Margaret and David Simmons are married and file a joint income tax return. They have two dependent

Question:

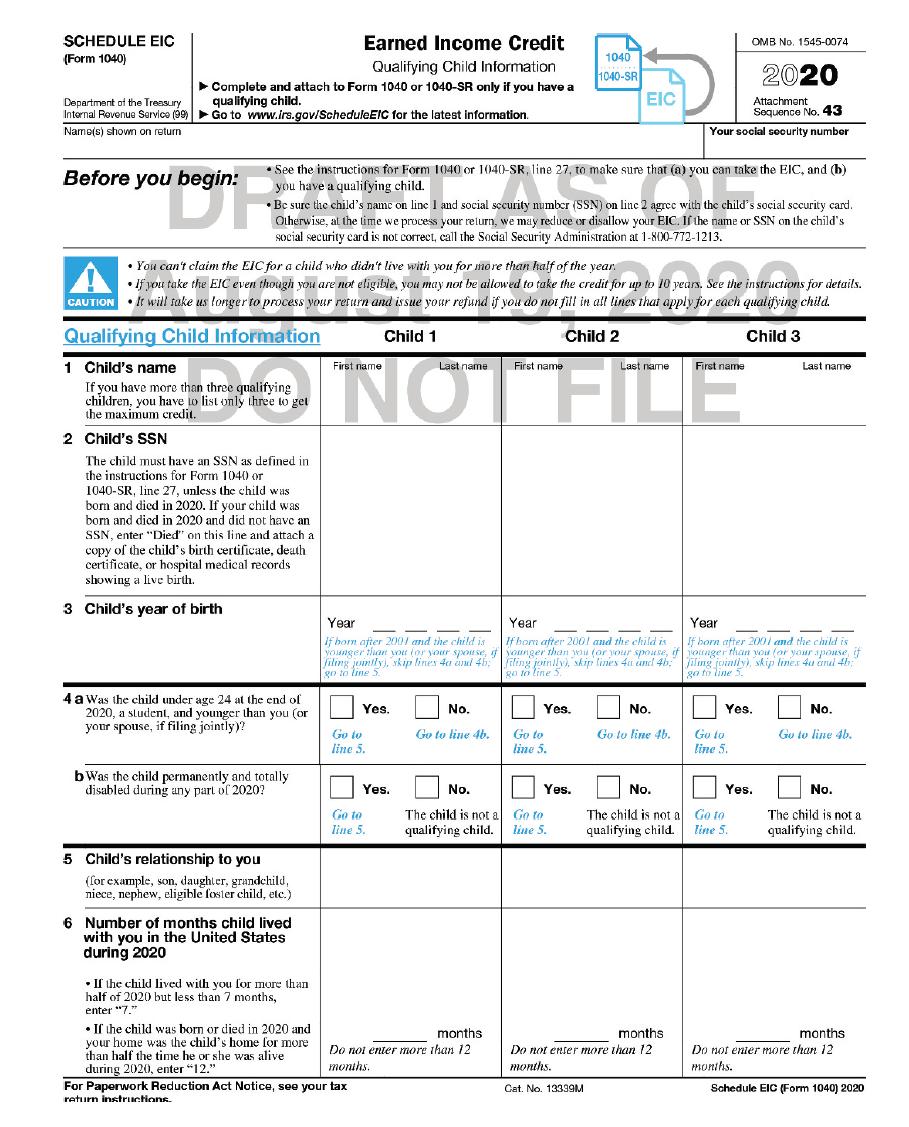

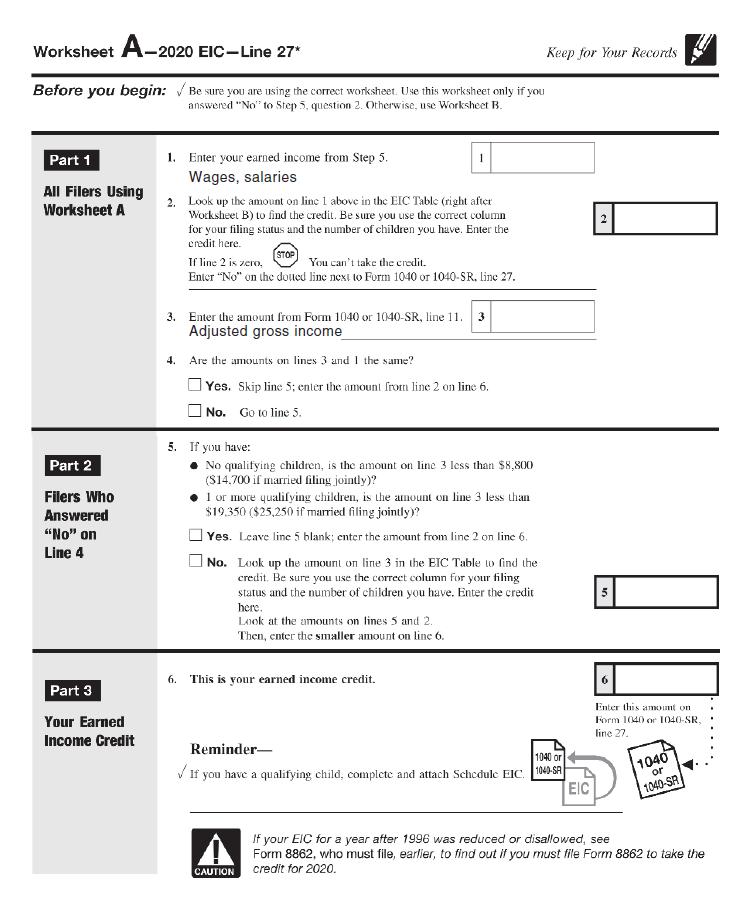

Margaret and David Simmons are married and file a joint income tax return. They have two dependent children, Margo, 5 years old (Social Security number 316-31-4890), and Daniel, who was born during the year (Social Security number 316-31-7894). Margaret’s wages are $3,000, and David has wages of $14,000. In addition, they receive interest income of $200 during the year. Margaret and David do not have any other items of income and do not have any deductions for adjusted gross income. Assuming the Simmons file Form 1040 for 2020, complete Schedule EIC and the Earned Income Credit Worksheet A, on Pages 7-55 and 7-56. (The EIC table is in Appendix B.)

SCHEDULE EIC (Form 1040) Earned Income Credit Qualifying Child Information Complete and attach to Form 1040 or 1040-SR only if you have a qualifying child. Go to www.irs.gov/ScheduleEIC for the latest information. Department of the Treasury Internal Revenue Service (99) Name(s) shown on return Before you begin: 2 Child's SSN The child must have an SSN as defined in the instructions for Form 1040 or 1040-SR, line 27, unless the child was born and died in 2020. If your child was born and died in 2020 and did not have an SSN, enter "Died on this line and attach a copy of the child's birth certificate, death certificate, or hospital medical records showing a live birth. 3 Child's year of birth 4 a Was the child under age 24 at the end of 2020, a student, and younger than you (or your spouse, if filing jointly)? b Was the child permanently and totally disabled during any part of 2020? 5 Child's relationship to you See the instructions for Form 1040 or 1040-SR, line 27, to make sure that (a) you can take the EIC, and (b) you have a qualifying child. with the Be sure the child's name on line I and social security number (SSN) on line 2 agree with the child's social security card. Otherwise, at the time we process your return, we may reduce or disallow your EIC. If the name or SSN on the child's social security card is not correct, call the Social Security Administration at 1-800-772-1213. You can't claim the EIC for a child who didn't live with you for more than half of the year. If you take the EIC even though you are not eligible, you may not be allowed to take the credit for up to 10 years. See the instructions for details. CAUTION It will take us longer to process your return and issue your refund if you do not fill in all lines that apply for each qualifying child. Qualifying Child Information Child 1 Child 2 Child 3 1 Child's name If you have more than three qualifying children, you have to list only three to get the maximum credit. (for example, son, daughter, grandchild, niece, nephew, eligible foster child, etc.) 6 Number of months child lived with you in the United States during 2020 First name INOTFILE . If the child lived with you for more than half of 2020 but less than 7 months, enter "7." If the child was born or died in 2020 and your home was the child's home for more than half the time he or she was alive during 2020, enter "12." First name Year If born after 2001 and the child is younger than you for your spouse, filing jointly), skip lines 4a and 4h;" go to line Yes. Go to line 5. Yes. Go to line 5. For Paperwork Reduction Act Notice, see your tax return instructions. Last name No. Go to line 4b. No. The child is not a qualifying child. months Do not enter more than 12 months. 1040 1040-SR Yes. EIC Go to line 5. Year If hom after 2001 and the child is younger than wou (or your spouse, if filing jointly), skip lines 4u und 4b; go to line 5. Yes. Go to line 5. Last name First name 2020 Attachment Sequence No. 43 Your social security number No. Go to line 4b. No. The child is not a qualifying child. months Do not enter more than 12 months. Cat. No. 13339M OMB No. 1545-0074 Year If born after 2001 and the child is younger than you (or your spouse, if Jiling jointly), skip lines 4u anul 4b; go to line 5 Yes. Go to line 5. Yes. Go to line 5. Last name No. Go to line 4b. No. The child is not a qualifying child. months Do not enter more than 12 months. Schedule EIC (Form 1040) 2020

Step by Step Answer:

Earned income credit 5920 See Schedule EIC and Earned Income Credit Worksheet A on pages 73 and 74 SCHEDULE EIC Form 1040 Department of the Treasury Internal Revenue Service 99 Names shown on return E...View the full answer

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Students also viewed these Business questions

-

Consider the figure. (a) What must be true about the expressions for the area of the blue square found in Exercises 124 and 128?(b) Write an equation based on the answer in part (a). Data from in...

-

Margaret and David Simmons are married and file a joint income tax return. They have two dependent children, Margo, 5 years old (Social Security number 316-31-4890), and Daniel, who was born during...

-

Margaret and David Simmons are married and file a joint income tax return. They have two dependent children, Margo, 5 years old (Social Security number 316-31-4890), and Daniel, who was born during...

-

Assignment: Based on your reading and analysis of the case study above, address the following items in a detailed essay response of approximately 600 words. Each number below should be addressed...

-

Carla is a statistician with a bank. She has collected debt-to-equity mix data on mature (M) and young (Y) companies. The debt percentages vary from 20% to 80% in her sample. Carla has defined D M as...

-

What is neuroeconomics? Describe Sanfey and coworkers (2003) experiment, and indicate what it adds to our understanding of decision making. L01

-

The case lists various approaches TEK follows to minimize its exposure to currency risk. If hired by TEK, what other strategies and tactics would you recommend to reduce the firms exposure even...

-

Prepare the income statement for South Marine Company for the most recent year, using the information in E2-41B. Assume that the company sold 37,000 units of its product at a price of $14 each during...

-

Culver Corporation reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 117 $5 $ 585 12 Purchases 404 6 2.424 23 Purchases 211 7 1.477 30...

-

Assume that today is March 28, 2019. Natasha Kingery is 30 years old and has a Bachelor of Science degree in computer science. She is currently employed as a Tier 2 field service representative for a...

-

Ann hires a nanny to watch her two children while she works at a local hospital. She pays the 19-year-old nanny $180 per week for 42 weeks during the current year. a. What is the employer's portion...

-

For 2020, Roberta is a self-employed truck driver with earnings of $48,728 from her business. During the year, Roberta received $2,500 in interest income and dividends of $500. She also sold...

-

Darcy borrowed $4,000 in 2014 from her employer to purchase a new computer. She repays $1,000 of the loan plus 6% interest on the unpaid balance in 2014, 2015, and 2016. After closing a big deal in...

-

Critical Values. In Exercises 41-44, find the indicated critical value. Round results to two decimal places. 41. Z0.25 42. Z090 43. Z0.02 44. Z0.05

-

Case Study X Ltd. has 10 lakhs equity shares outstanding at the beginning of the accounting year 2016. The appropriate P/E ratio for the industry in which D Ltd. is 8.35. The earnings per share is...

-

Notation of 0 + Using the same survey described in Exercise 1, the probability of randomly selecting 50 speaking characters from movies and getting 40 females is expressed as 0+. Does 0+ indicate...

-

A simple random sample of 10 pages from a dictionary is obtained. The numbers of words defined on those pages are found, with the results n = 10, x = 66.4 words, s = 16.6 words. Given that this...

-

Question 3 58.5 Average global temperature 1880-2013 58.0 $ 57.5 57.0 56.5 1880 1900 1920 1940 1960 1980 2000 2020 Year The graph above indicates that global temperatures have Ovaried randomly over...

-

Sophia inherited 1,000 shares of IBM that her father's parents bought for her when she was a child. The father's cost was $2 per share at the time of purchase and $84 per share at the time of his...

-

The activities listed in lines 2125 serve primarily as examples of A) Underappreciated dangers B) Intolerable risks C) Medical priorities D) Policy failures

-

Carl transfers land with a fair market value of $120,000 and basis of $30,000, to a new corporation in exchange for 85 percent of the corporations stock. The land is subject to a $40,000 liability,...

-

What is the shareholders basis in stock of a corporation received as a result of the transfer of property to the corporation and as a result of which gain was recognized by the stockholder? a. The...

-

Which of the following statements regarding personal holding companies is false? a. A personal holding company is one which has few shareholders. b. A personal holding company has income primarily...

-

In 2019, Sunland Company had a break-even point of $388,000 based on a selling price of $5 per unit and fixed costs of $155,200. In 2020, the selling price and the variable costs per unit did not...

-

11. String Conversion Given a binary string consisting of characters '0's and '1', the following operation can be performed it: Choose two adjacent characters, and replace both the characters with...

-

Consider the table shown below to answer the question posed in part a. Parts b and c are independent of the given table. Callaway Golf (ELY) Alaska Air Group (ALK) Yum! Brands (YUM) Caterpillar...

Study smarter with the SolutionInn App