Mitchell, Max, and Romeo form a partnership to operate a grocery store. For each of the following

Question:

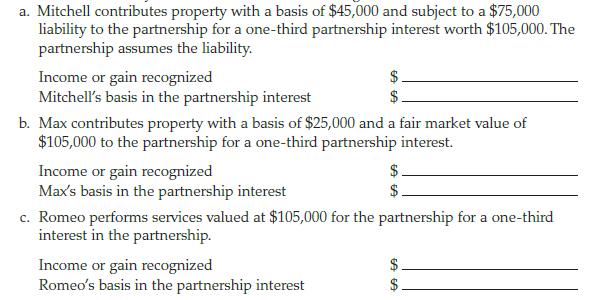

Mitchell, Max, and Romeo form a partnership to operate a grocery store. For each of the following contributions by the partners, indicate (1) the amount of income or gain recognized, if any, by the partner, and (2) the partner’s basis in the partnership interest immediately after the contribution including the allocation of liabilities.

Transcribed Image Text:

a. Mitchell contributes property with a basis of $45,000 and subject to a $75,000 liability to the partnership for a one-third partnership interest worth $105,000. The partnership assumes the liability. Income or gain recognized Mitchell's basis in the partnership interest Income or gain recognized Max's basis in the partnership interest EA GA b. Max contributes property with a basis of $25,000 and a fair market value of $105,000 to the partnership for a one-third partnership interest. $. Income or gain recognized Romeo's basis in the partnership interest $. $. c. Romeo performs services valued at $105,000 for the partnership for a one-third interest in the partnership. GA GA

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

a b c Income or gain reco...View the full answer

Answered By

GERALD KAMAU

non-plagiarism work, timely work and A++ work

4.40+

6+ Reviews

11+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Hal, Steve, and Lew form a partnership to operate a grocery store. For each of the following contributions by the partners, indicate (1) the amount of income or gain recognized, if any, by the...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Hal, Steve, and Lew form a partnership to operate a grocery store. For each of the following contributions by the partners, indicate (1) the amount of income or gain recognized, if any, by the...

-

Bilge Pumpworks and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of the merger agreement, the companies reported the following data: Bilge Pumpworks has 10,000 shares of its...

-

Ronald O. Perelman, chairman of the board and CEO of Pantry Pride, met with his counterpart at Revlon, Michel C. Bergerac, to discuss a friendly acquisition of Revlon by Pantry Pride. Revlon rebuffed...

-

The traditional criteria used in training evaluation, along with a newer perspective on these criteria

-

After purchasing one of these products, why might you experience postpurchase cognitive dissonance? What might the seller do to help you resolve this dissonance? BATTLE OF THE TITANS: AMAZON ECHO VS....

-

Was the confiscation of all cigar manufacturers by the Cuban government in the early 1960s and expropriation or a nationalization? Was this confiscation commercial activity in which a private...

-

Franco owns a 6 0 % interest in the Dulera LLC . On December 3 1 of the current tax year, his basis in the LLC interest is $ 1 9 4 , 6 0 0 . The fair market value of the interest is $ 2 1 4 , 0 6 0 ....

-

An accounting entry is required, with one exception: the annual change in employee pay rates, Trans. Document ? Dec. Flowchart Description Received customer purchase order No. 53426 (Doc. No. 4) from...

-

Telly, age 38, has a $140,000 IRA with Blue Mutual Fund. He has read good things about the management of Green Mutual Fund, so he opens a Green Fund IRA. Telly asked for a distribution rollover and...

-

Yeet Inc. has 14 employees in 2020. Yeets 2020 second quarter business was 70 percent lower than 2019 due to COVID-related impacts. Yeet was able to stay in business and kept ten of the fourteen...

-

Solve each equation. x 2 - 5x + 6 = 0

-

Rosita Flores owns Rosita's Mexican Restaurant in Tempe, Arizona. Rosita's is an affordable restaurant near campus and several hotels. Rosita accepts cash and checks. Checks are deposited...

-

Your second task will require you to recover a payload from the conversation. Just need 2.3. Need you to explain step by step, and concept by concept if possible. Use wireshark. Tell me your answer...

-

2. Supply for art sketchbooks at a price of $p per book can be modelled by P <10 S(p) = = textbooks. p3+p+3 p 10 (a) What is the producer revenue at the shutdown point? (b) What is the producer...

-

Patterson Company produces wafers for integrated circuits. Data for the most recent year are provided: Expected Consumption Ratios Activity Driver Wafer A Wafer B Inserting and sorting process...

-

The elementary gas-phase reaction 2A + B C+D is carried out isothermally at 450 K in a PBR with no pressure drop. The specific reaction rate was measured to be 2x10-3 L/(mol-min-kgcat) at 50C and the...

-

List five keys to a successful financial plan?

-

Provide examples of a situations in which environmental disruptions affected consumer attitudes and buying behaviors.

-

Mindy has a Roth IRA held longer than 5 years to which she has contributed $30,000. The IRA has a current value of $62,000. Mindy is 55 years old and she takes a distribution of $38,000 after...

-

What is the deadline for making a contribution to a traditional IRA or a Roth IRA for 2016? a. April 15, 2017 b. April 17, 2017 c. December 31, 2016 d. October 15, 2017

-

What is the maximum tax-deferred contribution that can be made to a Section 401(k) plan for an employee under age 50? a. $7,500 b. $10,000 c. $15,000 d. $18,000 e. $19,000

-

firm purchased a new piece of equipment with an estimated useful life of eight years. The cost of the equipment was $65,000. The salvage value was estimated to be $10,000 at the end of year 8. Using...

-

On an average day, a company writes checks totaling $1,500. These checks take 7 days to clear. The company receives checks totaling $1,800. These checks take 4 days to clear. The cost of debt is 9%....

-

Olds Company declares Chapter 7 bankruptcy. The following are the book values of the asset and liability accounts at that time. A bankruptcy expert estimates that administrative expense will total $...

Study smarter with the SolutionInn App