Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social

Question:

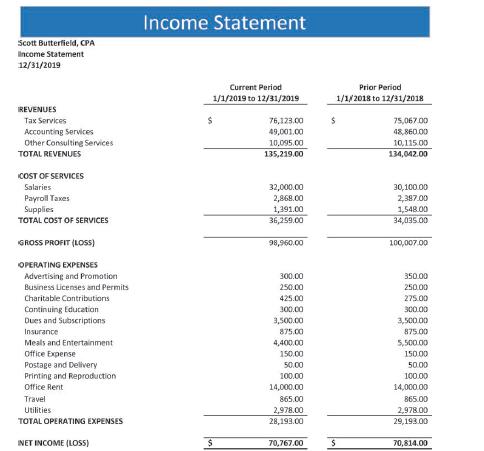

Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social Security number is 644-47-7833. His principal business code is 541211.

Scott’s CPA practice is located at 678 Third Street, Riverside, CA 92860. Scott’s income statement for the year shows the following:

Scott also mentioned the following:

●● The expenses for dues and subscriptions were his country club membership dues for the year.

●● $300 of the charitable contributions were made to a political action committee.

●● Scott does not generate income from the sale of goods and therefore does not record supplies and wages as part of cost of goods sold.

●● Scott placed a business auto in service on January 1, 2016 and drove it 3,792 miles for business, 3,250 miles for commuting, and 4,500 miles for nonbusiness purposes. His wife has a car for personal use.

Complete Schedule C on Pages 3-37 and 3-38 for Scott showing Scott’s net taxable profit from self-employment.

Step by Step Answer:

Income Tax Fundamentals Whittenburg Gill 2020

ISBN: 9780357107065

1st Edition

Authors: Whittenburg/Altus Buller/Gill