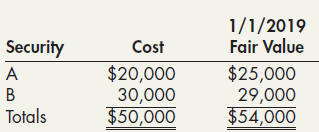

At the beginning of 2019, Able Company had the following portfolio of investments in trading securities (all

Question:

At the beginning of 2019, Able Company had the following portfolio of investments in trading securities (all of which were acquired at par value):

During 2019, the following transactions occurred:

May 3 Purchased C debt securities at their par value for $50,000.

July 1 Sold all of the A securities for $27,000 plus interest of $1,000.

Dec. 31 Received interest of $7,600 on the B and C securities. Additionally the following information was available:

.................12/31/2019

Security.....Fair Value

B....................$29,000

C.....................52,500

Required:

1. Prepare journal entries to record the preceding information.

2. Next Level What justification does the FASB give for its treatment of unrealized holding gains and losses for trading securities?

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach