Steve Drake sells a rental house on January 1, 2018, and receives $120,000 cash and a note

Question:

Steve Drake sells a rental house on January 1, 2018, and receives $120,000 cash and a note for $45,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $35,000. Steve’s original cost for the house was $180,000 on January 1, 2010 and accumulated depreciation was $30,000 on the date of sale. He collects only the $120,000 down payment in the year of sale.

a. If Steve elects to recognize the total gain on the property in the year of sale, calculate the taxable gain.

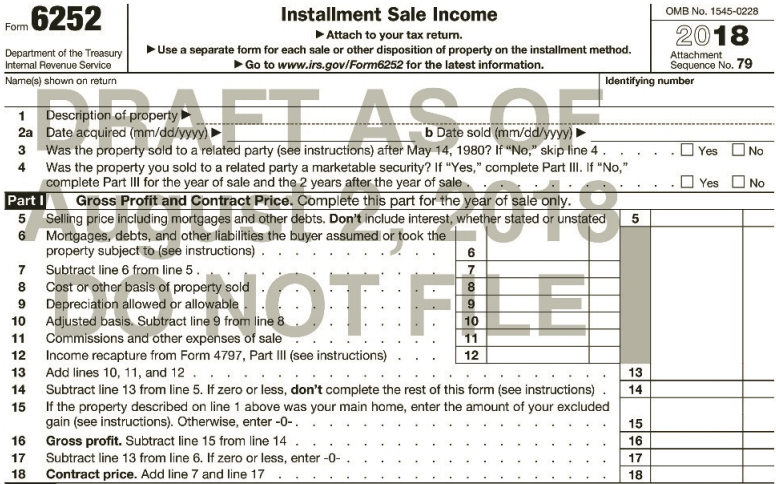

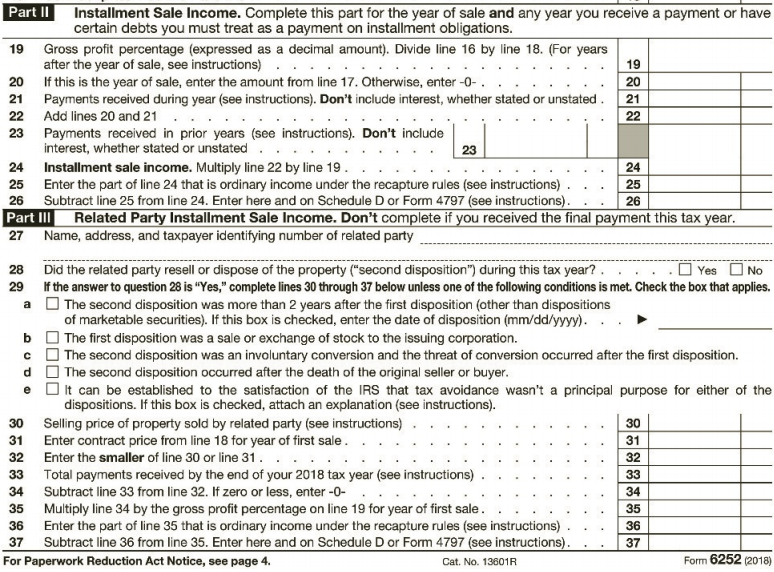

b. Assuming Steve uses the installment sale method, complete Form 6252 on Page 847 for the year of the sale.

c. Assuming Steve collects $5,000 (not including interest) of the note principal in the year following the year of sale, calculate the amount of income recognized in that year under the installment sale method.

