Philcon Corporation created the following 2020 employee payroll report for one of its employees. a. Complete the

Question:

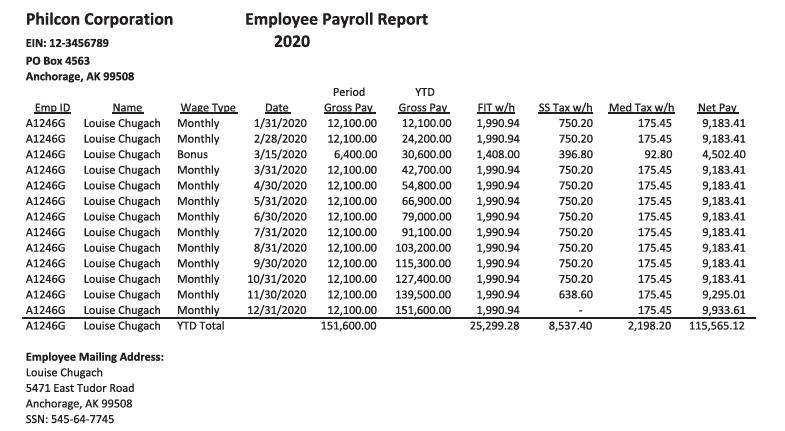

Philcon Corporation created the following 2020 employee payroll report for one of its employees.

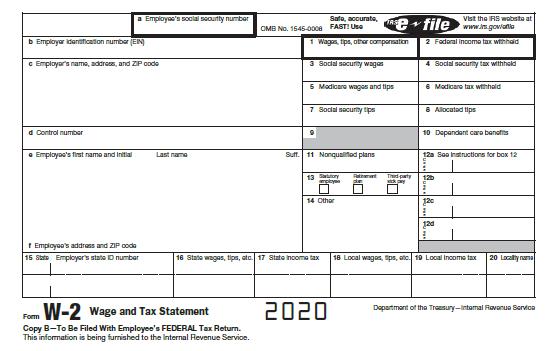

a. Complete the following Form W-2 for Louise Chugach from Philcon Corporation.

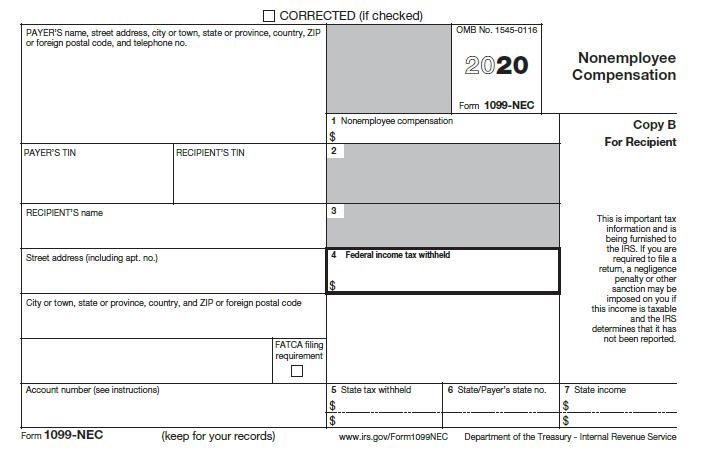

b. Philcon Corporation also paid $1,100 to Ralph Kincaid for presenting a management seminar. Ralph is not a Philcon employee and lives at 1455 Raspberry Road, Anchorage, AK 99508, and his Social Security number is 475-45-3226. Complete the Form 1099-NEC located on Page 9-60 for the payment to Ralph from Philcon Corporation.

Transcribed Image Text:

Philcon Corporation EIN: 12-3456789 PO Box 4563 Anchorage, AK 99508 Emp ID Name A1246G Louise Chugach A1246G Louise Chugach A1246G Louise Chugach A1246G Louise Chugach A1246G Louise Chugach Monthly Bonus Monthly Wage Type Monthly Monthly A1246G Louise Chugach A1246G Louise Chugach A1246G Louise Chugach A1246G Louise Chugach A1246G Louise Chugach Louise Chugach A1246G A1246G Louise Chugach A1246G Louise Chugach Monthly A1246G Louise Chugach YTD Total Employee Mailing Address: Louise Chugach 5471 East Tudor Road Anchorage, AK 99508 SSN: 545-64-7745 Monthly Monthly Monthly Monthly Monthly Monthly Monthly Employee Payroll Report 2020 Period Gross Pay YTD Gross Pav Date 1/31/2020 FIT w/h 1,990.94 12,100.00 2/28/2020 24,200.00 1,990.94 3/15/2020 6,400.00 30,600.00 1,408.00 3/31/2020 12,100.00 42,700.00 1,990.94 4/30/2020 12,100.00 54,800.00 1,990.94 5/31/2020 12,100.00 66,900.00 1,990.94 6/30/2020 12,100.00 79,000.00 1,990.94 7/31/2020 12,100.00 91,100.00 1,990.94 8/31/2020 12,100.00 103,200.00 1,990.94 9/30/2020 12,100.00 115,300.00 1,990.94 10/31/2020 12,100.00 127,400.00 1,990.94 11/30/2020 12,100.00 139,500.00 1,990.94 12/31/2020 12,100.00 151,600.00 1,990.94 151,600.00 25,299.28 8,537.40 12,100.00 12,100.00 SS Tax w/h 750.20 750.20 396.80 750.20 750.20 750.20 750.20 750.20 750.20 750.20 750.20 638.60 Med Tax w/h 175.45 175.45 92.80 175.45 175.45 175.45 175.45 175.45 175.45 175.45 175.45 175.45 175.45 2,198.20 115,565.12 Net Pay 9,183.41 9,183.41 4,502.40 9,183.41 9,183.41 9,183.41 9,183.41 9,183.41 9,183.41 9,183.41 9,183.41 9,295.01 9,933.61

