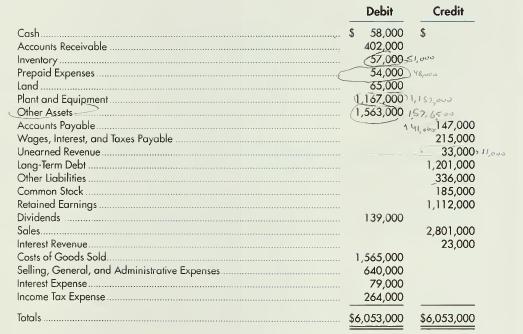

Below is the trial balance for Feigenbaum Company as of December 31. Consider the following additional information:

Question:

Below is the trial balance for Feigenbaum Company as of December 31.

Consider the following additional information:

(a) Feigenbaum uses a perpetual inventory system.

(b) The prepaid expenses were paid on September 1 and relate to a 3-year insurance policy that went into effect on September 1

(c) The unearned revenue relates to rental of an unused portion of the corporate offices. The \($33,000\) was received on April 1 and represents payment in advance for one year's rental.

(d) Plant and Equipment includes \($10,000\) for routine equipment repairs that were erroneously recorded as equipment purchases. The repairs were made on December 30.

(e) Other Assets include \($8,000\) for miscellaneous office supplies, which were pur-

chased in mid-October An end-of-year count reveals that only \($6,500\) of the office supplies remain.

(f) Selling, General, and Administrative Expenses incorrectly includes \($15.000\) for office furniture purchases (Other Assets). The purchases were made on December 30.

(g) Inventory wrongly includes \($6,000\) of inventory that Feigenbaum had purchased on account but that was returned to the supplier on December 28 because of unsatisfactory quality.

Based on the information provided:

1. Record the entries necessary to adjust the books.

2. Record the entries necessary to close the books. Assume the adjustments in (1) do not affect Income Tax Expense.

3. Prepare a post-closing trial balance.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice