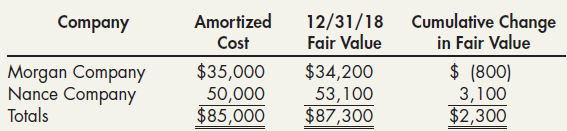

At the end of 2018, Terry Company prepared the following schedule of investments in available-for-sale debt securities

Question:

At the end of 2018, Terry Company prepared the following schedule of investments in available-for-sale debt securities (all of which were acquired at par value):

During 2019, the following transactions occurred:

July 1 Purchased Oscar Company debt securities with a par value of 100,000 for $98,000. The securities carry an annual interest rate of 10%, mature on December 31, 2021, and pay interest seminannually on July 1 and December 31. Terry uses the straight-line method to amortize any discounts or premiums.

Oct. 11 Sold all of the Morgan Company securities for $33,000 plus interest of $1,300.

Dec. 31 Received interest of $6,000 on the Nance Company and Oscar Company debt securities, and the following year end total market values were available: Nance Company debt securities, $55,000; Oscar Company debt securities, $96,000.

Required:

1. Prepare journal entries to record the preceding information.

2. Show how the preceding items are reported on Terry’s December 31, 2019, balance sheet. Assume all investments are noncurrent.

3. Next Level If Terry uses IFRS, how would the accounting for investments be different from U.S. GAAP?

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach