Walter receives cash of $18,000 and land with a fair market value of $75,000 (adjusted basis of

Question:

Walter receives cash of $18,000 and land with a fair market value of $75,000 (adjusted basis of $50,000) in a current distribution. His basis in his partnership interest is $16,000 before the distribution.

Transcribed Image Text:

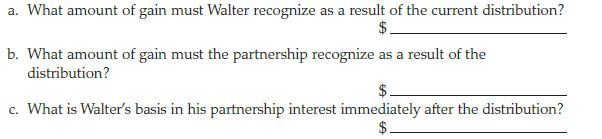

a. What amount of gain must Walter recognize as a result of the current distribution? b. What amount of gain must the partnership recognize as a result of the distribution? c. What is Walter's basis in his partnership interest immediately after the distribution?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

a 2000 18000 16000 Only the cash received that exc...View the full answer

Answered By

Grace Igiamoh-Livingwater

I am a qualified statistics lecturer and researcher with an excellent interpersonal writing and communication skills. I have seven years tutoring and lecturing experience in statistics. I am an expert in the use of computer software tools and statistical packages like Microsoft Office Word, Advanced Excel, SQL, Power Point, SPSS, STATA and Epi-Info.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Walter receives cash of $18,000 and land with a fair market value of $75,000 (adjusted basis of $50,000) in a current distribution. His basis in his partnership is $16,000. a. What amount of gain...

-

1. Betty contributed property with a $40,000 basis and fair market value of $85,000 to the Rust Partnership in exchange for a 50% interest in partnership capital and profits. During the first year of...

-

Walter receives cash of $18,000 and land with a fair market value of $75,000 (adjusted basis of $50,000) in a current distribution. His basis in his partnership interest is $16,000 before the...

-

Norman Freight purchased a building for $1,100,000 and depreciated it on a straight-line basis over a 30-year period. The estimated residual value was $140,000. After using the building for 15 years,...

-

William H. Sullivan, Jr., purchased all the voting shares of the New England Patriots Football Club, Inc. (the Old Patriots). He organized a new corporation called the New Patriots Football Club,...

-

The similarities and differences between equity theory and expectancy theory

-

Tazo makes a blend of exotic green teas, spearmint, and rare herbs into a tea called Zen. Using Maslows hierarchy of needs, explain which need(s) is (are) being fulfilled by this tea.

-

In addition to the information presented in Mini Exercises 14.1 and 14.2, ABC Company currently pays a standard rate of $1 per pound for raw materials. Each unit should be produced in 15 minutes of...

-

The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the triat balance was overstated by $7,000. b. A cash receipt of $8,200 was posted as a debit to...

-

On February 12, 2005, Nancy Trout and Delores Lake formed Kingfisher Corporation to sell fishing tackle. Pertinent information regarding Kingfisher is summarized as follows: ? Kingfisher?s business...

-

Meredith has a 40 percent interest in the assets and income of the Gantt Partnership, and the basis in her partnership interest is $60,000 at the beginning of 2020. During 2020, the partnerships net...

-

Abigail contributes land with an adjusted basis of $50,000 and a fair market value of $60,000 to Blair and Partners, a partnership. Abigail receives a 50 percent interest in Blair. What is Abigails...

-

Some analysts believe cash-based numbers are more reliable than accrual-based numbers because they feel the adjustment process allows management too much discretion to manipulate the results. One...

-

According to a recent study, 21% of American college students graduate with no student loan debt. Suppose we obtain a random sample of 106 American college students and record whether or not they...

-

Differentiate the following with respect to x: a. y=5x+2x + x + 15 b. y=4x+3x - 4x - 10 c. y = 3Sin(5x) d. y = 3Cos(3x) e. y=10e -25x f. y = log(6x)

-

Question 2. The rate of drug destruction by the kidneys is proportional to the amount of the drug in the body. The constant of proportionality is denoted by K. At time t the quantity of the drug in...

-

5. 6. -1 (4a) U u X2 1 X2 -2 x -1 -2 12 (4b) U -2 2 Y y 16 x2 X2 3 1 (4c) U u - x 2 Y y -8 Y y -20 5 x X2 2 Find the state space models of the three systems shown in Fig. 4a, Fig. 4b, and Fig. 4c,...

-

Given the following data for Mehring Company, compute total manufacturing costs, prepare a cost of goods manufactured statement, and compute cost of goods sold. Direct materials used $230,000...

-

Do those who protest against globalization make any valid point(s) that all people, whether for or against globalization, should consider?

-

Find the radius of convergence in two ways: (a) Directly by the CauchyHadamard formula in Sec. 15.2. (b) From a series of simpler terms by using Theorem 3 or Theorem 4.

-

Which of the following business gifts are fully deductible? a. A gift to a client costing $35 b. A gift to an employee, for 10 years of continued service, costing $250 c. A gift to a client and her...

-

Kathy is a self-employed taxpayer working exclusively from her home office. Before the home office deduction, Kathy has $3,000 of net income. Her allocable home office expenses are $5,000 in total...

-

Which of the following taxpayers qualifies for a home office deduction? a. An attorney who is employed by a law firm and has a home office in which to read cases b. A doctor who has a regular office...

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

-

1. Determine the value of the right to use asset and lease liability at commencement of the lease.

-

Problem 22-1 The management of Sunland Instrument Company had concluded, with the concurrence of its independent auditors, that results of operations would be more fairly presented if Sunland changed...

Study smarter with the SolutionInn App