Installment Sale Income OMB No. 1545-0228 Fom 6252 2018 Attach to your tax retum. Use a separate form for each sale or other disposition of property on the installment method. Go to www.irs.gov/Form6252 for the latest information. Department of the Treasury Internal Revenue Service Attachment Sequence No. 79 Name(s) shown on return Identifying number DBAET AS OE Description of property I 2a Date acquired (mm/dd/yyyy) Was the property sold to a related party (see instructions) after May 14, 1980? If “No," skip line 4. 4 Was the property you sold to a related party a marketable security? If "Yes," complete Part III. If "No," complete Part II for the year of sale and the 2 years after the year of sale. Part I b Date sold (mm/dd/yyyy) O Yes ONo O Yes No Gross Profit and Contract Price. Complete this part for the year of sale only. 5 Selling price including mortgages and other debts. Don't include interest, whether stated or unstated Mortgages, debts, and other liabilities the buyer assumed or took the 6. property subject to (see instructions) . Subtract line 6 from line 5. Cost or other basis of property sold Depreciation allowed or allowable Adjusted basis. Subtract line 9 from line 8 11 6. ENOT FILE 8. 9. 10 10 Commissions and other expenses of sale Income recapture from Form 4797, Part III (see instructions) 11 12 12 13 Add lines 10, 11, and 12 .. 13 Subtract line 13 from line 5. If zero or less, don't complete the rest of this form (see instructions). 14 14 If the property described on line 1 above was your main home, enter the amount of your excluded 15 gain (see instructions). Otherwise, enter -0-. 15 16 Gross profit. Subtract line 15 from line 14 Subtract line 13 from line 6. If zero or less, enter -0- Contract price. Add line 7 and line 17 16 17 17 18 18 Installment Sale Income. Complete this part for the year of sale and any year you receive a payment or have certain debts you must treat as a payment on installment obligations. Part II 19 Gross profit percentage (expressed as a decimal amount). Divide line 16 by line 18. (For years after the year of sale, see instructions) 20 If this is the year of sale, enter the amount from line 17. Otherwise, enter -0- . Payments received during year (see instructions). Don't include interest, whether stated or unstated. 19 20 21 21 22 Add lines 20 and 21 22 23 Payments received in prior years (see instructions). Don't include interest, whether stated or unstated . 23 24 Installment sale income. Multiply line 22 by line 19. 25 Enter the part of line 24 that is ordinary income under the recapture rules (see instructions). 26 Subtract line 25 from line 24. Enter here and on Schedule D or Form 4797 (see instructions). Part III Related Party Installment Sale Income. Don't complete if you received the final payment this tax year. 27 Name, address, and taxpayer identifying number of related party 24 25 26 O Yes ONo 28 Did the related party resell or dispose of the property ("second disposition") during this tax year? . 29 If the answer to question 28 is "Yes," complete lines 30 through 37 below unless one of the following conditions is met. Check the box that applies. a O The second disposition was more than 2 years after the first disposition (other than dispositions of marketable securities). If this box is checked, enter the date of disposition (mm/dd/yyyy).. b O The first disposition was a sale or exchange of stock to the issuing corporation. c O The second disposition was an involuntary conversion and the threat of conversion occurred after the first disposition. d O The second disposition occurred after the death of the original seller or buyer. e O It can be established to the satisfaction of the IRS that tax avoidance wasn't a principal purpose for either of the dispositions. If this box is checked, attach an explanation (see instructions). Selling price of property sold by related party (see instructions) Enter contract price from line 18 for year of first sale. . Enter the smaller of line 30 or line 31 . . Total payments received by the end of your 2018 tax year (see instructions) 30 30 31 31 32 32 33 33 34 Subtract line 33 from line 32. If zero or less, enter -0- 34 35 Multiply line 34 by the gross profit percentage on line 19 for year of first sale. 36 Enter the part of line 35 that is ordinary income under the recapture rules (see instructions) 37 Subtract line 36 from line 35. Enter here and on Schedule D or Form 4797 (see instructions). 35 36 37 For Paperwork Reduction Act Notice, see page 4. Form 6252 (2018) Cat. No. 13601R

Step by Step Answer:

Form 6252 Department of the Treasury Internal Revenue Service Names shown on return 7 8 9 10 11 12 13 14 15 1 2a b Date sold mmddyyyy 3 Was the property sold to a related party see instructions after ...View the full answer

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Students also viewed these Business questions

-

Steve Drake sells a rental house on January 1, 2014, and receives $130,000 cash and a note for $55,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $45,000....

-

Steve Drake sells a rental house on January 1, 2015, and receives $120,000 cash and a note for $45,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $35,000....

-

Steve Drake sells a rental house on January 1, 2013, and receives $130,000 cash and a note for $55,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $45,000....

-

Josie Inc. collects cash from customers two ways: 1. Accrued Revenue. Some customers pay Josie after Josie has performed service for the customer. During 2017, Josie made sales of $50,000 on account...

-

Calculate the book value of a three-year-old machine that cost $400,000, has an estimated residual value of $40,000, and has an estimated useful life of 20,000 machine hours. The company uses...

-

How might interest rates impact on the financial account of the balance of payments?

-

1. Before you took this quiz, did you think of yourself as a careful planner? Did this quiz change your opinion?

-

Journalize the following transactions in the accounts of Champion Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19....

-

( Financial statement analysis ) The T . P . Jarmon Company manufactures and sells a line of exclusive sportswear. The firm's sales were $ 6 0 0 , 0 0 0 for the year just ended, and its total assets...

-

What is an eccentric riveted joint? Explain the method adopted for designing such a joint? A bracket, attached to a vertical column by means of four identical rivets, is subjected to an eccentric...

-

Virginia has business property that is stolen and partially destroyed by the time it was recovered. She receives an insurance reimbursement of $6,000 on property that had a $14,000 basis and a...

-

Pat sells real estate for $30,000 cash and a $90,000 5year note. If her basis in the property is $90,000 and she receives only the $30,000 down payment in the year of sale, how much is Pats taxable...

-

Amortization of Intangibles} On January 1, 2018, Birnbaum Investments Ltd. acquired a franchise to operate a Burger Doodle restaurant. Birnbaum paid \(\$ 275,000\) for a 10 -year franchise and...

-

The four forces, 400, 500, 600 and 700N are acting along the edges of a 0.8m cube as shown. Represent the resultant of these forces by 1) A force Fr through the point A 2) A couple moment Mr (give...

-

Problem 1. What is the degree of freedom of the following mechanism? Sliding joint Sliding joint

-

PILAR Manufacturing Co. has three producing departments (P, I, & L), and two service departments (A&R). The total estimated departmental expenses for 2021 before distribution of service department...

-

1. A volleyball player serves the ball at point A with an initial velocity vo at an angle of 20 to the horizontal. (a) Determine the minimum velocity of the serve such that the ball will just clear...

-

9.50. Dipping low ** A top with I = 3/3 floats in outer space and initially spins around its x3 axis with angular speed w3. You apply a strike at the bottom point, directed into the page, as shown in...

-

A politician is considering removing the maximum taxable income and having all income subject to Social Security tax. Why might this be unfair to very affluent people?

-

Show that every group G with identity e and such that x * x = e for all x G is abelian.

-

Which of the following is a true statement about depreciation on listed property? a. All listed property is not depreciable, and any costs are recovered when the property is sold. b. Cellphones and...

-

Which of the following is not considered a limit on the immediate expensing election of Section 179? a. Fifty percent of qualified improvement property b. Total Section 179-eligible property acquired...

-

On September 14, 2022, Jay purchased a passenger automobile that is used 75 percent in his business. The automobile has a basis for depreciation purposes of $48,000, and Jay uses the accelerated...

-

Callaho Inc. began operations on January 1 , 2 0 1 8 . Its adjusted trial balance at December 3 1 , 2 0 1 9 and 2 0 2 0 is shown below. Other information regarding Callaho Inc. and its activities...

-

Required: 1. Complete the following: a. Colnpute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile...

-

Bond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have an 8% coupon rate, payable semiannually. The bonds mature in 6 years, have a face value of $1,000, and a yield to...

Study smarter with the SolutionInn App