Question:

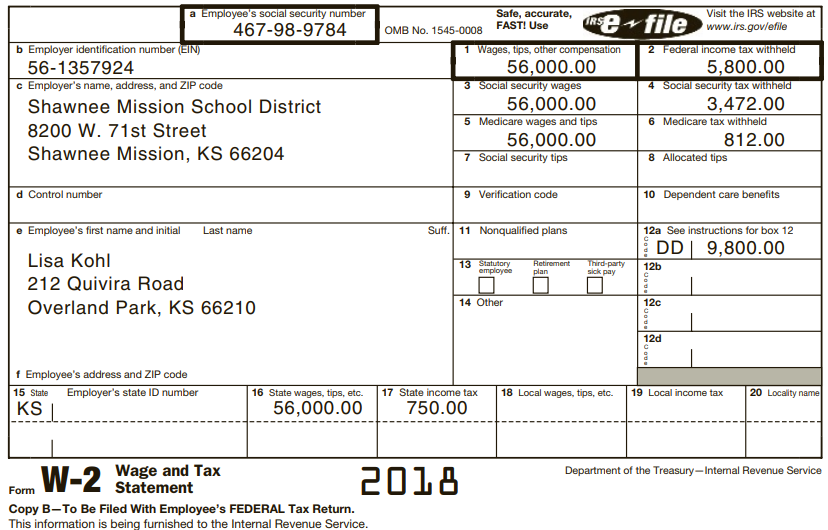

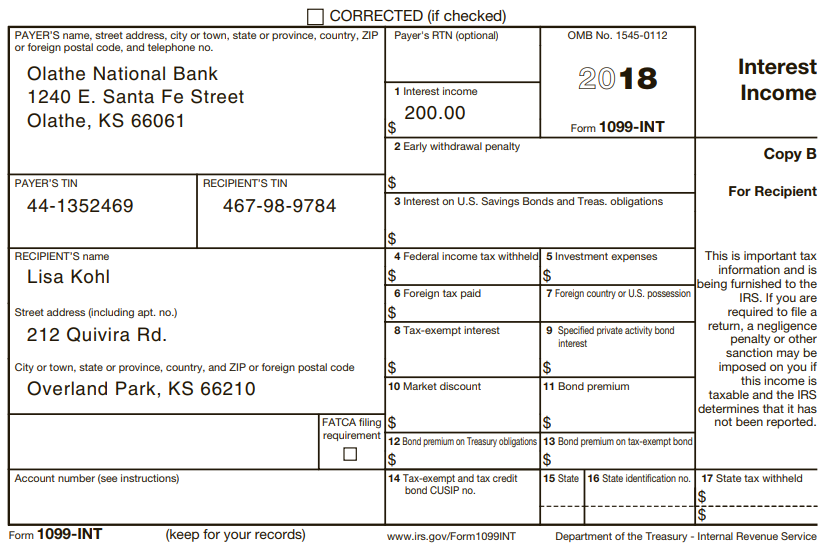

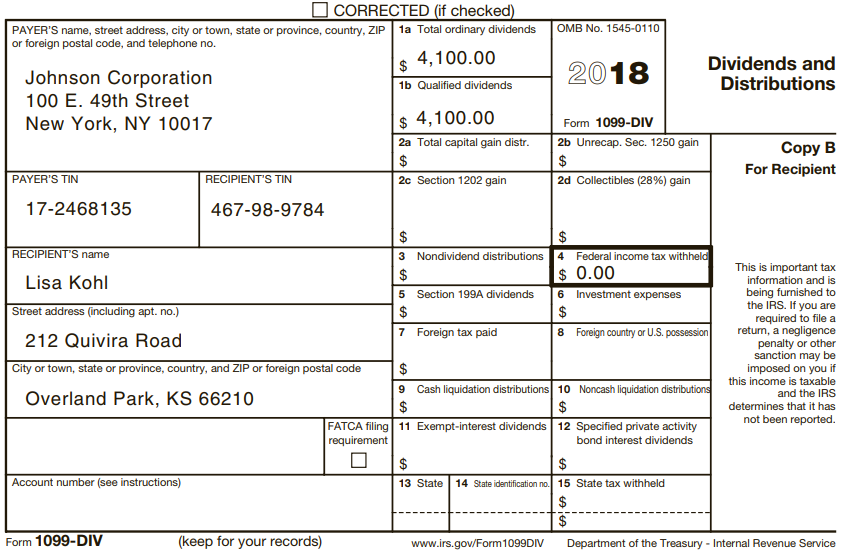

