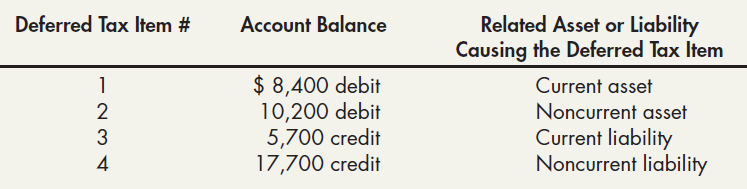

At the end of 2018, Duff Company prepared the following schedule of its deferred tax items (based

Question:

At the end of 2018, Duff Company prepared the following schedule of its deferred tax items (based on the currently enacted tax rate of 30%):

On April 30, 2019, Congress changed the income tax rate to 40% for 2019 and future years. At the end of 2019, Duff reported taxable income of $62,500. At that time, Dolf determined that its deferred tax items should have balances as follows at the end of 2019 (based on the 40% tax rate): #1, $10,700 debit; #2, $15,000 debit; #3, $7,000 credit; #4, $25,900 credit.

Required:

1. Show how the deferred tax items are reported on Duff’s December 31, 2018, balance sheet.

2. Prepare the April 30, 2019, journal entry to correct Duff’s deferred tax items.

3. Prepare Dolf’s income tax journal entry at the end of 2019.

4. Show how the current and deferred tax items are reported on Duff’s December 31, 2019, balance sheet.

5. Calculate the total income tax expense for 2019.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach