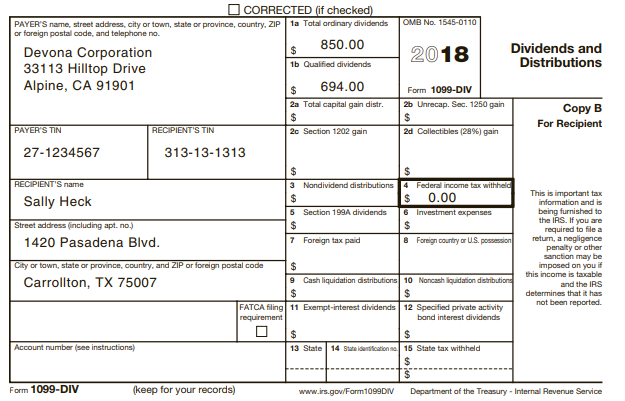

Sally and Charles Heck received the following Form 1099-DIV in 2018: The Hecks also received the following

Question:

Sally and Charles Heck received the following Form 1099-DIV in 2018:

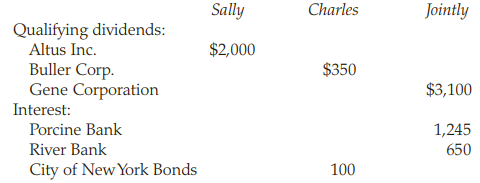

The Hecks also received the following dividends and interest in 2018 (Forms 1099-DIV not shown):

Assuming the Hecks file a joint tax return, complete Schedule B of Form 1040 (on Page 2-53) for them for the 2018 tax year. Do not attempt to complete the Qualified Dividends and Capital Gain Tax Worksheet.

Transcribed Image Text:

CORRECTED (if checked) OMB No. 1545-0110 1a Total ordinary dividends PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 850.00 Dividends and Distributions Devona Corporation 33113 Hilltop Drive Alpine, CA 91901 2$ 2018 1b Qualified dividends 694.00 Form 1099-DIV 2a Total capital gain distr. 2$ 26 Unrecap. Sec. 1250 gain 2$ Copy B For Recipient RECIPIENT'S TIN PAYER'S TIN 20 Section 1202 gain 2d Collectibles (28%) gain 27-1234567 313-13-1313 24 24 RECIPIENT'S name 3 Nondividend distributions 24 5 Section 199A dividends Federal income tax withheld 2$ 4 This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable 0.00 6 Investment expenses 24 Sally Heck Street address (including apt. no.) 24 7 Foreign tax paid 8 Foreign country or U.S. possesion 1420 Pasadena Blvd. City or town, state or province, country, and ZIP or foreign postal code 2$ 9 Cash liquidation distributions 10 Noncash liquidation distributions 24 Carrollton, TX 75007 and the IRS determines that it has not been reported. %24 FATCA filing 11 Exempt-interest dividends 12 Specified private activity requirement bond interest dividends 2$ Account number (see instructions) 13 State 14 Sute identification no 15 State tax withheld 24 Form 1099-DIV (keep for your records) www.irs.gov/Form1099DIV Department of the Treasury - Internal Revenue Service Sally Charles Jointly Qualifying dividends: Altus Inc. Buller Corp. Gene Corporation Interest: Porcine Bank River Bank City of New York Bonds $2,000 $350 $3,100 1,245 650 100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

SCHEDULE B Form 1040 Department of the Treasury Internal Revenue Service 99 Names shown on return Charles and Sally Heck Part I Interest See instructi...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Sally and Charles Heck received the following dividends and interest during 2012: Assuming the Hecks file a joint tax return, complete Schedule B of Form 1040 (on page 2-33) for them for the 2012 tax...

-

Sally and Charles Heck received the following dividends and interest during 2016: Assuming the Hecks file a joint tax return, complete Schedule B of Form 1040 for them for the 2016 tax year. Do not...

-

Kathy Kennedy (age 44) is a single taxpayer and she lives at 212 North Pine Way, Payson, AZ 85541. Her Social Security number is 467-98-9784. Kathy's earnings and income tax withholding as the...

-

You are looking at buying a piece of real estate and you intend to borrow as much as you possibly can from a bank to buy the property. The bank you are dealing with has a requirement that the LVR for...

-

The 2013 financial statements for Armstrong and Blair companies are summarized here: The companies are in the same line of business and are direct competitors in a large metropolitan area. Both have...

-

1. The text speaks of the importance of rewards in motivating and determining the success of a team. What kinds of rewards could Joe have offered to each of the members of the team considering what...

-

Explain why the quantity of precautionary balances held by consumers and firms domestically would rise as the domestic money supply was increased by the central bank.

-

You are given the following information concerning four stocks: a) Using 20X0 as the base year, construct three aggregate measures of the market that simulate the Dow Jones Industrial Average, the...

-

If an auditor reviews the reasonableness of the depreciation expense by considering the acquisitions and disposals and comparing their calculation to the previous year's balance, they are likely...

-

Complete an SFAS Matrix and a TOWS Matrix on your Strategic Audit firm using your EFAS Start with your EFAS and IFAS assignments. O Make all corrections to these assignments. The SFAS matrix is to...

-

Which of the following gifts would probably be held to be taxable to the person receiving the gift? a. One thousand dollars given to a taxpayer by his or her father b. An acre of land given to a...

-

Interest from which of the following types of bonds is included in taxable income? a. State of California bond b. City of New Orleans bond c. Bond of the Commonwealth of Puerto Rico d. U.S. Treasury...

-

On January 1, 2012, a machine was installed at Jillian Factory at a cost of $56,000. Its estimated residual value at the end of its estimated life of four years is $24,000. The machine is expected to...

-

Plains Wars United States history

-

Presented below are four independent situations. (a) On March 1, 2013, Wilke Co. issued at 103 plus accrued interest $4,000,000, 9% bonds. The bonds are dated January 1, 2013, and pay interest...

-

Use the formula to determine the value of the indicated variable for the values given. Use a calculator when one is needed. When necessary, use the key on your calculator and round answers to the...

-

Ellen's tax client is employed at a large company that offers medical flexible spending accounts to its employees. Tom must decide at the beginning of the year whether he wants to put as much as...

-

During the 2016 tax year, Brian, a single taxpayer, received $7,200 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he...

-

How are qualified dividends taxed in 2016? Please give the rates of tax which apply to qualified dividends, and specify when each of these rates applies.

-

Bought an old van for 4000 from Peters promising to pay laterwhat is the transactions

-

Company has a following trade credit policy 1/10 N45. If you can borrow from a bank at 9,5% annual rate, would it be beneficial to borrow money and pay off invoices earlier?

-

Given the following exchange rates, which of the multiple-choice choices represents a potentially profitable inter-market arbitrage opportunity? 129.87/$1.1226/$0.00864/ 114.96/ B $0.8908/ (C)...

Study smarter with the SolutionInn App