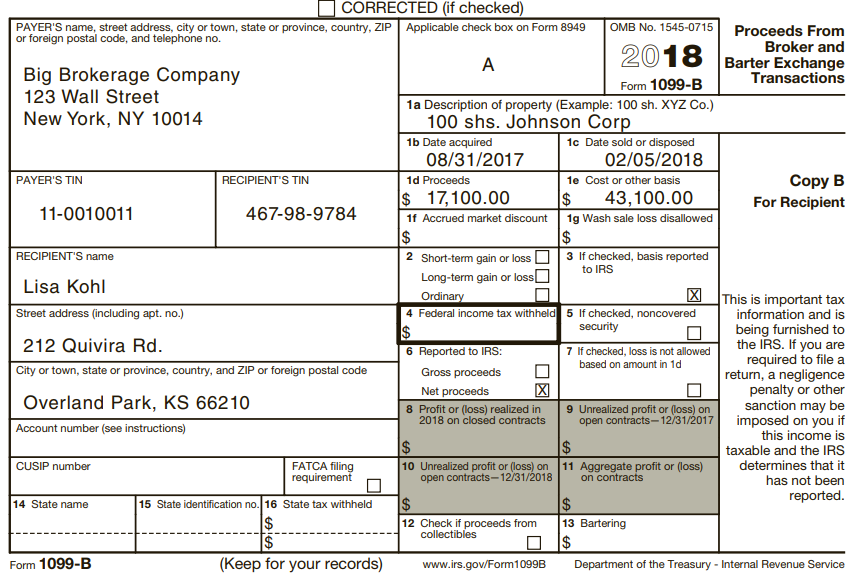

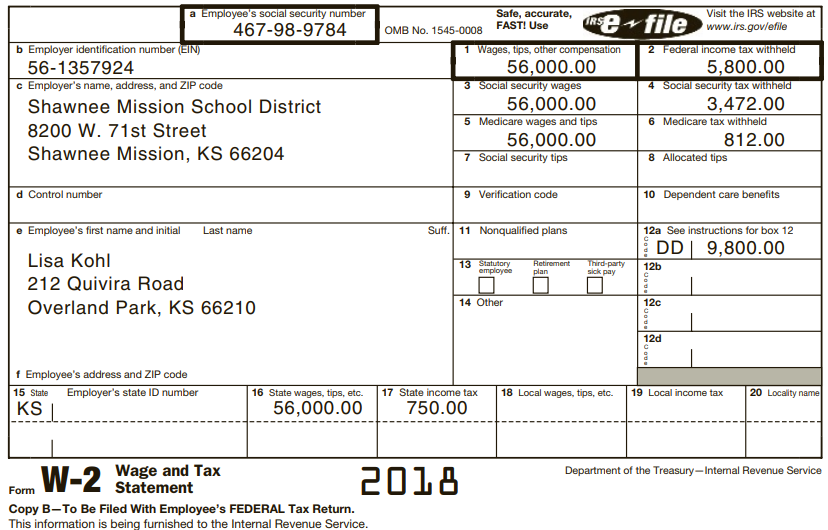

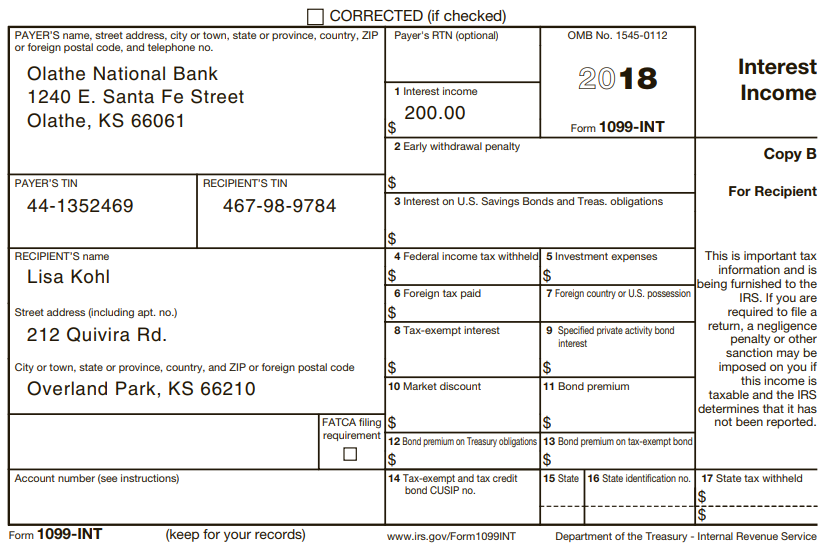

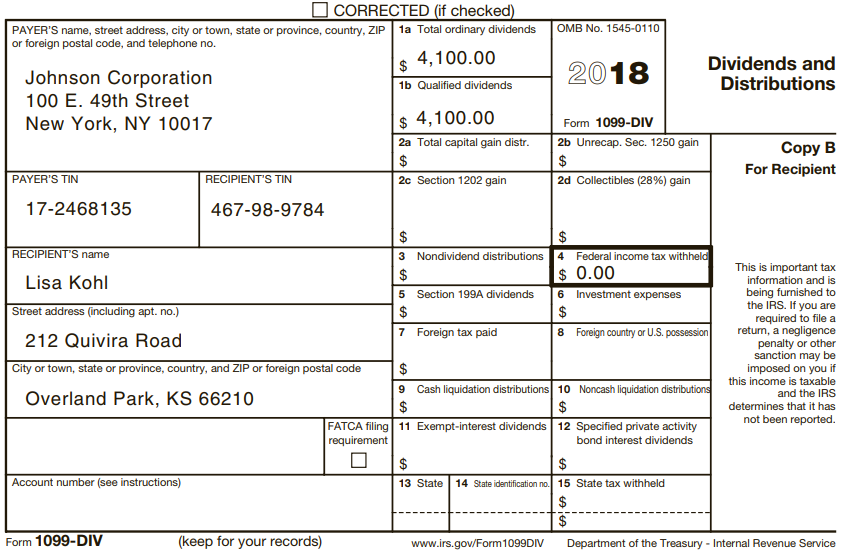

