In recent years, Avery Transportation purchased three used buses. Because of frequent turnover in the accounting department,

Question:

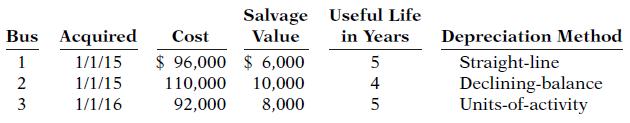

In recent years, Avery Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant selected the depreciation method for each bus, and various methods were selected. Information concerning the buses is summarized as follows.

For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 120,000. Actual miles of use in the first 3 years were 2016, 24,000; 2017, 34,000; and 2018, 30,000.

Instructions

(a) Compute the amount of accumulated depreciation on each bus at December 31, 2017.

(b) If Bus 2 was purchased on April 1 instead of January 1, what is the depreciation expense for this bus in (1) 2015 and (2) 2016?

Step by Step Answer:

Accounting Principles

ISBN: 978-1118875056

12th edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso