Bucky Corporation entered into an operating lease agreement to lease equipment from Badger, Inc. on January 1,

Question:

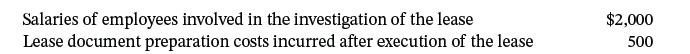

Bucky Corporation entered into an operating lease agreement to lease equipment from Badger, Inc. on January 1, 2025. The lease calls for annual lease payments of $30,000, beginning on January 1, for each of the 3 years of the lease. In addition, Badger will pay Bucky $5,000 as a cash incentive for entering the lease by January 1, 2025. In relation to the lease agreement, Bucky incurred the following costs.

Bucky’s incremental borrowing rate is 8%. If the value of the lease liability is $83,498, what amount will Bucky record as the value of the right-of-use asset on January 1, 2025, at commencement of the operating lease?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: