While preparing Massie Millers 2020 Schedule A, you review the following list of possible charitable deductions provided

Question:

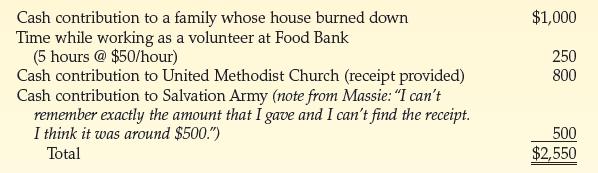

While preparing Massie Miller’s 2020 Schedule A, you review the following list of possible charitable deductions provided by Massie:

What would you say to Massie regarding her listed deductions? How much of the deduction is allowed for charitable contributions?

Transcribed Image Text:

Cash contribution to a family whose house burned down Time while working as a volunteer at Food Bank (5 hours @ $50/hour) Cash contribution to United Methodist Church (receipt provided) Cash contribution to Salvation Army (note from Massie: "I can't remember exactly the amount that I gave and I can't find the receipt. I think it was around $500.") Total $1,000 250 800 500 $2,550

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Massie can take a charitable contribution deduction for 800 the cash contribution donated ...View the full answer

Answered By

Asd fgh

sadasmdna,smdna,smdna,msdn,masdn,masnd,masnd,m asd.as,dmas,dma.,sd as.dmas.,dma.,s ma.,sdm.,as mda.,smd.,asmd.,asmd.,asmd.,asm

5.00+

1+ Reviews

15+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

While preparing Massie Millers 2014 Schedule A, you review the following list of possible charitable deductions provided by Massie: Cash contribution to a family whose house burned down.............

-

While preparing Massie Miller's 2015 Schedule A, you review the following list of possible charitable deductions provided by Massie: Cash contribution to a family whose house burned down...

-

While preparing Massie Miller's 2012 Schedule A, you review the following list of possible charitable deductions provided by Massie: Cash contribution to a family whose house burned...

-

Subsequent Events and Subsequently Discovered Facts. Michael Ewing is auditing the financial statements of Dallas Company for the year ended December 31, 2014. In concluding the process of gathering...

-

The PW value for an alternative is expected to be one of two values based on bids from two vendors. Your office partner told you that the low bid is $3200 per year. If she indicates a chance of 70%...

-

Why should employees be involved and what should they be involved in? LO3

-

Describe the unexplained variation about a regression line in words and in symbols.

-

What prescriptions do you have for thwarting arrogance in nonprofit and/or governmental organizations? Be as specific as you can, and support your recommendations.

-

4 Carmen's Dress Delivery operates a mail-order business that sells clothes designed for frequent travelers. It had sales of $720,000 in December. Because Carmen's Dress Delivery is in the mail-order...

-

Harriet's Hats is a retailer who buys hats from a manufacturer and then sells them in its stores. The following information includes the company's December 31, 20Y8 Balance Sheet and the details of...

-

In 2020, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified organization). Axel attended tenth grade...

-

In 2020, Tracy generates a $10,000 loss from an otherwise qualified business activity. Fortunately, she also works as an employee and has taxable wages of $40,000. Tracys 2020 QBI deduction is a. $0...

-

Postponement is not very effective if a large fraction of demand comes from multiple products. not very effective if a small fraction of demand comes from a single product. only effective if a large...

-

An epidemiologist plans to conduct a survey to estimate the percentage of women who give birth. How many women must be surveyed in order to be 90% confident that the estimated percentage is in error...

-

Palmerstown Company established a subsidiary in a foreign country on January 1, Year 1, by investing 8,000,000 pounds when the exchange rate was $1.00/pound. Palmerstown negotiated a bank loan of...

-

Question 1.Which of the following plans provide the greatest immediate tax benefit for the participating employee? (1) Roth IRA (2) deductible IRA (3) non-deductible IRA (4) 401(k) a. (1) and (3)...

-

Transcribed image text: 9:13 LTE Done 7 of 7 QUESTION WA AUDION QUESTION 23 = w the tons of a coin comes down heads, you win two dollars. If it comes down tails, you lose fifty cents. How much would...

-

TRUE or FALSE It is 2016 and the D.C. Circuit has issued its ruling in USTA v. FCC . The D.C. Circuit upheld the 2015 Open Internet Order so the FCC's net neutrality rule stands.True or...

-

Compare a municipal bond with a tax-deferred annuity. When would one be more attractive than the other?

-

Research corporate acquisitions using Web resources and then answer the following questions: Why do firms purchase other corporations? Do firms pay too much for the acquired corporation? Why do so...

-

In no more than three PowerPoint slides, list some general guidelines that a taxpayer can use to determine whether it has an obligation to file an income tax return with a particular state. (Include...

-

Fallow Corporation is subject to tax only in State X. Fallow generated the following income and deductions. State income taxes are not deductible for X income tax purposes. Sales...

-

Dillman Corporation has nexus in States A and B. Dillmans activities for the year are summarized below. Determine the apportionment factors for A and B assuming that A uses a three-factor...

-

On an average day, a company writes checks totaling $1,500. These checks take 7 days to clear. The company receives checks totaling $1,800. These checks take 4 days to clear. The cost of debt is 9%....

-

Olds Company declares Chapter 7 bankruptcy. The following are the book values of the asset and liability accounts at that time. A bankruptcy expert estimates that administrative expense will total $...

-

As the representative of the local accounting club, you have been asked by the dean to help her understand the costs of the different degrees offered at the school. You decide to use an...

Study smarter with the SolutionInn App