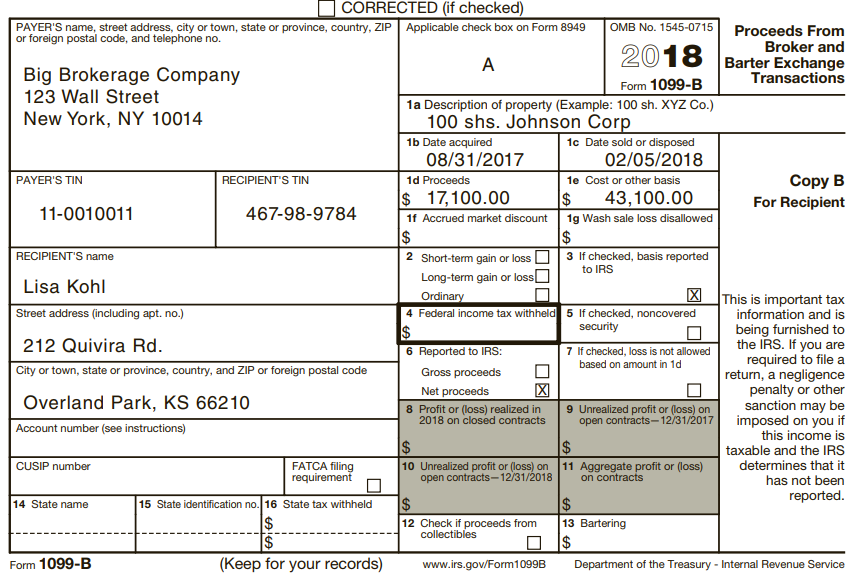

Lisa Kohl (age 44) is an unmarried high school principal. Lisa received the following tax documents:

