2) contains 763 variables, including demographic information on the 43,034 respondents and survey questions on a variety of...

-

Jane is a single taxpayer with a current year AGI of $181,000 and current year income tax liability of $34,968. Her AGI in the prior year was $150,400 and prior year tax liability was $27,247. Jane...

-

Amy is a single taxpayer. Her income tax liability in the prior year was $3,803. Amy earns $50,000 of income ratably during the current year and her tax liability is $4,315. In order to avoid...

-

Four Sheets (FS) Company uses standard costing. Kate King, the new president of FS Company, is presented with the following data for 2015: Required 1. At what percentage of denominator level was the...

-

Solve X+1U6x-13x+2-4x+5

-

Summarize the selected poster's design format, such as the color, layout, font style, size, space, and the subject's analysis format. Also, analyze how the study started. Such as background and...

-

Income statement Prior year Current year Revenues 782.6 900.0 Cost of sales Selling costs Depreciation (27.0) (31.3) Operating profit 90.4 85.7 Interest Earnings before taxes 85.4 78.2 Taxes (31.1)...

-

View the video at the slide title "Lab: Social Media Post" at time 28:20. Link:...

-

Write a program ranges.py in three parts. (Test after each added part.) This problem is not a graphics program. It is just a regular text program to illustrate your understanding of ranges and loops....

-

1. Assuming you can afford (and are interested in) some of the "Maasai" products, would you like to pay more for these products if royalties are paid to the Maasai? 2. As CEO of one of the tribes...

-

Create an appropriate display of the navel data collected in Exercise 25 of Section 3.1. Discuss any special properties of this distribution. Exercise 25 The navel ratio is defined to be a persons...

-

During 2019, Paul sells residential rental property for $240,000, which he acquired in 1998 for $160,000. Paul has claimed straight-line depreciation on the building of $60,000. What is the amount...

-

Jeanie acquires an apartment building in 2008 for $280,000 and sells it for $480,000 in 2019. At the time of sale there is $60,000 of accumulated straight-line depreciation on the apartment building....

-

On March 8, 2019, Holly purchased a residential apartment building. The cost basis assigned to the building is $700,000. Holly also owns another residential apartment building that she purchased on...

-

explain the concept of Time Value of Money and provide and example. In addition to your discussion, please explain the differences between Stocks and Bonds

-

Wildhorse Inc. has just paid a dividend of $3.80. An analyst forecasts annual dividend growth of 9 percent for the next five years; then dividends will decrease by 1 percent per year in perpetuity....

-

Jenny wanted to donate to her alma mater to set up a fund for student scholarships. If she would like to fund an annual scholarship in the amount of $6,000 and her donation can earn 5% interest per...

Study smarter with the SolutionInn App