Question: Terry Wade, the new controller of Hellickson Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of

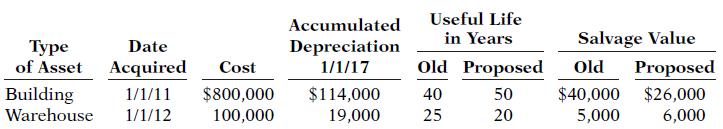

Terry Wade, the new controller of Hellickson Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2017. His findings are as follows.

All assets are depreciated by the straight-line method. Hellickson Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Terry’s proposed changes.

Instructions

(a) Compute the revised annual depreciation on each asset in 2017. (Show computations.)

(b) Prepare the entry (or entries) to record depreciation on the building in 2017.

Useful Life Accumulated in Years Salvage Value of Asset Acquired Building Warehouse Date Depreciation Cost Old Proposed 1/1/17 Old Proposed 1/1/11 $800,000 $114,000 40 50 $40,000 $26,000 1/1/12 100,000 19,000 25 20 5,000 6,000

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

a Building 8000001140002600044 15000 per year ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

426_61d57f2606d5b_826974.pdf

180 KBs PDF File

426_61d57f2606d5b_826974.docx

120 KBs Word File