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

a b a Employees social security number 545647745 b Employer Identification number EIN 123456789 c Em...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Philcon Corporation created the following 2018 employee payroll report for one of its employees. a. Complete the following Form W-2 for Louise Chugach from Philcon Corporation. b. Philcon Corporation...

-

Philcon Corporation (P.O. Box 4563, Anchorage, AK 99508; EIN 12-3456789) paid Louise Chugach, an employee who lives at 5471 East Tudor Road, Anchorage, AK99508, wages of $124,554 in 2016. The income...

-

Philcon Corporation (P.O. Box 4563, Anchorage, AK 99508; EIN 12-3456789) paid Louise Chugach, an employee who lives at 5471 East Tudor Road, Anchorage, AK 99508, wages of $24,554 in 2015. The...

-

Some economists argue that Inflation numbers calculated by CPI are not accurate especially during the pandemic. Explain why do they believe inflation numbers are not that accurate during pandemic?

-

Were the payments to Alan protected by the business judgment rule? Years ago, Harry Lippman purchased Despatch Industries, Inc., which manufactured hardware for cabinets. His son, James, worked for...

-

How important training is to both organizations and employees

-

Learn about exchange rates and currencies in international business. LO.1

-

Compute the multifactor productivity measure for each of the weeks shown for production of chocolate bars. What do the productivity figures suggest? Assume 40-hour weeks and an hourly wage of $ 12....

-

Inventory Costing Methods The following data are for the Evans Company, which sells just one product: \ table [ [ , , Units, \ table [ [ Unit ] , [ Cost ] ] ] , [ Beginning inventory,January 1 , 2 0...

-

Blue-Eyed Beauty Supply is the talk of the town. When Elaine started her business, she had no idea it would evolve to be the number-one supplier of cosmetology products in the region. While her...

-

Fiduciary Investments paid its employee, Yolanda, wages of $139,000 in 2020. Calculate the FICA tax: Withheld from Yolanda's wages: Paid by Fiduciary: Total FICA Tax Social Security Medicare Social...

-

What is Sarajanes basis in the land received in the exchange described in Question 19, assuming her basis in the land given up was $12,000? Question 19 Fred and Sarajane exchanged land in a...

-

What is m-commerce and what are some of the new business opportunities associated with it?

-

How do we design an electromagnetic sensor?

-

What is a virtual breadboard?

-

Joe secured a loan of $13,000 four years ago from a bank for use toward his college expenses. The bank charges interest at the rate of 9%/year compounded monthly on his loan. Now that he has...

-

Answer these two questions 1 32 2 Number of Units Sold 3 4 ! Direct Material units per unit of production 5 i 6 Total Direct Materials Used 7! 8 Price Per Unit 9 10 Cost of Direct Materials 11 12 13...

-

Give an algorithm for converting a tree to its mirror. Mirror of a tree is another tree with left and right children of all non-leaf nodes interchanged. The trees below are mirrors to each other....

-

Monica asked that we meet to see if I could help to reduce the differences between them. When the time came, she started the conversation by saying that Richard wasn't saving any money at all. They...

-

Graph one period of each function. y = 4 cos x

-

Wilma had $3,100 in state income taxes withheld from her paychecks during 2016. In April of 2016, Wilma paid the $50 due for her 2015 state tax return. Wilmas total tax liability on her state tax...

-

Which of the following taxes are not deductible as an itemized deduction? a. Property tax on land held for investment b. State income taxes c. Auto registration fees based on the value of the auto d....

-

Ramon, a single taxpayer, has adjusted gross income for 2016 of $208,000 and his itemized deductions total $19,000. The itemized deductions consist of $11,000 in state income taxes and $8,000 of...

-

Kirk and Spock formed the Enterprise Company in 2010 as equal owners. Kirk contributed land held an investment ($50,000 basis; $100,000 FMV), and Spock contributed $100,000 cash. The land was used in...

-

Pedro lives in Puerto Rico and had a net taxable income of $35,000 for the year 20X1. Your gross income totals $60,000. What is Pedro's regular income tax for 20X1? a.$4,620 b.$4,900 c.$2,318 d.$2,520

-

The change in cash is equal to the change in liabilities less the change in equity plus the change in noncash assets. O True False

Study smarter with the SolutionInn App