During the year, Lisa paid the following amounts (all of which can be substantiated):

Home mortgage interest...............$9,250

KS state income tax payment for 2017...............$425

MasterCard interest 550 Life insurance (whole life policy) ...............750

Property taxes on personal residence...............1,425

Blue Cross medical insurance premiums...............250

Other medical expenses...............780

Income tax preparation fee...............300

Charitable contributions (in cash)...............730

Lisa’s sole stock transaction was reported to her on a Form 1099B:

On January 28, 2018, Lisa sold raw land for $180,000 (basis to Lisa of $135,000). The land was purchased 6 years ago. She received $25,000 as a down payment and the buyer’s 10year note for $155,000. The note is payable at the rate of $15,500 per year plus 8 percent interest. On January 28, 2019, the first of the ten principal and interest payments is due. Required: Complete Lisa’s federal tax return for 2018. Use Form 1040, Schedule 1, Schedule A, Schedule B, Schedule D, Form 8949, the Qualified Dividends and Capital Gain Tax Worksheet, and Form 6252 to complete this tax return. Make realistic assumptions about any missing data.

Transcribed Image Text:

a Employee's social security number 467-98-9784 Safe, accurate, FAST! Use Visit the IRS website at RSP file www.irs.gov/efile OMB No. 1545-0008 b Employer identification number (EIN) 56-1357924 c Employer's name, address, and ZIP code Shawnee Mission School District 2 Federal income tax withheld 5,800.00 4 Social security tax withheld 1 Wages, tips, other compensation 56,000.00 3 Social security wages 56,000.00 5 Medicare wages and tips 3,472.00 6 Medicare tax withheld 8200 W. 71st Street 812.00 56,000.00 7 Social security tips Shawnee Mission, KS 66204 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits Employee's first name and initial Suff. 11 Nonqualified plans Last name 12a See instructions for box 12 DD | 9,800.00 Lisa Kohl 13 Statutory αmpioyos Hetirement Third-party sick pay 12b plan 212 Quivira Road Overland Park, KS 66210 14 Other 12c 12d f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 56,000.00 750.00 Department of the Treasury-Intemal Revenue Service 2018 Form W-2 Wage and Tax Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Payer's RTN (optional) or foreign postal code, and telephone no. OMB No. 1545-0112 Olathe National Bank 2018 Interest 1240 E. Santa Fe Street 1 Interest income Income 200.00 Olathe, KS 66061 Form 1099-INT 2 Early withdrawal penalty Copy B %24 3 Interest on U.S. Savings Bonds and Treas. obligations PAYER'S TIN RECIPIENT'S TIN For Recipient 44-1352469 467-98-9784 RECIPIENT'S name Lisa Kohl 4 Federal income tax withheld 5 Investment expenses This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is 6 Foreign tax paid 7 Foreign country or U.S. possession Street address (including apt. no.) 212 Quivira Rd. 8 Tax-exempt interest 9 Specified private activity bond interest City or town, state or province, country, and ZIP or foreign postal code Overland Park, KS 66210 10 Market discount 11 Bond premium taxable and the IRS determines that it has not been reported. FATCA filing $ requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond |$ 15 State 16 State identification no. 17 State tax withheld Account number (see instructions) |14 Tax-exempt and tax credit bond CUSIP no. Form 1099-INT (keep for your records) www.irs.gov/Form1099INT Department of the Treasury - Internal Revenue Service %24