Carli Company adopted a defined benefit pension plan on January 1, 2018, and funded the entire amount

Question:

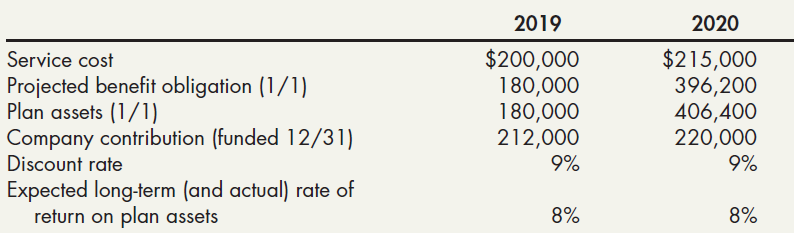

Carli Company adopted a defined benefit pension plan on January 1, 2018, and funded the entire amount of its 2018 pension expense. The following information pertains to the pension plan for 2019 and 2020:

There are no other components of Carli’s pension expense.

Required:

1. Compute the amount of Carli’s pension expense for 2019 and 2020.

2. Prepare the journal entries to record the pension expense for 2019 and 2020.

3. Next Level If the actual return on plan assets was greater than the expected return in 2019 how would it effect the calculation of pension expense?

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Question Posted: