Patty Banyan is a single taxpayer living at 543 Space Drive, Houston, TX 77099. Her Social Security

Question:

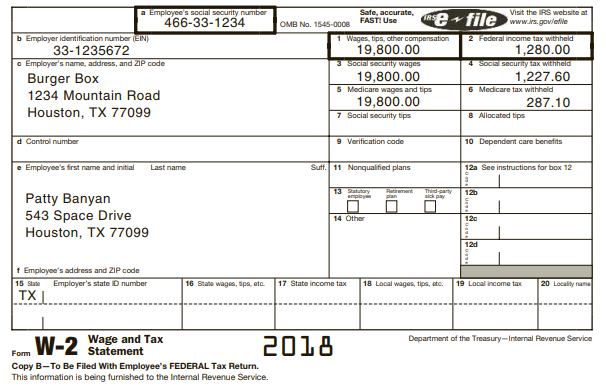

Patty Banyan is a single taxpayer living at 543 Space Drive, Houston, TX 77099. Her Social Security number is 466-33-1234. For 2018, Patty has no dependents, and her W-2, from her job at a local restaurant where she parks cars, contains the following information:

These wages are Patty’s only income for 2018.

Required:

Complete Form 1040 for Patty Banyan for the 2018 tax year.

Transcribed Image Text:

a Employee's social security number 466-33-1234 Safe, accurate, Visit the IRS website at Pfile www.s.govlefile IRS FASTI Use OMB No. 1545-000e b Employer identification number (EIN) 33-1235672 a Employer's name, address, and ZIP code 1 Wages, tips, other compensation 2 Federal income tax withheld 19,800.00 Social securily wages 19,800.00 5 Medicare wages and tips 19,800.00 7 Social security tips 1,280.00 4 Social security tax withheld Burger Box 1234 Mountain Road 1,227.60 6 Medicare tax withheld 287.10 Houston, TX 77099 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits Suff. 11 Nonqualified plans e Employee's first name and initial Last name 12a See instructions for box 12 13 atutory empley Thind party ick pay Retirement 12b Patty Banyan 543 Space Drive Houston, TX 77099 14 Other 120 12d t Employee's address and ZIP code 15 Sate Employer's state D number TX 17 State income tax 16 State wages, Spa, etc. 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Department of the Treasury-Internal Revenue Service 2018 Fom W-2 Wage and Tax Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

1040 Filing status Single Your first name and initial Patty Your standard deduction If joint return spouses first name and initial Spouse standard deduction Spouse is blind Department of the TreasuryI...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Patty Bayan is a single taxpayer living at 543 Space Drive, Houston, TX 77099. Her Social Security number is 466-33-1234. For 2014, Patty has no dependents, and her W-2 from her job at a local...

-

Steve Jackson (age 51) is a single taxpayer living at 3215 Pacific Dr., Del Mar, CA 92014. His Social Security number is 465-88-9415. In 2014, Steves earnings and income tax withholding as the...

-

Robert Ramos (age 36) is a single taxpayer, living at 8765 Bay Dr., Monterey, CA 93940. His Social Security number is 976-23-5132. Roberts earnings and income tax withholding as the manager of a...

-

Explain the difference between impregnation and infiltration. Give some applications for each?

-

What is the role of the controller in an organization? Describe some of the activities over which he or she has control.

-

Show the computation for the misclassification rate of this confusion matrix. Confusion Matrix Actual\Predicted 0 1 0 970 20 1 2 8

-

Explain the role of the control limits of a control chart.

-

Hamleys Toy Store is on Regent Street in London. It has a magic department near the main door. Suppose that management is considering dropping the magic department, which has consistently shown an...

-

i need help with required 2 & 3 Salsa Company is considering an investment in technology to improve its operations. The investment costs $255,000 and will yield the following net cash flows,...

-

If a mothers self-report is considered completely accurate, then what is the PV+ of the daughters report, in which positive indicates smoking and negative indicates not smoking? Obstetrics, Health...

-

Marcs brother, Phillip, who is a 20-year-old French citizen, lives in France for the full year. Marc supports Phillip while he attends college. Can Marc claim Phillip as a dependent? Why or why not?

-

Which of the following is not a change made to individual taxation by the Tax Cuts and Jobs Act? a. Repeal of personal exemptions b. General lowering of tax rates c. Repeal of the individual...

-

Describe the NPSV model of capital budgeting.

-

I have attached a case study, primarily based on your textbook chapter reading assignments. The background material for the case also references chapters 3 and 15, not assigned for this course....

-

On December 1 , 2 0 2 5 , Sandhill Distributing Company had the following account balances.DebitCash$ 7 , 1 0 0 Accounts Receivable 4 , 5 0 0 Inventory 1 1 , 9 0 0 Supplies 1 , 2 0 0 Equipment 2 2 ,...

-

Cindy Greene works at Georgia Mountain Hospital. The hospital experiences a lot of business closer to summer when the temperature is warmer. Cindy is meeting with her supervisor to go over the budget...

-

Use z scores to compare the given values. Based on sample data, newborn males have weights with a mean of 3247.4 g and a standard deviation of 575.4 g. Newborn females have weights with a mean of...

-

Gignment FULL SCAL Exercise 4- The following ndependent situations require professional judgment for determining when to recognize revenue from the transactions. Identify when revenue should be...

-

Equivalent lattice points within the unit cell of a Bravais lattice have identical surroundings. What points within a face-centred cubic unit cell are equivalent to the point (1/2,0,0)?

-

What do you think?

-

Explain the two different ways that the tax on unearned income of minor children, or kiddie tax, can be reported....

-

Does the tax on unearned income of minor children, or kiddie tax, apply to wages earned by minors in summer and other jobs?...

-

Cindy and Paul are married and live together in Arizona. During the year, Paul receives a salary of $45,000 and $4,000 of dividends from stock that is his separate property. Cindy receives a salary...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App